Printable Georgia Gift Deed Template

Misconceptions

Understanding the Georgia Gift Deed form is essential for anyone considering transferring property as a gift. However, several misconceptions can lead to confusion. Here are six common misconceptions:

- Gift Deeds are only for family members. Many believe that gift deeds can only be used between family members. In reality, anyone can gift property to another person, regardless of their relationship.

- A Gift Deed does not require any legal formalities. Some think that a gift deed can be executed informally. However, it must be in writing, signed by the donor, and typically notarized to be legally valid.

- Gifting property eliminates all tax implications. Many assume that a gift deed means no taxes are involved. While the recipient may not pay taxes upon receiving the gift, the donor might be subject to gift tax if the value exceeds the annual exclusion limit.

- Once a gift deed is signed, it cannot be revoked. Some people believe that a signed gift deed is final and cannot be undone. However, the donor may have the option to revoke the deed before it is recorded, depending on specific circumstances.

- A Gift Deed transfers ownership immediately. It is a common belief that ownership transfers instantly upon signing. In Georgia, the deed must be recorded with the county to complete the transfer of ownership officially.

- Gift Deeds are the same as sales contracts. Many confuse gift deeds with sales contracts. A gift deed involves no exchange of money, while a sales contract requires payment in exchange for the property.

Clarifying these misconceptions can help individuals navigate the process of gifting property in Georgia more effectively.

Documents used along the form

When preparing a Georgia Gift Deed, several other forms and documents may be necessary to ensure a smooth transfer of property. Each of these documents serves a specific purpose and can help clarify the intentions of the parties involved. Below is a list of common forms that are often used alongside the Gift Deed.

- Affidavit of Gift: This document confirms that the property is being given as a gift without any expectation of payment. It provides legal assurance regarding the nature of the transfer.

- Property Tax Exemption Application: In some cases, a gift of property may qualify for tax exemptions. This application helps the new owner secure any applicable benefits.

- Quitclaim Deed: Although not always necessary, a quitclaim deed can be used to clarify the transfer of property rights, especially if there are multiple owners involved.

- Title Search Report: A title search ensures that the property is free of liens or encumbrances. This report provides peace of mind to both the giver and receiver.

- New York Residential Lease Agreement: A OnlineLawDocs.com form that outlines the terms of renting residential property in New York, establishing a clear relationship between landlord and tenant.

- Gift Tax Return (Form 709): If the value of the gift exceeds a certain threshold, the giver may need to file this federal tax form to report the gift to the IRS.

- Consent to Transfer Form: If the property is part of a joint ownership or has restrictions, this form may be necessary to obtain consent from other owners.

- Warranty Deed: Sometimes used in conjunction with a gift deed, a warranty deed provides a guarantee that the title is clear and the property is free from claims.

- Power of Attorney: If the giver is unable to sign the Gift Deed personally, a power of attorney may be used to allow someone else to act on their behalf.

Understanding these additional documents can help streamline the process of transferring property as a gift. Ensuring that all necessary forms are completed correctly will provide clarity and security for both parties involved in the transaction.

Steps to Filling Out Georgia Gift Deed

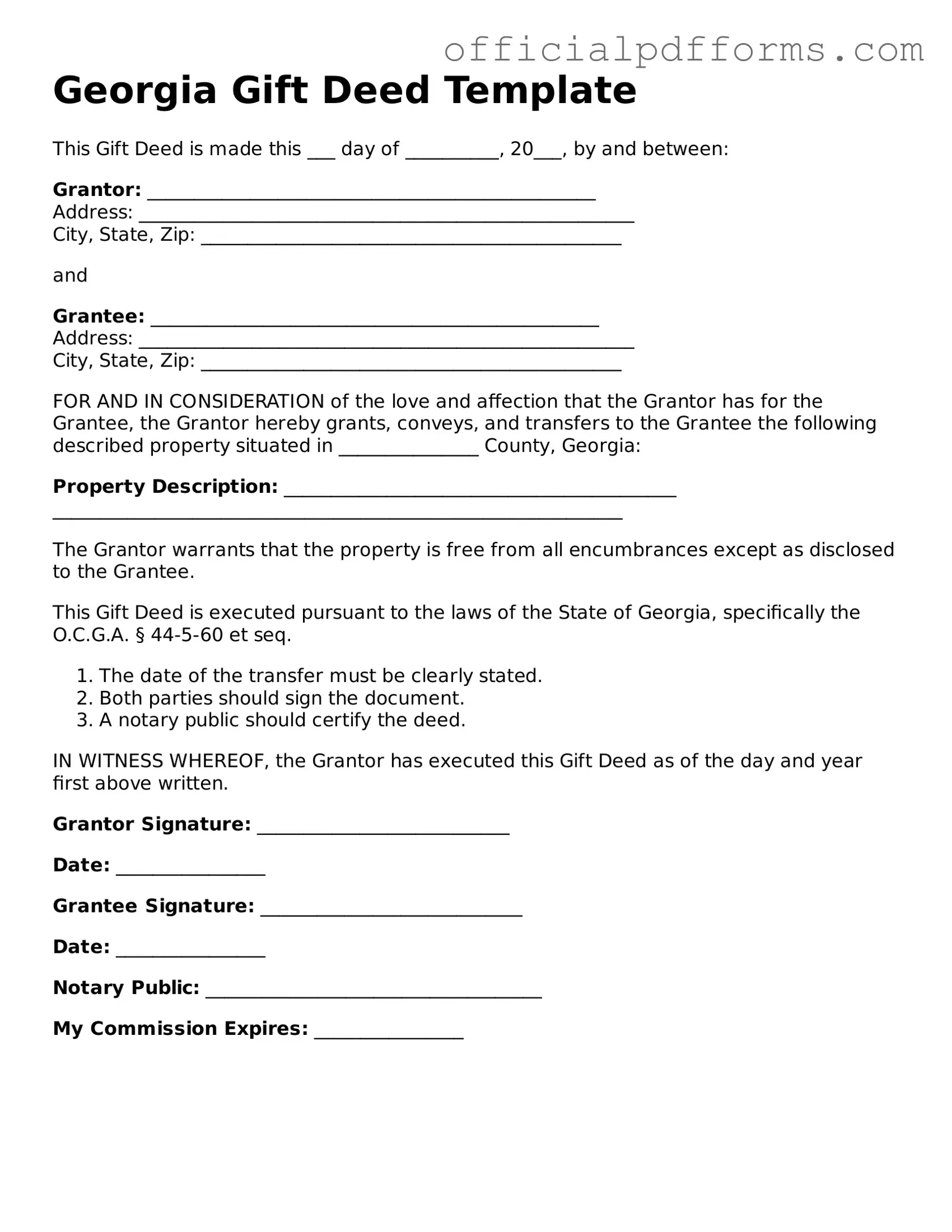

After you have gathered the necessary information and documents, you are ready to fill out the Georgia Gift Deed form. This process requires attention to detail to ensure all information is accurate and complete. Follow these steps carefully.

- Begin by entering the date at the top of the form. Use the format Month/Day/Year.

- Identify the grantor (the person giving the gift). Fill in their full name and address.

- Next, list the grantee (the person receiving the gift). Provide their full name and address as well.

- Describe the property being gifted. Include the address and any legal descriptions if available.

- State the consideration. In this case, write “Love and Affection” to signify the nature of the gift.

- Include any additional terms or conditions if applicable. This may include restrictions or stipulations regarding the property.

- Both the grantor and grantee must sign and date the form at the designated spaces.

- Have the signatures notarized. A notary public must witness the signing of the document.

- Make copies of the completed form for your records before submitting it.

- Finally, file the Gift Deed with the appropriate county clerk’s office in Georgia.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary details. This includes not listing the full names of both the donor and the recipient, or omitting the property description. Ensure that every required field is filled out completely.

-

Incorrect Property Description: The property being gifted must be described accurately. Errors can occur if the legal description is not used or if the address is incomplete. Double-check the property details to avoid confusion or disputes later.

-

Not Signing the Document: A Gift Deed must be signed by the donor. Sometimes, people forget this crucial step. Without a signature, the document is not valid, and the gift cannot be legally recognized.

-

Failure to Notarize: In Georgia, a Gift Deed typically needs to be notarized to be valid. Skipping this step can lead to issues with the enforceability of the deed. It is important to have a notary public witness the signing of the document.

-

Not Recording the Deed: After completing the Gift Deed, it should be recorded with the county clerk’s office. Many individuals neglect this step, which can result in legal complications regarding ownership. Recording the deed protects the recipient's interest in the property.

Get Clarifications on Georgia Gift Deed

What is a Georgia Gift Deed?

A Georgia Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. This type of deed is often utilized among family members or close friends, signifying a voluntary transfer of property as a gift. It is important to ensure that the deed is properly executed and recorded to establish clear ownership and protect against future claims.

What are the requirements for a valid Gift Deed in Georgia?

To create a valid Gift Deed in Georgia, several requirements must be met:

- Grantor and Grantee: The document must clearly identify the person giving the gift (grantor) and the person receiving it (grantee).

- Legal Description: A complete legal description of the property being transferred must be included. This ensures that there is no ambiguity about what property is being gifted.

- Intent to Gift: The grantor must explicitly express the intent to make a gift. This can be stated in the deed itself.

- Signature: The grantor must sign the deed in the presence of a notary public to validate the document.

Do I need to pay taxes on a Gift Deed in Georgia?

While the recipient of a gift generally does not pay income tax on the value of the gift, there may be other tax implications. The grantor may need to file a gift tax return if the value of the property exceeds the annual exclusion limit set by the IRS. It's advisable to consult with a tax professional to understand the specific tax obligations related to gifting property.

How do I record a Gift Deed in Georgia?

Recording a Gift Deed in Georgia is essential to make the transfer official and protect the new owner's rights. Here’s how to do it:

- Obtain the Deed: Ensure the Gift Deed is completed, signed, and notarized.

- Visit the County Clerk's Office: Take the original deed to the appropriate county clerk’s office where the property is located.

- Pay the Recording Fee: Be prepared to pay a recording fee, which varies by county.

- Receive Confirmation: After recording, you will receive a stamped copy of the deed, which serves as proof of the transfer.