Printable Georgia Durable Power of Attorney Template

Find Other Popular Durable Power of Attorney Templates for Specific States

How to Notarize a Power of Attorney in Ohio - This Power of Attorney is 'durable' because it outlasts the usual end of the agent’s authority.

Understanding the importance of a reliable document is crucial when dealing with transactions. An informative guide on how to fill out the RV Bill of Sale form effectively can ensure that both buyers and sellers are protected in their dealings.

Durable Power of Attorney Nc - Ensure a smooth management of your affairs by appointing a trusted decision-maker.

New Jersey Power of Attorney - It can help manage your care and financial responsibilities in the event of a severe accident or illness.

Misconceptions

When it comes to the Georgia Durable Power of Attorney (DPOA), many people hold misconceptions that can lead to confusion and potential legal pitfalls. Understanding the realities of this important legal document can help individuals make informed decisions about their financial and medical affairs. Here are eight common misconceptions:

- A Durable Power of Attorney is only for the elderly. Many believe that DPOAs are only necessary for older adults. In reality, anyone can benefit from having a DPOA, especially if they want to ensure their wishes are honored in case of incapacity.

- A DPOA is the same as a will. Some people think a DPOA functions like a will, but they serve different purposes. A DPOA allows someone to make decisions on your behalf while you are alive, whereas a will takes effect after your death.

- Once a DPOA is signed, it cannot be changed. This is a common myth. You can revoke or modify a DPOA at any time, as long as you are mentally competent to do so.

- The agent must be a family member. While many choose family members to serve as their agent, it is not a requirement. You can appoint a trusted friend, attorney, or even a professional fiduciary.

- A DPOA grants unlimited power to the agent. This misconception can be concerning. A DPOA can be tailored to grant specific powers, and you can limit what your agent can do on your behalf.

- A DPOA is only valid in Georgia. While a DPOA is governed by Georgia law, it may still be recognized in other states. However, it is wise to check the specific requirements of the state where it will be used.

- Agents must act in the best interest of the principal. Although agents are expected to act in good faith, the law does not always enforce this obligation. It is essential to choose an agent you trust completely.

- A DPOA is only for financial matters. Many people think DPOAs only cover financial decisions. In Georgia, a DPOA can also be used for medical decisions if you include healthcare powers within the document.

Understanding these misconceptions can empower individuals to take control of their future planning. A well-drafted Durable Power of Attorney can provide peace of mind, knowing that your affairs will be managed according to your wishes, regardless of what life may bring.

Documents used along the form

When preparing a Georgia Durable Power of Attorney, it is beneficial to consider additional documents that may complement this legal tool. Each of these forms serves a unique purpose and can enhance your overall estate planning strategy. Below is a list of commonly used documents that may accompany a Durable Power of Attorney.

- Advance Healthcare Directive: This document allows individuals to outline their medical preferences in case they become unable to communicate their wishes. It combines a living will and a healthcare power of attorney, ensuring that healthcare decisions align with personal values.

- Motor Vehicle Power of Attorney: This form allows you to designate someone else to handle matters related to your motor vehicle, such as registration and title transfer. For more details, visit OnlineLawDocs.com.

- Living Will: A living will specifies an individual's wishes regarding medical treatment and end-of-life care. It provides guidance to healthcare providers and family members about the types of medical interventions desired or refused.

- Last Will and Testament: This document outlines how an individual's assets should be distributed after their death. It can also name guardians for minor children and appoint an executor to manage the estate.

- Revocable Living Trust: A revocable living trust allows individuals to place their assets into a trust during their lifetime. This can help avoid probate and manage assets in case of incapacity, while still allowing the individual to retain control over the assets.

- HIPAA Authorization: This authorization grants specific individuals access to an individual's medical records and health information. It ensures that healthcare providers can share necessary information with designated family members or friends.

- Property Deed: A property deed is used to transfer ownership of real estate. When combined with a Durable Power of Attorney, it allows an agent to manage or sell property on behalf of the principal if needed.

Understanding these documents can help individuals make informed decisions about their legal and healthcare preferences. Proper planning ensures that your wishes are respected and can provide peace of mind for both you and your loved ones.

Steps to Filling Out Georgia Durable Power of Attorney

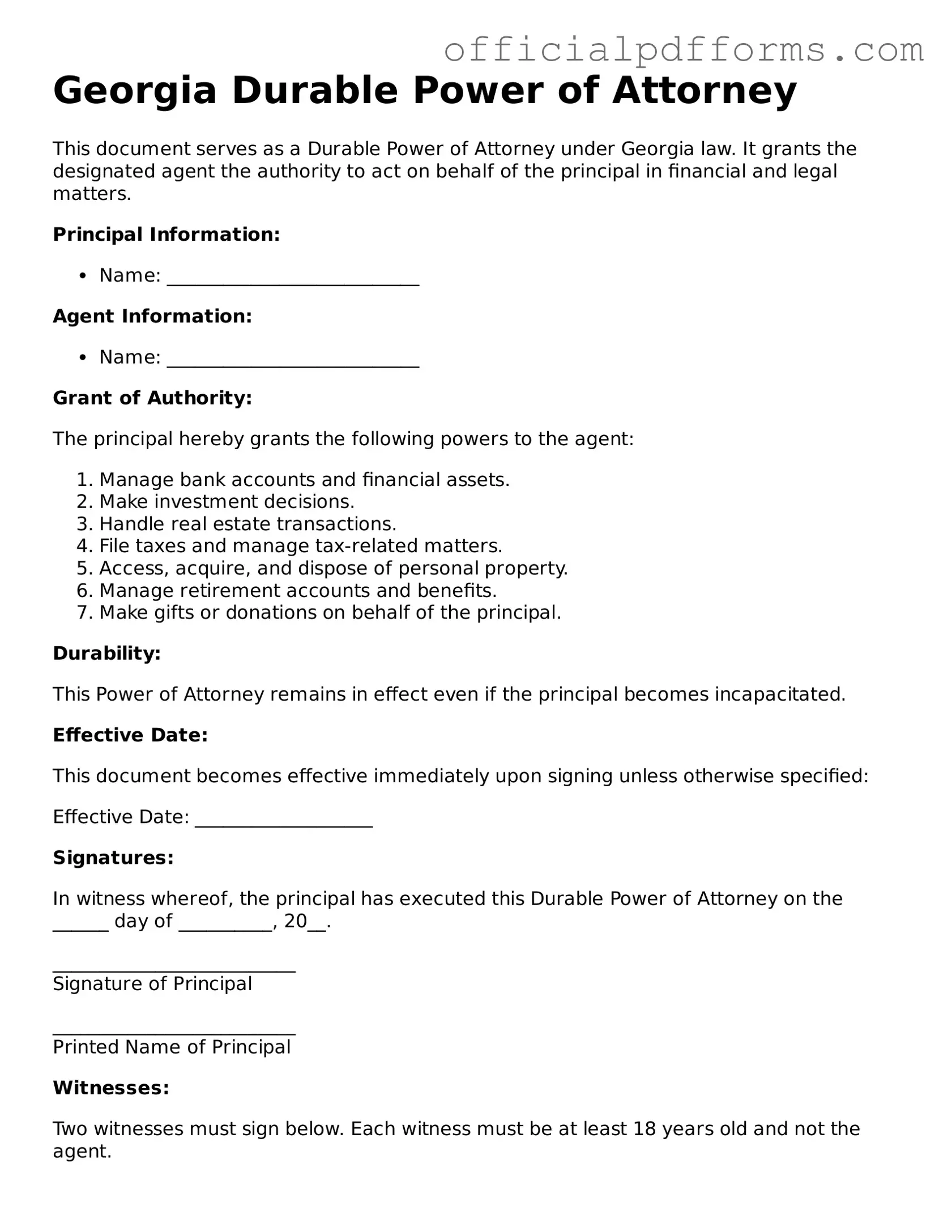

Filling out the Georgia Durable Power of Attorney form is an important step in planning for your future. This document allows you to designate someone to make decisions on your behalf when you cannot do so. Follow these steps carefully to ensure the form is completed correctly.

- Begin by downloading the Georgia Durable Power of Attorney form from a reliable source.

- Read through the form to familiarize yourself with its sections and requirements.

- In the first section, enter your full name and address as the principal.

- Next, provide the name and address of the person you are appointing as your agent.

- Clearly state the powers you wish to grant to your agent. You can choose specific powers or grant general authority.

- If you want to limit your agent's authority, specify any restrictions in the designated area.

- Review the section regarding alternate agents. If you want to name a backup, fill in their information.

- Sign and date the form at the bottom. Make sure to do this in the presence of a notary public.

- Have the notary public sign and stamp the form to validate it.

- Make copies of the completed form for your records and provide copies to your agent and any relevant institutions.

Common mistakes

-

Not Specifying Powers Clearly: Individuals often fail to clearly outline the specific powers they wish to grant. This can lead to confusion and misinterpretation of the agent's authority.

-

Forgetting to Date the Document: A common oversight is neglecting to date the Durable Power of Attorney form. Without a date, it may be difficult to establish when the document was executed, which can lead to legal complications.

-

Not Signing in Front of a Notary: Many people forget that the form must be notarized to be legally binding. Without a notary's signature, the document may not hold up in court.

-

Choosing the Wrong Agent: Selecting an agent who is untrustworthy or lacks the necessary skills can lead to poor decision-making. It’s vital to choose someone who understands your wishes and can act in your best interest.

-

Failing to Discuss with the Agent: People often overlook the importance of discussing their wishes with the designated agent. This conversation ensures that the agent understands your preferences and is prepared to act accordingly.

-

Not Reviewing Regularly: Some individuals create the document and then forget about it. Regular reviews are essential to ensure that the powers granted still align with your current wishes and circumstances.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding Durable Power of Attorney forms. Failing to comply with Georgia’s specific requirements can invalidate the document.

Get Clarifications on Georgia Durable Power of Attorney

What is a Durable Power of Attorney in Georgia?

A Durable Power of Attorney (DPOA) in Georgia is a legal document that allows an individual, known as the principal, to appoint someone else, called an agent, to make decisions on their behalf. This authority remains effective even if the principal becomes incapacitated. The DPOA can cover a wide range of decisions, including financial matters, healthcare choices, and property management.

How do I create a Durable Power of Attorney in Georgia?

To create a Durable Power of Attorney in Georgia, follow these steps:

- Choose an agent you trust to act on your behalf.

- Obtain a Durable Power of Attorney form, which can be found online or through legal resources.

- Fill out the form, specifying the powers you want to grant to your agent.

- Sign the document in the presence of a notary public, as notarization is required for the DPOA to be valid.

What powers can I grant to my agent through a Durable Power of Attorney?

In Georgia, you can grant your agent a variety of powers, including but not limited to:

- Managing bank accounts and financial transactions.

- Buying, selling, or managing real estate.

- Handling tax matters.

- Making healthcare decisions, if specified in the document.

It is important to clearly outline the specific powers you wish to grant to avoid any confusion in the future.

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your Durable Power of Attorney at any time as long as you are mentally competent. To do so, you should create a written revocation document, sign it, and notify your agent. It’s also a good idea to inform any institutions or individuals who may have relied on the original DPOA.

What happens if I become incapacitated and have a Durable Power of Attorney?

If you become incapacitated, your Durable Power of Attorney remains in effect. Your appointed agent can step in and make decisions on your behalf, ensuring that your financial and healthcare matters are managed according to your wishes. It is crucial to have a DPOA in place to avoid potential conflicts or delays in decision-making during such times.

Is a Durable Power of Attorney the same as a healthcare proxy?

No, a Durable Power of Attorney and a healthcare proxy are not the same, although they can overlap. A DPOA primarily focuses on financial and legal matters, while a healthcare proxy specifically grants someone the authority to make medical decisions for you if you are unable to do so. In Georgia, you can create both documents to ensure comprehensive coverage for your needs.