Printable Georgia Deed in Lieu of Foreclosure Template

Find Other Popular Deed in Lieu of Foreclosure Templates for Specific States

Will I Owe Money After a Deed in Lieu of Foreclosure - Executing this form may also eliminate the need for maintaining an unoccupied property through the foreclosure process.

In order to fully understand and properly utilize the California Lease Agreement form, it is important to familiarize yourself with its contents and implications; to facilitate this understanding, click here to get the document that provides essential insights and guidelines.

Deed in Lieu of Mortgage - Understanding the implications of this deed is crucial for borrowers.

Misconceptions

Many homeowners facing financial difficulties may consider a deed in lieu of foreclosure as a way to avoid the lengthy and stressful foreclosure process. However, several misconceptions surround this option. Understanding these misconceptions can help individuals make informed decisions.

- A deed in lieu of foreclosure eliminates all debt. This is not true. While it may relieve the borrower of the mortgage obligation, it does not automatically erase other debts associated with the property, such as property taxes or homeowner association fees.

- It will not affect your credit score. In reality, a deed in lieu of foreclosure can negatively impact your credit score, although it may be less damaging than a full foreclosure.

- All lenders accept deeds in lieu of foreclosure. Not all lenders offer this option. Some may prefer to proceed with foreclosure instead, depending on their policies and the specific circumstances.

- It is a quick and easy process. While it may be faster than foreclosure, the process can still be complex and require significant paperwork and negotiation with the lender.

- Homeowners can simply hand over the keys. A formal agreement is necessary. Homeowners must follow specific steps and obtain the lender's approval to complete the deed in lieu of foreclosure.

- It is the same as a short sale. These are different processes. A short sale involves selling the property for less than the mortgage balance, while a deed in lieu transfers ownership back to the lender without a sale.

- It absolves homeowners from liability. In some cases, lenders may still pursue a deficiency judgment if the property's value is less than the mortgage balance.

- It is only available for primary residences. This is not accurate. Deeds in lieu can apply to investment properties as well, although the terms may vary.

- Homeowners will never be able to buy a home again. While it may take time to rebuild credit, many individuals can qualify for a mortgage again after a deed in lieu, typically within a few years.

- Legal advice is unnecessary. Seeking legal advice is crucial. Understanding the implications of a deed in lieu can help homeowners make the best choice for their financial situation.

Documents used along the form

When dealing with a Deed in Lieu of Foreclosure in Georgia, several other forms and documents may be necessary to complete the process. Each of these documents serves a specific purpose and helps ensure that all legal requirements are met. Below is a list of commonly used documents in conjunction with the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines any changes made to the original loan terms. It may include adjustments to interest rates, payment schedules, or loan amounts to help the borrower avoid foreclosure.

- Recommendation Letter: A critical document for providing insights into a candidate's abilities, it can significantly enhance their application. For templates and guidance, visit toptemplates.info.

- Notice of Default: This is a formal notification sent to the borrower indicating that they have defaulted on their loan. It typically includes details about the missed payments and the total amount owed.

- Settlement Agreement: This document details the terms agreed upon by both the lender and borrower to resolve the outstanding debt. It may include provisions for forgiveness of some debt or a repayment plan.

- Release of Liability: This form releases the borrower from any further obligations related to the mortgage after the Deed in Lieu is executed. It protects the borrower from future claims regarding the debt.

- Affidavit of Title: This sworn statement confirms the ownership of the property and that there are no undisclosed liens or claims against it. It ensures the lender receives clear title to the property.

- Property Condition Disclosure: This document provides information about the condition of the property being transferred. It may include details about repairs needed or existing issues that could affect the property's value.

Understanding these documents is crucial for both borrowers and lenders. Each plays a role in facilitating a smooth transition during the foreclosure process. Properly handling these forms can help protect the interests of all parties involved.

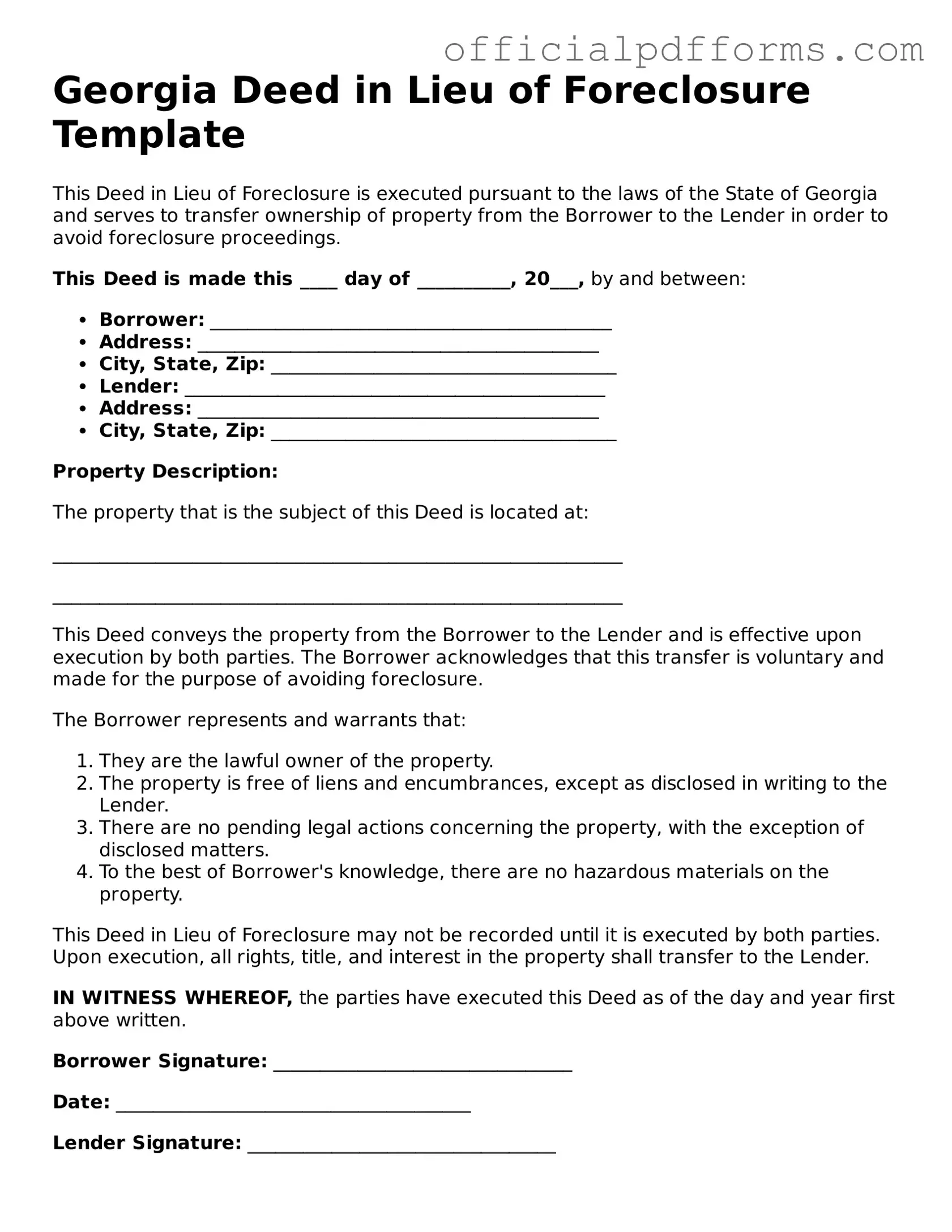

Steps to Filling Out Georgia Deed in Lieu of Foreclosure

After completing the Georgia Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the appropriate parties, typically the lender and local county office. Ensure that all required signatures are obtained and consider consulting with a legal professional to confirm that the process adheres to local regulations.

- Begin by downloading the Georgia Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the date at the top of the form.

- Provide the name of the grantor (the borrower) in the designated space.

- Enter the name of the grantee (the lender) in the appropriate section.

- Include the property address, ensuring accuracy in the details provided.

- List any legal descriptions of the property as required, which may include parcel numbers or lot descriptions.

- Specify any encumbrances or liens on the property, if applicable.

- Sign the document in the presence of a notary public to ensure its validity.

- Have the notary public complete their section, confirming the authenticity of the signatures.

- Make copies of the signed document for personal records and for the lender.

- Submit the original deed to the lender and file it with the local county office, if required.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to delays or rejection. Ensure every section is filled out accurately.

-

Incorrect Property Description: Misidentifying the property can create legal complications. Double-check the address and legal description.

-

Not Notarizing the Document: A deed in lieu must be notarized to be valid. Skipping this step can render the document unenforceable.

-

Failure to Include All Parties: All owners must sign the document. Omitting a co-owner can cause issues later on.

-

Not Reviewing Loan Documents: Ignoring the original loan terms can lead to misunderstandings about what is being relinquished.

-

Ignoring Tax Implications: Not considering the potential tax consequences of a deed in lieu can result in unexpected liabilities.

-

Not Consulting a Professional: Attempting to complete the process without legal advice can lead to costly mistakes. Seek guidance from a real estate attorney.

-

Failing to Communicate with Lender: Not keeping the lender informed throughout the process can create misunderstandings. Maintain open lines of communication.

Get Clarifications on Georgia Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure in Georgia?

A Deed in Lieu of Foreclosure is an agreement between a homeowner and a lender where the homeowner voluntarily transfers the property title to the lender to avoid foreclosure. This process allows the homeowner to walk away from the mortgage obligation while the lender takes ownership of the property, typically to recover their losses.

Who can use a Deed in Lieu of Foreclosure?

Homeowners facing financial difficulties and unable to keep up with mortgage payments may consider this option. However, both parties must agree to the deed transfer, and the homeowner must be current on mortgage payments or have a good reason for the default. It’s essential to consult with your lender to see if this option is available for your specific situation.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several advantages to a Deed in Lieu of Foreclosure:

- It can help avoid the lengthy and stressful foreclosure process.

- The homeowner may be able to negotiate a more favorable outcome, such as debt forgiveness.

- It typically results in less damage to the homeowner’s credit score compared to a foreclosure.

- The process can be quicker and less costly for both the homeowner and the lender.

What are the potential drawbacks?

While there are benefits, there are also some drawbacks to consider:

- Homeowners may still face tax implications if the lender forgives any remaining debt.

- Not all lenders may accept a Deed in Lieu of Foreclosure.

- Homeowners may need to vacate the property quickly, which can be stressful.

How do I initiate a Deed in Lieu of Foreclosure?

To start the process, you should first contact your lender and express your interest in a Deed in Lieu of Foreclosure. They will likely require you to provide financial documentation to assess your situation. If they agree to the arrangement, they will guide you through the necessary steps and paperwork.

What documentation is required?

Typically, the lender will request the following documents:

- Proof of income and financial hardship.

- Current mortgage statements.

- Property tax information.

- Any other relevant financial documents.

Be prepared to provide these documents promptly to facilitate the process.

Will I be responsible for any remaining mortgage balance?

In many cases, lenders may agree to forgive any remaining balance after the Deed in Lieu of Foreclosure. However, this is not guaranteed and can vary based on the lender’s policies and your specific circumstances. Always clarify this aspect with your lender before proceeding.

How does a Deed in Lieu of Foreclosure affect my credit score?

While a Deed in Lieu of Foreclosure is less damaging than a foreclosure, it will still have an impact on your credit score. Generally, it may result in a score drop, but the extent can vary based on your overall credit history. It’s wise to check with credit reporting agencies to understand how this action may affect you specifically.