Printable Georgia Deed Template

Find Other Popular Deed Templates for Specific States

What Does a Deed Look Like in Pa - Local laws may vary in terms of what is required for a valid Deed.

How to Obtain the Deed to My House - A Deed can be used for personal property, real estate, or other assets.

The Aaa International Driving Permit Application form is a document that allows U.S. citizens to drive legally in many countries around the world. This permit is recognized internationally and serves as a translation of a driver's existing license. To streamline the application process, resources like Fast PDF Templates can be incredibly helpful, enhancing your travel experience and providing peace of mind when on the road abroad.

Nc Deed Transfer Form - Parties involved should understand the implications of the Deed they are signing.

Warranty Deed Form Ohio - Specific language in a deed can impact future property developments or use.

Misconceptions

Understanding the Georgia Deed form can be challenging due to various misconceptions. Here are four common misunderstandings and clarifications about the form:

- The Georgia Deed form is only for transferring property ownership. While the primary purpose of the deed is to transfer ownership, it can also be used to clarify property rights, establish easements, or convey interests in real estate.

- All deeds in Georgia must be notarized. Although notarization is highly recommended for validity, not all deeds require it. Certain types of deeds, such as those executed by a government entity, may not need notarization to be legally binding.

- Only attorneys can prepare a Georgia Deed form. This is not true. While legal advice is beneficial, individuals can prepare their own deeds as long as they follow the state’s requirements and provide accurate information.

- Once a Georgia Deed is filed, it cannot be changed. This misconception overlooks the fact that deeds can be amended or corrected. If errors are found, a new deed can be created to rectify the situation, provided the necessary legal procedures are followed.

Documents used along the form

When dealing with property transactions in Georgia, several important documents accompany the Georgia Deed form. Each of these documents plays a crucial role in ensuring a smooth transfer of ownership and protecting the rights of all parties involved. Below is a list of common forms and documents that are often used alongside the Georgia Deed.

- Title Search Report: This document provides information about the property's ownership history. It reveals any liens, encumbrances, or claims against the property, ensuring that the buyer is aware of any potential issues before the purchase.

- Purchase Agreement: This contract outlines the terms of the sale between the buyer and seller. It includes details such as the sale price, closing date, and any contingencies that must be met for the sale to proceed.

- California ATV Bill of Sale Form: To ensure proper documentation during vehicle transfers, refer to our comprehensive California ATV Bill of Sale documentation for a secure and legally binding transaction.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and asserts that there are no undisclosed liens or claims. It provides additional assurance to the buyer regarding the property's title.

- Closing Statement: Also known as a HUD-1 statement, this document summarizes the financial details of the transaction. It lists all costs, fees, and credits involved in the sale, ensuring transparency for both parties.

- Property Disclosure Statement: This form requires the seller to disclose any known issues or defects with the property. It helps protect buyers by providing them with crucial information about the property's condition.

- Power of Attorney: If one party cannot be present at the closing, a power of attorney allows another person to act on their behalf. This document must be properly executed to ensure its validity.

- IRS Form 1099-S: This form is used to report the sale of real estate to the IRS. It provides essential tax information for both the seller and the buyer, ensuring compliance with federal regulations.

- Title Insurance Policy: This insurance protects the buyer and lender against any future claims or disputes regarding the property's title. It is often a requirement for closing and provides peace of mind to the new owner.

Each of these documents serves a specific purpose in the property transaction process. Understanding their roles can help ensure a smooth and successful closing, safeguarding the interests of all parties involved.

Steps to Filling Out Georgia Deed

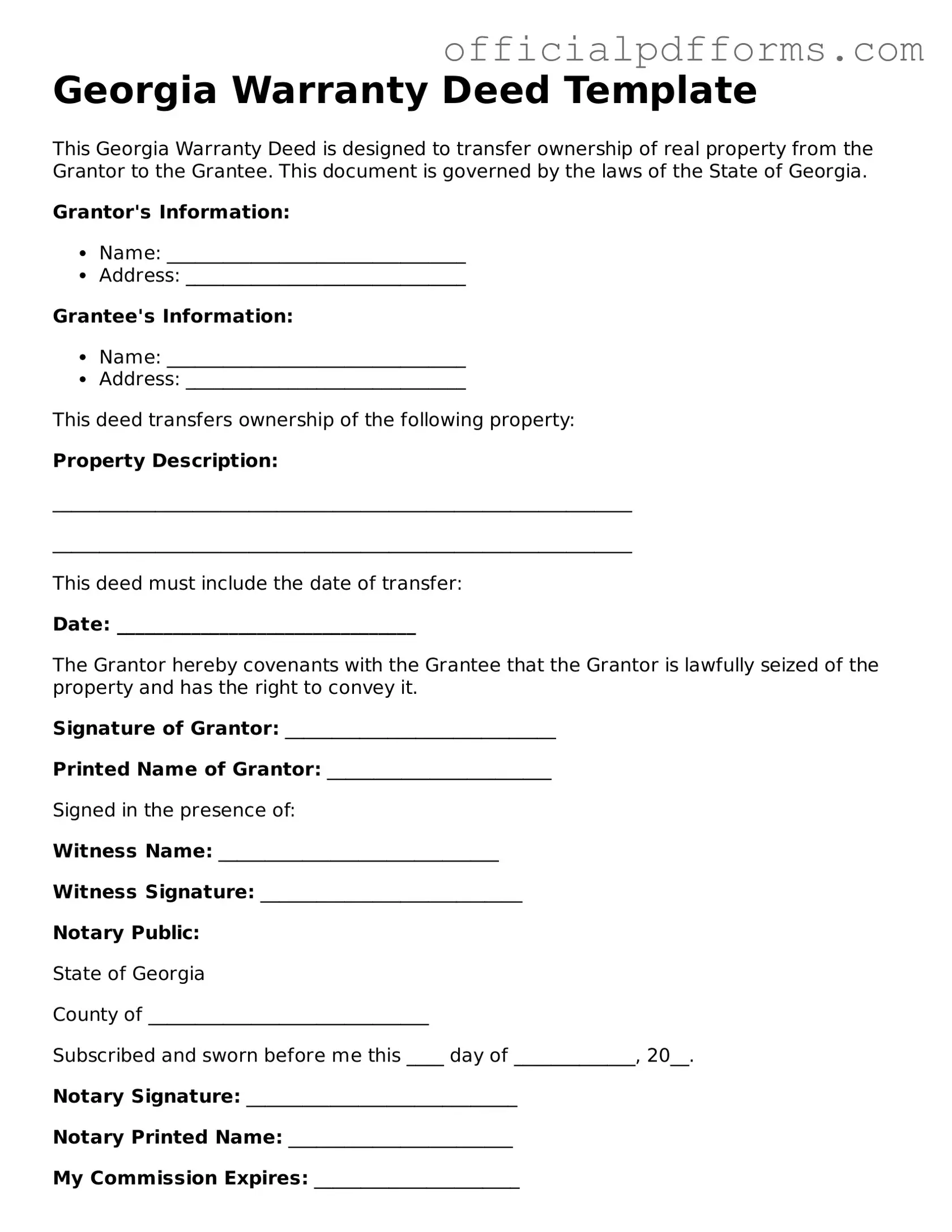

Once you have gathered all necessary information, you will be ready to fill out the Georgia Deed form. Completing this form accurately is crucial, as it will serve as a legal document for the transfer of property ownership. Follow these steps carefully to ensure that all required information is provided correctly.

- Begin by entering the date of the deed at the top of the form.

- In the section labeled "Grantor," provide the full name of the person or entity transferring the property. If there are multiple grantors, list all names.

- Next, in the "Grantee" section, write the full name of the person or entity receiving the property. Again, include all names if there are multiple grantees.

- Describe the property being transferred. Include the address, legal description, and any relevant details that clearly identify the property.

- Indicate the consideration, or the amount paid for the property. This can be a specific dollar amount or a statement indicating that the transfer is a gift.

- Include any additional terms or conditions of the transfer in the designated section, if applicable.

- Sign the form in the "Grantor's Signature" area. If there are multiple grantors, each must sign the form.

- Have the signatures notarized. A notary public will verify the identities of the signers and witness the signing of the document.

- Finally, ensure that the completed deed is filed with the appropriate county office to make the transfer official.

Common mistakes

Filling out a Georgia Deed form can be a straightforward process, but many people make common mistakes that can lead to complications later. Here are six mistakes to watch out for:

-

Incorrect Names: One of the most frequent errors is misspelling names. Ensure that the names of all parties involved are spelled correctly and match the names on their identification documents.

-

Missing Signatures: Every party involved must sign the deed. Omitting a signature can render the document invalid.

-

Improper Notarization: A deed must be notarized to be legally binding. Failing to have a notary public witness the signing can lead to issues with the validity of the deed.

-

Inaccurate Property Description: The description of the property must be precise. Vague or incomplete descriptions can create confusion and legal disputes in the future.

-

Failure to Record the Deed: After completing the deed, it must be recorded with the county clerk's office. Neglecting this step can result in loss of rights to the property.

-

Not Consulting Legal Advice: Many individuals skip seeking legal advice. A brief consultation can help avoid mistakes that may have long-term consequences.

By being aware of these common pitfalls, individuals can better navigate the process of filling out a Georgia Deed form and ensure that their property transactions go smoothly.

Get Clarifications on Georgia Deed

What is a Georgia Deed form?

A Georgia Deed form is a legal document used to transfer ownership of real estate in the state of Georgia. This form outlines the details of the property being transferred, including the names of the parties involved, the legal description of the property, and any relevant conditions of the transfer. It serves as an official record of the transaction and is essential for establishing legal ownership.

What types of deeds are available in Georgia?

In Georgia, several types of deeds can be used, including:

- Warranty Deed: Guarantees that the seller holds clear title to the property and has the right to sell it.

- Quitclaim Deed: Transfers whatever interest the seller has in the property without any warranties.

- Special Warranty Deed: Offers limited guarantees, only covering the time the seller owned the property.

- Deed of Bargain and Sale: Implies that the seller has the right to sell the property but does not guarantee clear title.

How do I fill out a Georgia Deed form?

Filling out a Georgia Deed form involves several steps:

- Begin with the names and addresses of the grantor (seller) and grantee (buyer).

- Provide a legal description of the property, which can be found in previous deeds or tax records.

- Include the consideration amount, which is the price paid for the property.

- Sign the document in front of a notary public.

- Ensure that the deed is recorded with the county clerk’s office to make it official.

Do I need a lawyer to prepare a Georgia Deed?

While it is not legally required to hire a lawyer to prepare a Georgia Deed, consulting with one can be beneficial. A lawyer can help ensure that the deed is correctly filled out and that all legal requirements are met. However, many individuals choose to use online services or templates to create their deeds without legal assistance.

What is the cost to record a Georgia Deed?

The cost to record a Georgia Deed varies by county. Typically, the fee can range from $10 to $50, depending on the specific county's regulations and the number of pages in the document. It’s important to check with your local county clerk’s office for the exact fees and any additional requirements.

How long does it take to record a Georgia Deed?

The recording process for a Georgia Deed is usually quick. Once the deed is submitted to the county clerk’s office, it can be recorded within a few days. However, processing times may vary based on the volume of documents being filed and the specific county's procedures.

What happens after I record my Georgia Deed?

After you record your Georgia Deed, the deed becomes a public record. This means it can be accessed by anyone who wishes to verify property ownership. The recorded deed serves as proof of ownership and protects your rights as the property owner. It is advisable to keep a copy of the recorded deed for your records.

Can I change a Georgia Deed after it has been recorded?

Once a Georgia Deed has been recorded, changes cannot be made directly to that document. If you need to make changes, such as correcting errors or adding a co-owner, you will need to create a new deed. This new deed must then be properly executed and recorded to reflect the changes in ownership.