Printable Georgia Bill of Sale Template

Find Other Popular Bill of Sale Templates for Specific States

Vehicle Registration Sample - This document provides transparency in ownership changes of property.

To facilitate a seamless transaction, using the proper documentation is key, and you can find a helpful resource on an effective California ATV Bill of Sale template designed specifically for this purpose.

Vehicle Bill of Sale Template - It's a simple yet vital piece of paperwork that formalizes an agreement between two parties.

Bill of Sale Nc - This document may require notarization to enhance its legal standing.

Misconceptions

Understanding the Georgia Bill of Sale form is essential for anyone engaging in the sale or transfer of personal property. However, several misconceptions can lead to confusion. Below is a list of ten common misunderstandings regarding this important document.

- It is only needed for vehicle sales. Many believe that a Bill of Sale is only necessary for transferring ownership of vehicles. In reality, this form can be used for various types of personal property, including furniture, electronics, and even livestock.

- A Bill of Sale is not legally binding. Some individuals think that a Bill of Sale is merely a formality and holds no legal weight. In Georgia, a properly completed Bill of Sale is a legally binding document that can serve as proof of ownership and protect both the buyer and seller.

- Notarization is required for all Bill of Sale forms. While notarization can add an extra layer of security, it is not mandatory for all Bill of Sale transactions in Georgia. The form is valid as long as it is signed by both parties involved in the sale.

- Only the seller needs to sign the Bill of Sale. Some people mistakenly believe that only the seller's signature is necessary. However, both the buyer and seller should sign the document to ensure that the transaction is acknowledged by both parties.

- The Bill of Sale must be filed with the state. Many assume that a Bill of Sale needs to be submitted to a government agency. In Georgia, this is not required. The document should be kept by both parties for their records.

- A Bill of Sale does not need to include the sale price. Some individuals think that the sale price is irrelevant. However, including the sale price is crucial as it provides clarity on the terms of the transaction and can be important for tax purposes.

- Once signed, the Bill of Sale cannot be changed. Many believe that any changes to the document after it has been signed are not allowed. In fact, if both parties agree, they can amend the Bill of Sale, but it is wise to document any changes clearly.

- It is unnecessary for gifts or trades. Some think that a Bill of Sale is only needed for sales involving money. However, even if property is given as a gift or exchanged through trade, having a Bill of Sale can clarify the transfer of ownership.

- All Bill of Sale forms are the same. There is a misconception that a generic Bill of Sale can be used for any transaction. In reality, different types of property may require specific information, so it’s essential to use the correct form tailored to the item being sold.

- Once the Bill of Sale is completed, the transaction is final. While the Bill of Sale serves as proof of the transaction, it does not negate any warranties or agreements made verbally. Buyers and sellers should be aware of any additional terms that may exist outside of the document.

By addressing these misconceptions, individuals can better navigate the process of buying or selling personal property in Georgia, ensuring that their transactions are smooth and legally sound.

Documents used along the form

When engaging in the transfer of ownership for personal property in Georgia, the Bill of Sale form serves as a vital document. However, several other forms and documents often accompany it to ensure a smooth and legally sound transaction. Below are some commonly used documents that can complement the Georgia Bill of Sale.

- Title Transfer Form: This document is essential when transferring ownership of vehicles. It officially changes the title from the seller to the buyer and must be submitted to the appropriate state agency.

- Odometer Disclosure Statement: Required by federal law for vehicles, this statement verifies the mileage on the vehicle at the time of sale. It protects buyers from fraud and ensures transparency in the transaction.

- Arizona ATV Bill of Sale: This document is essential for recording the transfer of ownership of an all-terrain vehicle in Arizona, and you can find a useful template at Top Document Templates.

- Affidavit of Vehicle Value: This form is sometimes used to declare the fair market value of the vehicle being sold. It can be particularly useful for tax purposes and helps establish the legitimacy of the sale price.

- Release of Liability: This document protects the seller from any future claims or liabilities associated with the property after the sale. It confirms that the seller is no longer responsible for the item once it has been sold.

- Sales Tax Form: Depending on the nature of the sale, buyers may need to complete a sales tax form to ensure compliance with state tax regulations. This form helps in calculating any applicable taxes on the sale.

- Purchase Agreement: A more detailed contract that outlines the terms of the sale, including payment details, warranties, and any contingencies. This document provides additional protection for both parties involved in the transaction.

Utilizing these forms in conjunction with the Georgia Bill of Sale can help facilitate a clear and legally binding transaction. Each document serves a specific purpose, contributing to the overall security and transparency of the sale process.

Steps to Filling Out Georgia Bill of Sale

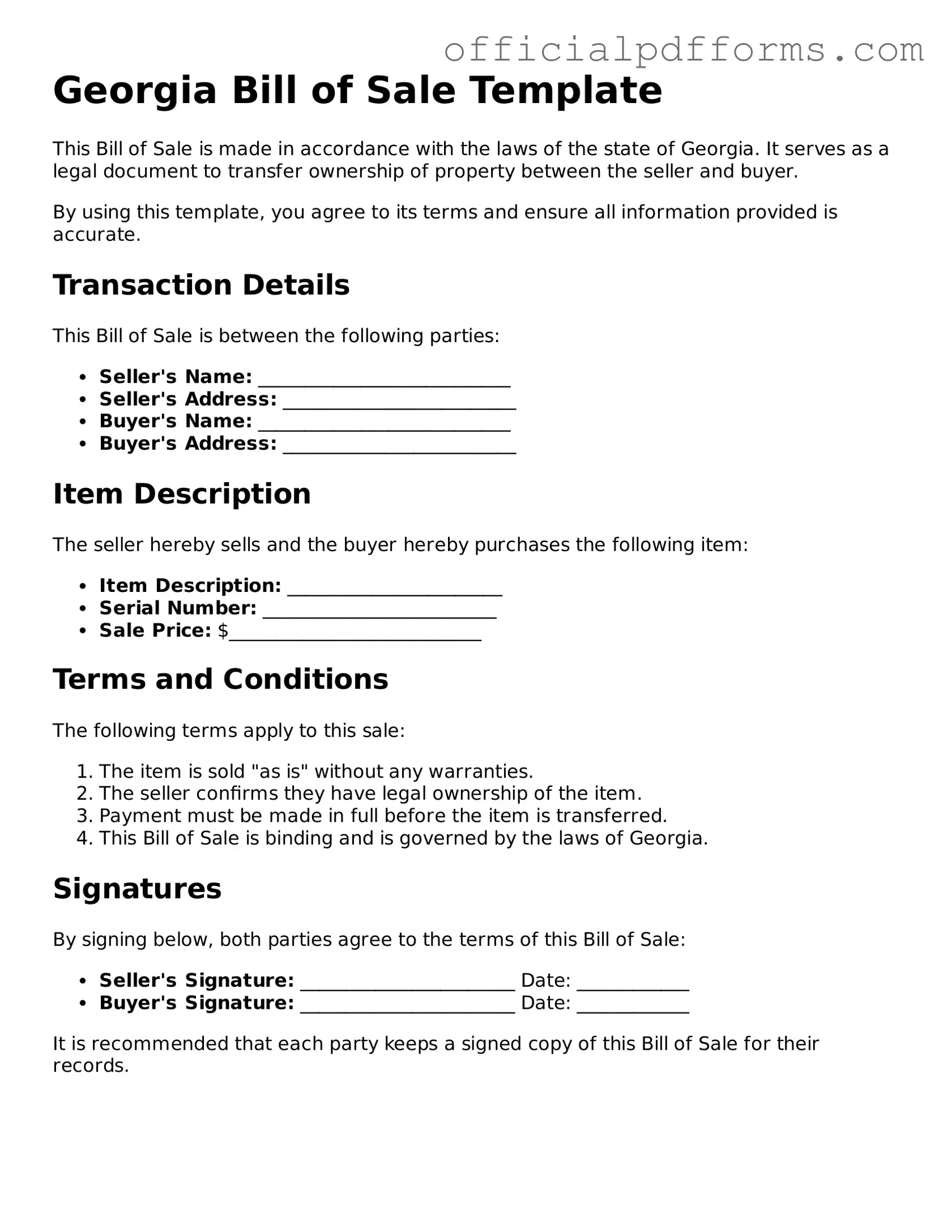

After gathering the necessary information, you are ready to fill out the Georgia Bill of Sale form. This document will serve as a record of the transaction between the buyer and seller. It is important to complete each section accurately to ensure clarity and prevent any potential disputes in the future.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller. Ensure that all information is correct and legible.

- Next, enter the full name and address of the buyer. Double-check for accuracy.

- Describe the item being sold. Include details such as make, model, year, and any identifying numbers, like a VIN for vehicles.

- Indicate the purchase price of the item clearly. This should be the amount agreed upon by both parties.

- Both the buyer and seller should sign the form. Each party should also print their name beneath their signature for clarity.

- If applicable, include any additional terms or conditions of the sale in the designated area.

Once the form is completed, both parties should keep a copy for their records. This document will serve as proof of the transaction and can be important for future reference.

Common mistakes

-

Incomplete Information: One common mistake is failing to fill out all required fields. Buyers and sellers must provide their full names, addresses, and signatures. Missing any of this information can render the document invalid.

-

Incorrect Vehicle Identification Number (VIN): Another frequent error involves entering an incorrect VIN. This number must match the one on the vehicle title. An error here can lead to confusion and potential legal issues down the line.

-

Not Including Sale Price: Some individuals forget to specify the sale price of the item being sold. This detail is crucial for both parties and for tax purposes. Omitting it can create complications later.

-

Failure to Sign: Lastly, many people overlook the necessity of signatures. Both the buyer and seller must sign the Bill of Sale for it to be legally binding. Without these signatures, the document may not hold up in court.

Get Clarifications on Georgia Bill of Sale

What is a Georgia Bill of Sale?

A Georgia Bill of Sale is a legal document that records the transfer of ownership of personal property from one person to another. It provides proof of the transaction and outlines important details about the item being sold.

What information is included in a Georgia Bill of Sale?

The Bill of Sale typically includes:

- The names and addresses of the buyer and seller

- A description of the item being sold, including make, model, and VIN (for vehicles)

- The sale price

- The date of the transaction

- Signatures of both the buyer and seller

Do I need a Bill of Sale for every transaction?

While not every transaction requires a Bill of Sale, it is highly recommended for significant purchases, especially vehicles or high-value items. It protects both parties by providing a record of the transaction.

Is a Bill of Sale required for vehicle sales in Georgia?

Yes, a Bill of Sale is required when selling a vehicle in Georgia. It serves as proof of the sale and is necessary for the buyer to register the vehicle in their name.

Can I create my own Bill of Sale in Georgia?

Yes, you can create your own Bill of Sale. However, it is important to ensure that it includes all necessary information and complies with Georgia laws. Templates are available online to help guide you.

Do I need to have the Bill of Sale notarized?

In Georgia, notarization is not required for a Bill of Sale. However, having it notarized can add an extra layer of security and may be beneficial if disputes arise later.

How long should I keep a Bill of Sale?

It is advisable to keep a Bill of Sale for at least three years after the transaction. This duration allows for any potential disputes or issues that may arise regarding the sale.

Where can I find a Georgia Bill of Sale template?

You can find Georgia Bill of Sale templates online through legal websites, state government resources, or local legal aid organizations. Make sure to choose a template that fits your specific needs.