Printable Georgia Articles of Incorporation Template

Find Other Popular Articles of Incorporation Templates for Specific States

How to Incorporate in Nc - The purpose clause explains what business activities the corporation will engage in.

Ohio Business Central - Some Articles include provisions on indemnification of directors.

To further clarify the importance of an Operating Agreement, it is essential to understand that having this document not only addresses the internal rules but also protects the members' interests. For more information on drafting such an agreement, you can visit OnlineLawDocs.com.

Pa Corporation - They can outline dissolution procedures should the corporation need to cease operations.

Misconceptions

When it comes to the Georgia Articles of Incorporation, several misconceptions can lead to confusion for those looking to establish a business. Understanding these common misunderstandings can help streamline the incorporation process.

- Misconception 1: You must have a physical office in Georgia to incorporate.

- Misconception 2: The Articles of Incorporation are the only document needed to start a business.

- Misconception 3: Incorporation guarantees personal liability protection.

- Misconception 4: You can file the Articles of Incorporation anytime without restrictions.

- Misconception 5: All businesses must file Articles of Incorporation.

- Misconception 6: Once filed, the Articles of Incorporation cannot be changed.

This is not true. While your business must be registered in Georgia, you do not need a physical office in the state. Many businesses operate remotely or from different locations while still being incorporated in Georgia.

Incorporating is just one step in starting a business. You may also need to obtain permits, licenses, and an Employer Identification Number (EIN) from the IRS. Each business type has its own requirements.

While incorporation generally provides liability protection for owners, it is not absolute. Personal liability can still arise from personal guarantees or certain actions taken outside the scope of the business.

There are specific guidelines and time frames for filing. It’s important to ensure you file during business hours and follow the state’s requirements to avoid delays.

This is misleading. Only certain types of businesses, like corporations, need to file Articles of Incorporation. Other business structures, such as sole proprietorships or partnerships, do not require this form.

This is incorrect. Amendments can be made to the Articles of Incorporation after filing. If changes occur, such as a change in business name or structure, you can file an amendment to reflect those changes.

Documents used along the form

When forming a corporation in Georgia, several additional documents may be required to ensure compliance with state regulations and to establish the corporation's operations effectively. Below is a list of forms and documents that are commonly used alongside the Georgia Articles of Incorporation.

- Bylaws: This document outlines the internal rules and procedures for the corporation. It governs the management structure, the responsibilities of directors and officers, and the process for holding meetings.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This report typically includes basic information about the corporation, such as its address and the names of its officers.

- Motor Vehicle Bill of Sale: This form is essential for recording the sale of a vehicle in Florida, serving as a receipt and necessary documentation for title transfer. More information can be found at smarttemplates.net/fillable-florida-motor-vehicle-bill-of-sale.

- Employer Identification Number (EIN): An EIN is necessary for tax purposes. It serves as the corporation's Social Security number and is required for hiring employees and opening a business bank account.

- Operating Agreement: While more common for LLCs, some corporations may choose to create an operating agreement to define the management structure and operational procedures, especially if the corporation has multiple owners.

- Stock Certificates: If the corporation issues shares, stock certificates may be created to represent ownership. These documents provide proof of ownership and detail the number of shares held by each shareholder.

- Minutes of the First Meeting: After incorporation, the first meeting of the board of directors should be documented. Minutes should include decisions made, resolutions passed, and the names of those present at the meeting.

- Business License: Depending on the type of business and location, a business license may be required to operate legally within the city or county. This document ensures compliance with local regulations.

- State Tax Registration: Corporations must register with the Georgia Department of Revenue for state tax purposes. This registration is essential for collecting sales tax and fulfilling other tax obligations.

- Annual Report: Corporations in Georgia are required to file an annual report to maintain good standing. This report typically includes updated information about the corporation's officers and registered agent.

Incorporating a business involves more than just filing the Articles of Incorporation. Each of these documents plays a crucial role in establishing a solid foundation for the corporation and ensuring compliance with legal requirements. Careful attention to these documents will help set the stage for future success.

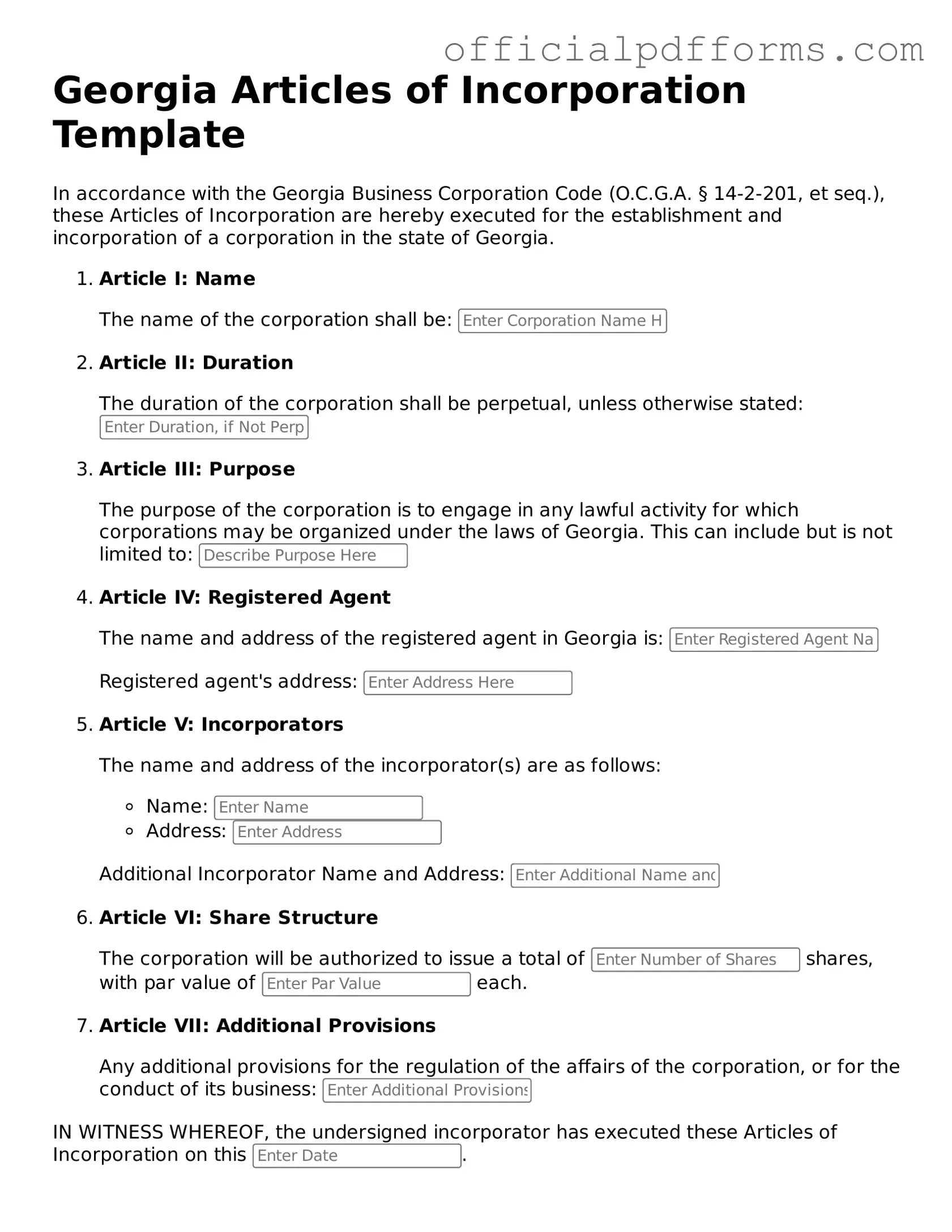

Steps to Filling Out Georgia Articles of Incorporation

Once you have the Georgia Articles of Incorporation form in hand, you can begin the process of filling it out. This form is essential for formally establishing your business in Georgia. After completing the form, you will need to submit it to the Secretary of State along with the required filing fee.

- Visit the Georgia Secretary of State's website to access the Articles of Incorporation form.

- Enter the name of your corporation. Ensure the name is unique and complies with Georgia naming rules.

- Provide the principal office address. This must be a physical address, not a P.O. Box.

- List the name and address of the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Indicate the purpose of your corporation. Be specific about the business activities you will engage in.

- State the number of shares the corporation is authorized to issue. If applicable, specify the classes of shares.

- Include the names and addresses of the incorporators. These are the individuals responsible for setting up the corporation.

- Sign and date the form. Ensure that the signature is from an authorized person, typically an incorporator.

- Review the completed form for accuracy. Make any necessary corrections before submission.

- Prepare the filing fee as required by the Georgia Secretary of State. Check the current fee amount on their website.

- Submit the form and payment either online or by mail to the appropriate address provided by the Secretary of State.

Common mistakes

-

Incorrect Business Name: The chosen name must be unique and not already in use by another corporation in Georgia. Failing to check name availability can lead to rejection.

-

Missing Registered Agent Information: Every corporation must designate a registered agent. Omitting this information can delay the filing process.

-

Inaccurate Incorporator Details: The form requires the names and addresses of the incorporators. Providing incorrect or incomplete information may result in legal complications.

-

Failure to Specify Business Purpose: A vague or overly broad business purpose can lead to questions about the corporation's legitimacy. Clearly defining the purpose is essential.

-

Omitting Initial Directors: The form should list the initial directors of the corporation. Not including this information can cause delays in approval.

-

Incorrect Filing Fee: Each submission requires a specific fee. Submitting the wrong amount can lead to rejection or processing delays.

-

Neglecting to Sign the Form: All incorporators must sign the Articles of Incorporation. A missing signature will invalidate the filing.

Get Clarifications on Georgia Articles of Incorporation

What is the Georgia Articles of Incorporation form?

The Georgia Articles of Incorporation form is a legal document that establishes a corporation in the state of Georgia. This form outlines essential information about the corporation, including its name, purpose, and the registered agent. Filing this document is a crucial step in the process of creating a corporation.

Who needs to file the Articles of Incorporation?

Any individual or group looking to form a corporation in Georgia must file the Articles of Incorporation. This includes businesses of various types, such as for-profit corporations, non-profit organizations, and professional corporations. The filing is necessary to gain legal recognition as a corporate entity.

What information is required on the form?

The Articles of Incorporation require several key pieces of information, including:

- The name of the corporation, which must be unique and not similar to existing entities.

- The purpose of the corporation, describing the nature of the business activities.

- The address of the corporation's registered office.

- The name and address of the registered agent, who will receive legal documents on behalf of the corporation.

- The names and addresses of the initial directors or incorporators.

How do I file the Articles of Incorporation?

Filing the Articles of Incorporation can be done online or by mail. To file online, individuals can visit the Georgia Secretary of State’s website. For mail submissions, the completed form should be sent to the appropriate office along with the required filing fee. It is important to ensure that all information is accurate and complete to avoid delays in processing.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation varies depending on the type of corporation being formed. As of the latest information, the fee for a standard for-profit corporation is typically around $100. Non-profit organizations may have different fees. It is advisable to check the Georgia Secretary of State’s website for the most current fee structure.

How long does it take for the Articles of Incorporation to be processed?

The processing time for the Articles of Incorporation can vary. Generally, if filed online, the processing is quicker and may take just a few business days. Mail submissions may take longer, often up to two weeks or more, depending on the volume of applications being processed. Tracking the status of the application is possible through the Secretary of State’s website.

What happens after the Articles of Incorporation are approved?

Once the Articles of Incorporation are approved, the corporation is officially formed. The corporation will receive a certificate of incorporation, which serves as proof of its legal existence. Following this, the corporation must comply with additional requirements, such as obtaining an Employer Identification Number (EIN) from the IRS and adhering to state and local business regulations.

Can I amend the Articles of Incorporation after filing?

Yes, amendments to the Articles of Incorporation can be made after the initial filing. If there are changes to the corporation's name, purpose, or other key details, a formal amendment must be filed with the Georgia Secretary of State. This process typically involves submitting a specific form and paying a fee. Keeping the Articles of Incorporation up to date is important for maintaining compliance with state laws.