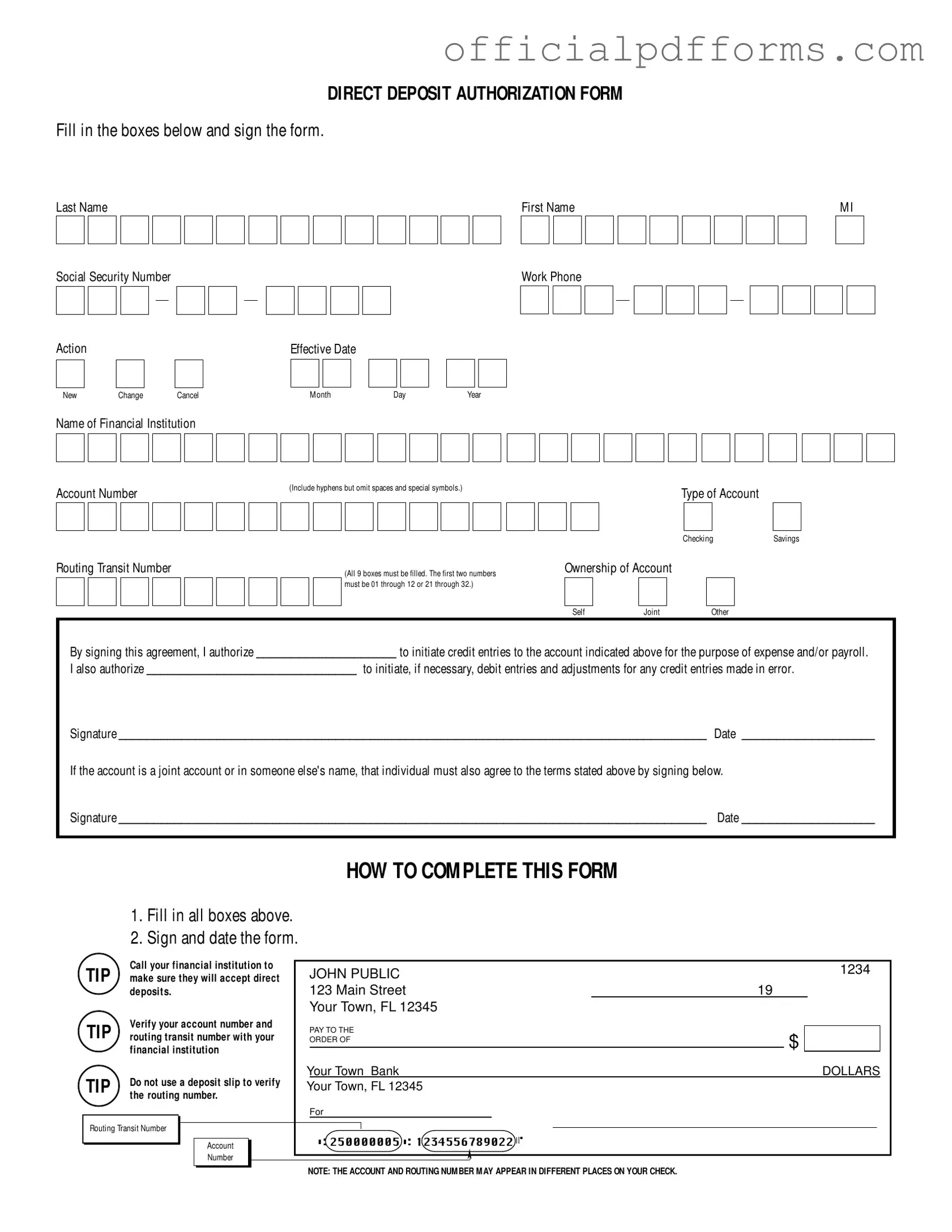

Fill in a Valid Generic Direct Deposit Form

Common PDF Forms

Employment Background Check on Myself - Applicants authorize checks with various agencies for background information.

The Georgia Trailer Bill of Sale form is a legal document used to record the transaction details when buying or selling a trailer in the state of Georgia. It serves as proof of purchase and verifies the change of ownership. For a smooth transfer and registration process, it is advisable to use the Trailer Bill of Sale form, which is essential for the buyer's registration and titling process of the trailer.

Profit and Loss Statement Template Pdf - Business owners use it to assess profitability.

Misconceptions

- Misconception 1: The Generic Direct Deposit form is only for payroll deposits.

- Misconception 2: You must fill out the entire form even if some information is not applicable.

- Misconception 3: You cannot change your direct deposit information once it is set up.

- Misconception 4: A signature is not necessary for a joint account.

- Misconception 5: The routing transit number can be found anywhere on the check.

- Misconception 6: You can use a deposit slip to verify your account information.

- Misconception 7: Once submitted, the direct deposit will start immediately.

- Misconception 8: You cannot cancel a direct deposit once it has been established.

This form can be used for various types of deposits, not just payroll. It can also facilitate expense reimbursements and other types of credit entries.

While most fields need to be completed, if certain information does not apply, it is acceptable to leave those sections blank. However, ensure that critical fields like account numbers and routing numbers are accurate.

Changes can be made at any time by submitting a new Generic Direct Deposit form. Just select the "Change" option and provide the updated details.

If the account is joint, all account holders must sign the form to authorize the direct deposit. This ensures that everyone agrees to the terms.

The routing number is typically located at the bottom left of a check. It is important to verify this number with your financial institution to ensure accuracy.

It is recommended not to use a deposit slip for verification. Instead, contact your financial institution directly to confirm your account and routing numbers.

There may be a processing period before the direct deposit takes effect. It is advisable to check with your employer or financial institution for specific timelines.

Cancellations are possible by submitting a new form and selecting the "Cancel" option. Make sure to follow up to confirm that the cancellation has been processed.

Documents used along the form

The Generic Direct Deposit form is a crucial document for setting up automatic payments into a bank account. However, several other forms and documents often accompany it to ensure a smooth and efficient process. Below is a list of these related documents, each serving a specific purpose.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. It helps determine the amount of federal income tax to withhold from paychecks.

- Paycheck Stub: This document provides a detailed breakdown of an employee's earnings, deductions, and net pay for a specific pay period. It serves as proof of income.

- Bank Account Statement: A monthly statement issued by a bank that summarizes all transactions in an account. It helps verify account ownership and balances.

- Employment Verification Letter: This letter confirms an individual's employment status, position, and salary. It may be required by financial institutions for loan applications.

- Texas RV Bill of Sale: This form is crucial for documenting the sale of recreational vehicles in Texas, helping buyers prove ownership and sellers finalize transfers. For more information, visit OnlineLawDocs.com.

- Void Check: A check that has "VOID" written across it. It is often requested to provide the correct account and routing numbers for direct deposit setups.

- Direct Deposit Change Form: This form is used when an employee wants to change their direct deposit details, such as account number or financial institution.

- IRS Form 1099: This form reports income received by non-employees, such as freelancers or contractors. It is essential for tax reporting purposes.

- State Tax Withholding Form: Similar to the W-4, this form is specific to state taxes and indicates how much state tax should be withheld from an employee's paycheck.

- Authorization for Electronic Funds Transfer (EFT): This document allows an organization to electronically transfer funds to an individual’s bank account for payments.

- Payroll Deduction Authorization Form: This form allows employees to authorize deductions from their paychecks for various reasons, such as retirement contributions or insurance premiums.

Understanding these documents can streamline the direct deposit process and help ensure that all necessary information is accurately provided. Each plays a vital role in financial transactions and employment verification, making them essential for both employers and employees.

Steps to Filling Out Generic Direct Deposit

Completing the Generic Direct Deposit form is a straightforward process that ensures your funds are deposited directly into your chosen bank account. After filling out the form, you will submit it to your employer or the relevant organization, which will then process your request for direct deposit.

- Begin by filling in your Last Name, First Name, and Middle Initial in the designated boxes.

- Enter your Social Security Number in the format of XXX-XX-XXXX.

- Select the Action you wish to take: New, Change, or Cancel.

- Provide the Effective Date by filling in the month, day, and year.

- Input your Work Phone number in the format of XXX-XXX-XXXX.

- Write the Name of Financial Institution where your account is held.

- Fill in your Account Number, including hyphens but omitting spaces and special symbols.

- Indicate the Type of Account by checking either Savings or Checking.

- Enter the Routing Transit Number, ensuring all 9 boxes are filled correctly.

- Specify the Ownership of Account by checking one of the options: Self, Joint, or Other.

- Sign the form to authorize the initiation of credit entries to your account.

- Provide the Date of your signature.

- If applicable, the joint account holder must also sign and date the form.

After completing these steps, ensure that you double-check all information for accuracy. It is advisable to contact your financial institution to confirm that they accept direct deposits and to verify your account and routing numbers. This will help prevent any issues with the deposit process.

Common mistakes

-

Incomplete Information: Many individuals fail to fill in all required fields. Every box must be completed, including the Social Security Number, account details, and effective date. Omitting any of this information can delay processing.

-

Incorrect Account Numbers: Errors often occur when entering the account number or routing transit number. It is crucial to verify these numbers with the financial institution. A single incorrect digit can result in funds being deposited into the wrong account.

-

Not Signing the Form: Some people neglect to sign the authorization form. A signature is necessary to validate the agreement. Without it, the financial institution cannot process the direct deposit request.

-

Using a Deposit Slip: Relying on a deposit slip to verify the routing number is a common mistake. It is important to confirm these details directly with the financial institution, as the routing number may differ from what is printed on a deposit slip.

-

Joint Accounts Misunderstanding: When using a joint account, both account holders must sign the form. Failing to obtain the necessary signatures can lead to complications and delays in setting up direct deposit.

Get Clarifications on Generic Direct Deposit

What is the Generic Direct Deposit form?

The Generic Direct Deposit form is a document that allows you to authorize your employer or another organization to deposit funds directly into your bank account. This can include payroll, expense reimbursements, or other payments.

How do I complete the form?

To complete the form, follow these steps:

- Fill in all required boxes, including your name, Social Security Number, and account details.

- Choose whether you are setting up a new direct deposit, making a change, or canceling an existing deposit.

- Sign and date the form to authorize the transactions.

Make sure to verify your account information with your financial institution before submitting the form.

What information do I need to provide?

You will need to provide the following information:

- Your full name

- Your Social Security Number

- Your work phone number

- The name of your financial institution

- Your account number

- Your routing transit number

- Ownership of the account (self, joint, or other)

What if my account is a joint account?

If your account is a joint account, both account holders must sign the form. Each person must agree to the terms stated in the authorization.

What is a routing transit number?

A routing transit number is a nine-digit code that identifies your financial institution. It is essential for processing direct deposits. Ensure that all nine boxes are filled in correctly, with the first two digits between 01-12 or 21-32.

Can I use a deposit slip to verify my account information?

No, do not use a deposit slip to verify your routing number. Instead, contact your financial institution directly for accurate information.

How long does it take for direct deposit to start?

The time it takes for direct deposit to begin can vary. Typically, it may take one to two pay cycles after submitting the form for the changes to take effect. Check with your employer for specific timelines.

What should I do if I change my bank account?

If you change your bank account, you need to fill out a new Generic Direct Deposit form. Indicate that you are making a change, and provide the new account and routing information. Submit the updated form to ensure that future deposits go to the correct account.

Who should I contact if I have questions about the form?

If you have questions about the form or the direct deposit process, contact your employer's payroll department or your financial institution for assistance. They can provide guidance and clarify any concerns you may have.