Fill in a Valid Florida Commercial Contract Form

Common PDF Forms

Direct Deposit Forms - Understanding your account ownership is important when filling out this form.

When completing a transaction involving a motorcycle, it is important to utilize a New York Motorcycle Bill of Sale form, as it serves as an essential legal document that facilitates the sale process. For those looking to create this document easily and efficiently, resources like OnlineLawDocs.com provide valuable guidance and templates to ensure all necessary details are captured correctly.

Da Form 638 Fillable - Recommenders must certify the nominee’s eligibility on the form.

Misconceptions

- Misconception 1: The Florida Commercial Contract form is only for large transactions.

- Misconception 2: All terms in the contract are fixed and cannot be negotiated.

- Misconception 3: Buyers have unlimited time to conduct due diligence.

- Misconception 4: The contract guarantees financing approval.

- Misconception 5: Sellers are responsible for all property inspections.

- Misconception 6: The closing date is flexible and can be changed at will.

- Misconception 7: A buyer can cancel the contract for any reason before closing.

- Misconception 8: The contract does not address issues of title and ownership.

- Misconception 9: All deposits are non-refundable.

This form can be used for various types of commercial property transactions, regardless of size. It is designed to accommodate both small and large deals.

While the contract includes standard terms, parties can negotiate specific provisions to suit their needs. Customization is often necessary to reflect the unique aspects of a transaction.

The contract specifies a defined Due Diligence Period. Buyers must act within this timeframe to assess the property's suitability for their intended use.

Financing is not guaranteed. Buyers must apply for financing and meet specific conditions to secure approval. If they fail to do so, they may lose their deposit.

Buyers are typically responsible for conducting their own inspections. The contract allows buyers to assess the property’s condition and suitability.

The closing date is set in the contract and can only be changed if both parties agree to the modification. Any extensions must be documented.

Cancellation is subject to specific conditions outlined in the contract. Buyers must adhere to the terms related to financing and property condition to cancel without penalty.

The contract includes provisions for title transfer and ensures that the seller conveys marketable title. Buyers should review these sections carefully to understand their rights.

Deposits can be refundable under certain conditions, such as failure to obtain financing or issues with title. The contract outlines specific scenarios where deposits may be returned.

Documents used along the form

The Florida Commercial Contract form serves as a crucial document in real estate transactions, outlining the terms and conditions under which a buyer agrees to purchase property from a seller. However, several other forms and documents are often utilized alongside this contract to ensure a smooth transaction. Below is a list of these essential documents, each playing a unique role in the process.

- Title Insurance Commitment: This document is provided by a title insurance company and outlines the terms under which title insurance will be issued. It details any existing liens, encumbrances, or defects in the title that could affect the buyer’s ownership rights.

- Property Disclosure Statement: Sellers are often required to provide this document, which discloses known issues with the property, such as structural problems, pest infestations, or environmental hazards. This transparency helps buyers make informed decisions.

- Escrow Agreement: This agreement outlines the terms under which an escrow agent will hold funds or documents until certain conditions are met. It protects both parties by ensuring that obligations are fulfilled before the transfer of ownership occurs.

- Closing Statement: This document summarizes the financial details of the transaction, including the purchase price, closing costs, and any adjustments. It provides a clear picture of the financial obligations of both the buyer and seller at closing.

- Lease Agreements (if applicable): If the property being sold includes tenants, lease agreements must be reviewed and potentially transferred to the new owner. These documents outline the terms of the rental agreements currently in place.

- Inspection Reports: Buyers often obtain inspection reports that assess the condition of the property. These reports can identify necessary repairs or maintenance issues, giving buyers leverage in negotiations.

- Motorcycle Bill of Sale Form: To ensure a smooth transfer of ownership, refer to our comprehensive motorcycle bill of sale process for accurate documentation of your motorcycle transactions.

- Loan Documents: If the buyer is financing the purchase, various loan documents will be required. These include the loan application, loan agreement, and any disclosures mandated by federal or state law.

Incorporating these documents into the transaction process not only helps ensure compliance with legal requirements but also fosters trust between buyers and sellers. Each document plays a vital role in protecting the interests of all parties involved, ultimately contributing to a successful real estate transaction.

Steps to Filling Out Florida Commercial Contract

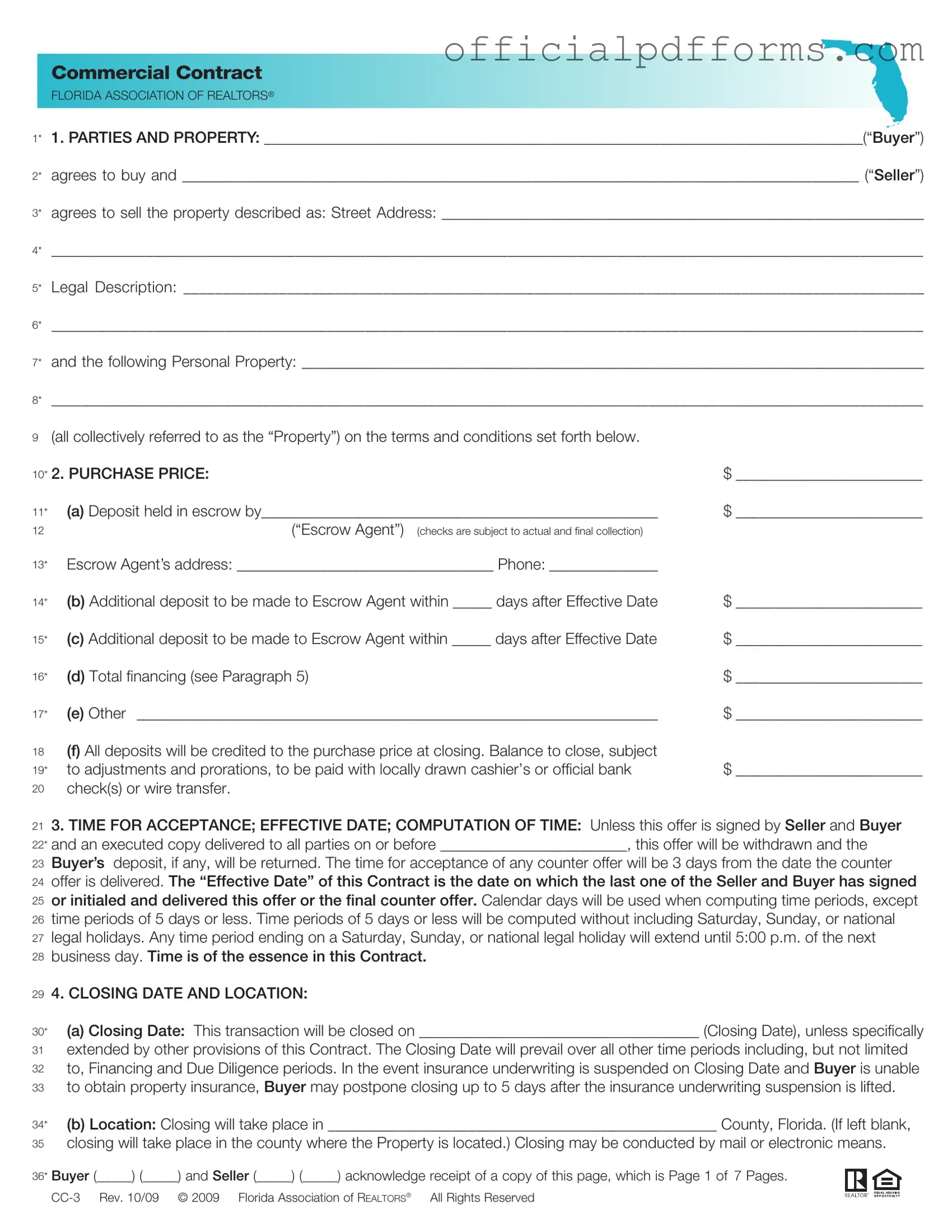

Completing the Florida Commercial Contract form requires careful attention to detail. Each section must be filled out accurately to ensure that both the buyer and seller understand the terms of the agreement. Below are the steps to guide you through the process of filling out the form.

- Identify the Parties: Write the names of the Buyer and Seller in the designated spaces.

- Property Description: Fill in the street address and legal description of the property being sold.

- Personal Property: List any personal property included in the sale.

- Purchase Price: Enter the total purchase price and details of any deposits to be held in escrow.

- Time for Acceptance: Specify the date by which the offer must be accepted.

- Closing Date and Location: Indicate the proposed closing date and location of the transaction.

- Third Party Financing: If applicable, provide details about financing, including the amount and terms.

- Title: Confirm that the seller can convey marketable title and specify the type of deed.

- Property Condition: Choose whether the property is sold "as is" or if there will be a due diligence period for inspections.

- Closing Procedure: Outline the responsibilities of both parties regarding possession, costs, and documents needed at closing.

- Escrow Agent: Designate the escrow agent and their responsibilities.

- Miscellaneous Provisions: Review and complete any additional terms or provisions as necessary.

Once the form is filled out, both parties should review it carefully before signing. This ensures that all terms are understood and agreed upon, minimizing the potential for disputes in the future.

Common mistakes

-

Incomplete Information: Failing to fill in all required fields can lead to significant delays. Ensure that all sections, including parties involved, property details, and purchase price, are fully completed.

-

Missing Signatures: Not obtaining signatures from both the buyer and seller can invalidate the contract. Always double-check that all necessary parties have signed before submission.

-

Incorrect Dates: Entering incorrect dates for acceptance and closing can create confusion. Verify that all dates are accurate and reflect the intended timeline for the transaction.

-

Ignoring Contingencies: Overlooking important contingencies, such as financing or inspection periods, can lead to unexpected complications. Make sure to clearly state any contingencies that apply to the transaction.

-

Not Reviewing Terms: Failing to thoroughly review the terms and conditions can result in misunderstandings. Take the time to read through the entire contract to ensure all terms are acceptable and understood.

Get Clarifications on Florida Commercial Contract

What is the Florida Commercial Contract form used for?

The Florida Commercial Contract form is a legal document used in real estate transactions involving commercial properties in Florida. It outlines the terms and conditions under which a buyer agrees to purchase property from a seller. This form includes details such as the purchase price, deposit amounts, closing dates, and any contingencies related to financing or property inspections.

Who are the parties involved in the contract?

In the Florida Commercial Contract, there are typically two main parties: the Buyer and the Seller. The Buyer is the individual or entity purchasing the property, while the Seller is the current owner of the property. Both parties must sign the contract for it to be valid, and their respective roles and responsibilities are clearly defined within the document.

What are the key components of the contract?

The Florida Commercial Contract contains several essential components, including:

- Parties and Property: Identification of the Buyer and Seller along with a detailed description of the property being sold.

- Purchase Price: The total price for the property, including deposit amounts and payment methods.

- Closing Date: The date when the transaction will be finalized and ownership transferred.

- Financing Contingency: Terms regarding any third-party financing the Buyer may require to complete the purchase.

- Title and Property Condition: Assurances regarding the title's marketability and the condition of the property.

What happens if the Buyer cannot secure financing?

If the Buyer is unable to secure financing despite making a good faith effort, they have the option to cancel the contract. The Buyer must notify the Seller within a specified timeframe if they choose to cancel. If this occurs, the Buyer’s deposit will be returned, and both parties will be released from further obligations under the contract.

How is the closing process handled?

The closing process is a critical part of the transaction, where ownership of the property is officially transferred. The contract specifies the closing date and location. During closing, various documents are exchanged, and payments are made. The Seller is responsible for providing necessary documents, while the Buyer must cover certain costs like attorney fees and recording fees. The contract also outlines what happens if any issues arise during this process.

Can the contract be modified after it is signed?

Yes, the Florida Commercial Contract can be modified after it is signed, but any changes must be documented in writing and signed by all parties involved. This ensures that all modifications are legally binding. It is important to keep a record of any changes to maintain clarity and enforceability of the contract.