Fill in a Valid Erc Broker Market Analysis Form

Common PDF Forms

Information Report of Security Guard - Document changes in scheduled patrols or checks.

An Employment Verification form serves as a critical document that confirms a person's employment status, position, and income. It is often used by lenders, landlords, or future employers to assess an individual's financial reliability and job stability. This simple yet significant piece of paper bridges the gap between trust and confirmation in various professional and personal dealings. For more information, you can visit https://smarttemplates.net/fillable-employment-verification/.

T47 Affidavit - A completed and signed T-47 can be beneficial in real estate negotiations.

Misconceptions

- Misconception 1: The ERC Broker Market Analysis form is an appraisal.

- Misconception 2: The form includes a home inspection.

- Misconception 3: The analysis is valid indefinitely.

- Misconception 4: All state-specific disclosure requirements are covered in the form.

This form is not an appraisal. It is a comparative market analysis, which means it provides an estimate of the property's Most Likely Sales Price based on market conditions and comparable properties. It does not follow the Uniform Standards of Professional Appraisal Practice.

While the form does require the broker to note the property's condition, it is not a home inspection. The broker is expected to observe visible issues but is not conducting a thorough inspection like a licensed home inspector would.

The ERC Broker Market Analysis form has an expiration date. The version referenced expires on December 31, 2009, which means it should be updated or replaced with a current version to ensure accuracy and compliance with regulations.

While the form prompts preparers to be aware of state-specific disclosure requirements, it does not automatically include them. Brokers must ensure they add any necessary disclosures relevant to their state to comply with local laws.

Documents used along the form

The ERC Broker Market Analysis form plays a vital role in evaluating a property's potential sale price and marketability. To complement this form, several other documents are often utilized in the real estate process. Each of these documents serves a unique purpose, helping brokers, homeowners, and potential buyers navigate the complexities of property transactions.

- Comparative Market Analysis (CMA): This document provides a detailed comparison of similar properties that have recently sold in the area. It helps to establish a fair market value for the subject property by analyzing factors like location, size, and features.

- Property Disclosure Statement: Homeowners use this form to disclose known issues or defects with the property. It protects both the seller and the buyer by ensuring transparency regarding the property's condition.

- New York Motorcycle Bill of Sale: This essential document formalizes the sale of a motorcycle, ensuring clarity in the transaction by recording details such as the sale date, price, and information pertaining to both buyer and seller. For more information, visit OnlineLawDocs.com.

- Listing Agreement: This contract outlines the terms between the seller and the real estate agent. It specifies the agent's responsibilities, the listing price, and the duration of the agreement, ensuring that both parties are on the same page.

- Purchase Agreement: Once a buyer is found, this legally binding contract is drafted to outline the terms of the sale. It includes details such as the purchase price, contingencies, and the closing date, ensuring that both parties are committed to the transaction.

- Inspection Report: Conducted by a professional inspector, this report evaluates the property's condition. It identifies any necessary repairs or maintenance issues, providing valuable information to the buyer before finalizing the sale.

- Appraisal Report: This document is prepared by a licensed appraiser and assesses the property's value based on various factors, including market trends and property condition. It is often required by lenders to ensure the property is worth the loan amount.

In summary, these documents work together to create a comprehensive picture of the property in question, aiding in the decision-making process for all parties involved. Understanding each document's role can significantly enhance the experience of buying or selling a home.

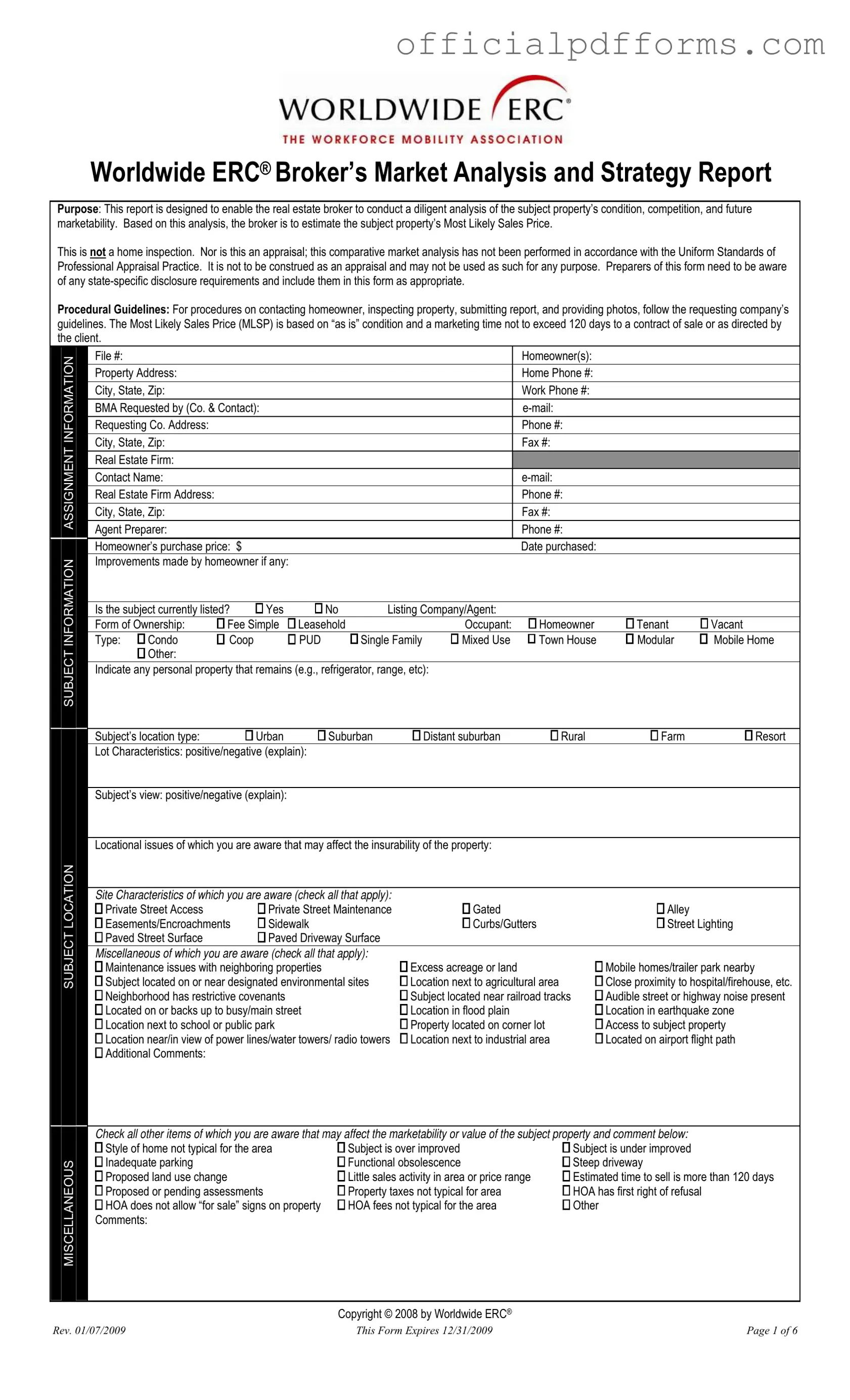

Steps to Filling Out Erc Broker Market Analysis

Completing the ERC Broker Market Analysis form is a crucial step in assessing the market value of a property. This process requires careful attention to detail and a thorough understanding of the property and its surroundings. Following the steps outlined below will help ensure that all necessary information is accurately captured.

- Begin by entering the File Number, Homeowner(s) names, and Property Address at the top of the form.

- Fill in the Home Phone Number, Work Phone Number, and e-mail addresses for both the homeowner and the requesting company.

- Provide the Real Estate Firm details, including Contact Name and Agent Preparer information.

- Document the Homeowner’s Purchase Price and Date Purchased.

- Indicate any Improvements Made by the homeowner, if applicable.

- Specify whether the property is currently listed and provide details of the Listing Company/Agent.

- Choose the Form of Ownership and identify the current Occupant type.

- Describe the Subject’s Location Type and any positive or negative Lot Characteristics.

- Check all relevant Site Characteristics and Miscellaneous Issues that may affect the property.

- Assess the Property Condition by checking the appropriate boxes and providing comments where necessary.

- Estimate costs for Interior Repairs and Exterior Repairs and provide comments on each.

- List all required and customary inspections relevant to the property.

- Identify the most probable means of financing and describe any necessary concessions.

- Evaluate the Subject Neighborhood and provide statistics that reflect the market area.

- Document Competing Listings and Comparable Sales, ensuring to capture all relevant details for each property.

- Finally, add any additional comments or notes that may be pertinent to the analysis.

Once the form is completed, it should be submitted according to the requesting company’s guidelines. Ensure that all required disclosures and state-specific requirements are included. This thorough approach will enhance the accuracy of the market analysis and assist in determining the Most Likely Sales Price for the property.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays. Ensure every section is completed accurately.

-

Misunderstanding the Purpose: Some may confuse this form with an appraisal or home inspection. Remember, this is a market analysis, not an official valuation.

-

Ignoring State-Specific Requirements: Each state has unique disclosure laws. Not including these can result in compliance issues.

-

Inaccurate Property Details: Providing incorrect information about the property’s condition or features can mislead potential buyers. Double-check all entries.

-

Overlooking Market Conditions: Failing to consider current market trends can skew the Most Likely Sales Price. Stay informed about local real estate dynamics.

Get Clarifications on Erc Broker Market Analysis

What is the purpose of the ERC Broker Market Analysis form?

The ERC Broker Market Analysis form helps real estate brokers assess a property’s condition, competition, and future marketability. It guides brokers in estimating the Most Likely Sales Price (MLSP) of a property. This is not a home inspection or appraisal. Instead, it provides a comparative market analysis that does not follow the Uniform Standards of Professional Appraisal Practice. Brokers must also be aware of any state-specific disclosure requirements and include them in their analysis.

What information is required to complete the form?

To complete the ERC Broker Market Analysis form, brokers need to gather various details, including:

- Property information: Address, homeowner details, and purchase price.

- Condition of the property: Any improvements made, current listing status, and potential issues.

- Neighborhood characteristics: Market trends, price ranges, and competing properties.

- Financing details: Anticipated financing issues and any necessary concessions.

Completing the form accurately requires thorough research and observation of the property and its surroundings.

How does the Most Likely Sales Price (MLSP) get determined?

The Most Likely Sales Price is based on the property’s “as is” condition and the expected marketing time, which should not exceed 120 days unless directed otherwise by the client. Brokers analyze comparable properties, market conditions, and property features to arrive at this estimate. The goal is to provide a realistic price that reflects current market trends.

Are there any specific guidelines for submitting the report?

Brokers must follow the requesting company’s guidelines for submitting the report. This includes contacting the homeowner, inspecting the property, and providing necessary photos. It’s crucial to ensure that all required information is complete and accurate before submission. Following these guidelines helps maintain professionalism and ensures that the analysis serves its intended purpose effectively.