Valid Employee Loan Agreement Document

Misconceptions

Understanding the Employee Loan Agreement form is crucial for both employers and employees. However, several misconceptions can lead to confusion. Here are eight common misconceptions about this important document:

-

All loans are the same.

Many people believe that all employee loans function identically. In reality, the terms and conditions can vary significantly based on the agreement and the employer's policies.

-

Employee loans are always interest-free.

While some employers may offer interest-free loans, this is not universally true. Some agreements may include interest rates, which should be clearly outlined in the document.

-

Signing means you can’t change your mind.

Some employees think that signing the agreement locks them into the terms permanently. In fact, discussions can often be had with employers to modify terms, especially if circumstances change.

-

Loans must be repaid immediately.

Another misconception is that repayment must start right away. Many agreements allow for a grace period or set a specific repayment schedule.

-

All loans require a credit check.

Some believe that a credit check is mandatory for all employee loans. However, many employers do not require a credit check for internal loans.

-

Employee loans are taxable income.

There is a belief that any amount borrowed under an employee loan agreement is considered taxable income. This is not the case; it generally depends on the terms of the loan.

-

Only full-time employees can apply.

Many assume that only full-time employees are eligible for loans. However, part-time employees may also qualify, depending on the employer’s policy.

-

Documentation isn’t necessary.

Some people think that informal agreements are sufficient. In reality, having a formal document protects both parties and clarifies the terms of the loan.

By clearing up these misconceptions, both employers and employees can navigate the Employee Loan Agreement form more effectively and ensure a smoother process.

Documents used along the form

When managing employee loans, several forms and documents work in tandem with the Employee Loan Agreement. Each of these documents serves a unique purpose, ensuring clarity and protection for both the employer and the employee. Below is a list of commonly used documents that complement the Employee Loan Agreement.

- Loan Application Form: This form is completed by the employee to request a loan. It typically includes personal information, the amount requested, and the purpose of the loan.

- Repayment Schedule: This document outlines the terms of repayment, including the amount of each installment, due dates, and the total duration of the loan.

- Employee Consent Form: This form is used to obtain the employee's consent for the employer to deduct loan payments directly from their paycheck.

- Credit Check Authorization: If applicable, this document allows the employer to perform a credit check on the employee to assess their creditworthiness before approving the loan.

- Loan Disbursement Receipt: After the loan is approved and funds are disbursed, this receipt serves as proof of the transaction, detailing the amount and date of disbursement.

- Default Notice: If an employee fails to make payments as agreed, this notice is sent to inform them of the default and the potential consequences.

- Loan Modification Agreement: Should the terms of the loan need to be changed, this document outlines the new terms and conditions agreed upon by both parties.

- Loan Agreement Form: For clarity in your financial arrangements, consider our user-friendly Loan Agreement documentation to streamline the loan process.

- Termination of Loan Agreement: In the event that the loan is fully repaid or the employee leaves the company, this document formally ends the loan agreement.

- Financial Counseling Resources: Providing information on financial counseling can assist employees in managing their finances effectively, especially if they encounter difficulties with loan repayment.

By utilizing these documents alongside the Employee Loan Agreement, employers and employees can navigate the loan process with greater ease and transparency. Each form plays a vital role in ensuring that all parties understand their rights and responsibilities throughout the loan lifecycle.

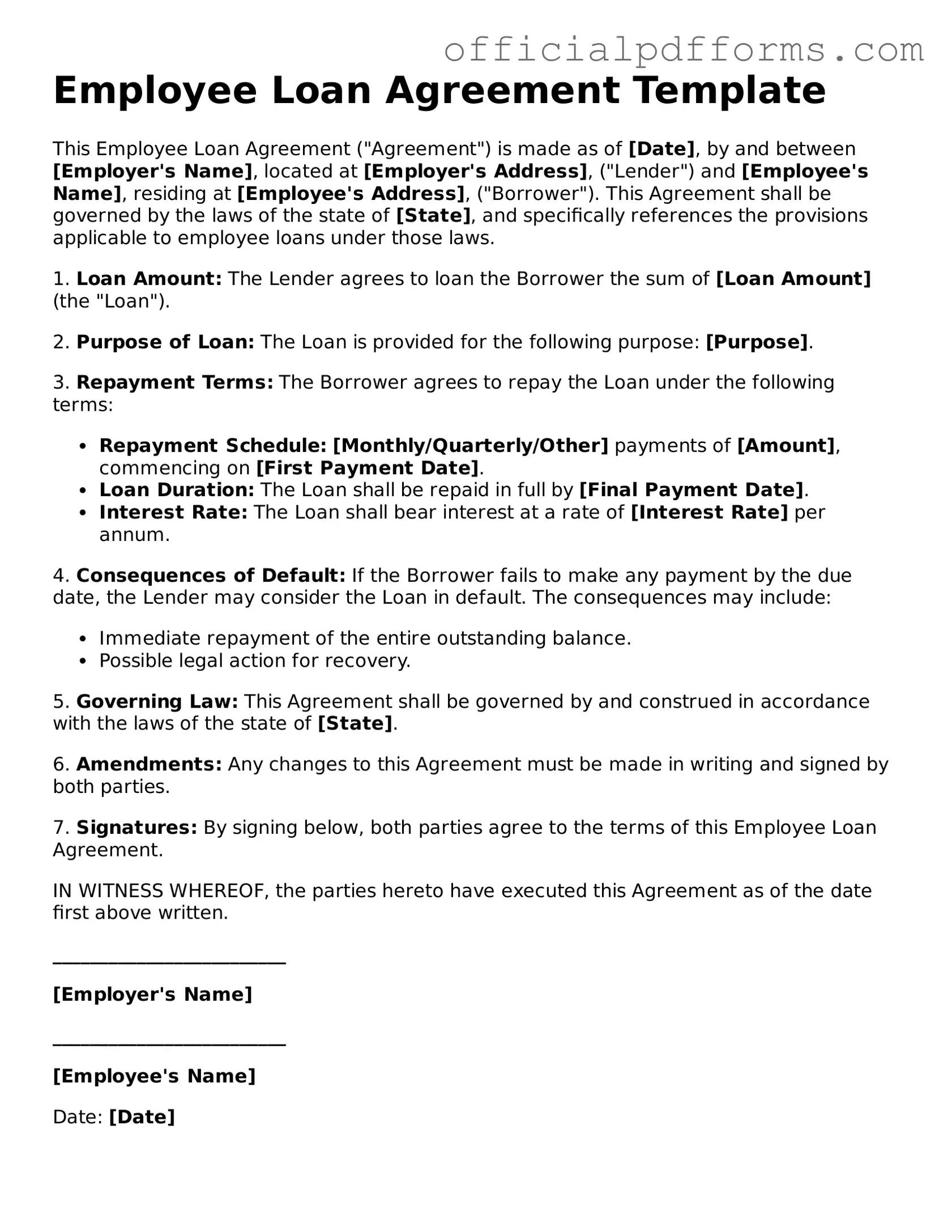

Steps to Filling Out Employee Loan Agreement

Filling out the Employee Loan Agreement form requires careful attention to detail. This document serves as a formal record of the loan arrangement between the employee and the employer. Ensuring accuracy will help avoid misunderstandings in the future.

- Begin by entering the date at the top of the form.

- Fill in the employee's full name as it appears on official documents.

- Provide the employee's job title and department to confirm their position within the company.

- Input the total loan amount requested by the employee.

- Specify the purpose of the loan clearly and concisely.

- Indicate the repayment terms, including the duration and frequency of payments.

- Include the interest rate, if applicable, ensuring it aligns with company policy.

- Sign and date the form at the designated section to validate the agreement.

- Have the employee sign and date the form as well, confirming their acceptance of the terms.

- Submit the completed form to the HR department for processing.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required personal information, such as their full name, address, and employee identification number. Omitting any of these details can lead to processing delays.

-

Incorrect Loan Amount: Some people mistakenly enter the wrong loan amount. It is crucial to double-check this figure to ensure it matches the agreed-upon terms.

-

Missing Signatures: A common oversight is neglecting to sign the form. Both the employee and the employer must sign the agreement for it to be valid.

-

Failure to Read Terms: Individuals often skim through the terms and conditions. Understanding the repayment schedule and interest rates is vital to avoid future disputes.

-

Not Including Purpose of Loan: Some forms lack a clear explanation of the loan's purpose. Providing this information can help clarify the context for both parties.

-

Ignoring Repayment Terms: Employees sometimes overlook the specifics of repayment, such as the frequency of payments and due dates. This can lead to missed payments.

-

Providing Inaccurate Contact Information: Incorrect phone numbers or email addresses can hinder communication regarding the loan. Ensure all contact details are accurate.

-

Not Specifying Collateral: If collateral is required, failing to specify what it is can create confusion. Clearly outlining any collateral can protect both parties.

-

Neglecting to Keep a Copy: After submitting the form, some individuals forget to keep a copy for their records. Retaining a copy is important for future reference.

-

Overlooking Legal Requirements: Some employees do not consider the legal implications of the agreement. Familiarity with applicable laws can prevent issues down the line.

Get Clarifications on Employee Loan Agreement

What is an Employee Loan Agreement?

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer provides a loan to an employee. This agreement serves to protect both parties by clearly stating the loan amount, repayment schedule, interest rates, and any other relevant terms.

Why would an employee need a loan from their employer?

Employees may seek loans from their employer for various reasons, including:

- Unexpected medical expenses

- Home repairs or emergencies

- Education costs or tuition fees

- Debt consolidation

These loans can provide quick access to funds without the need for traditional banking processes.

What should be included in an Employee Loan Agreement?

A comprehensive Employee Loan Agreement should include the following key components:

- Loan amount

- Interest rate (if applicable)

- Repayment schedule (e.g., monthly payments)

- Consequences of defaulting on the loan

- Any fees associated with the loan

- Conditions for early repayment

Including these details helps to avoid misunderstandings in the future.

How is the repayment schedule determined?

The repayment schedule is typically agreed upon by both the employer and the employee before the loan is issued. It can vary based on the loan amount and the employee's financial situation. Common schedules include monthly or bi-weekly payments, often deducted directly from the employee's paycheck.

Are there any tax implications for the employee?

Yes, there can be tax implications. If the loan is forgiven or if the interest rate is lower than the market rate, the IRS may consider it taxable income. Employees should consult a tax professional to understand how the loan may affect their tax situation.

What happens if an employee leaves the company before repaying the loan?

If an employee leaves the company before the loan is fully repaid, the agreement should specify the terms regarding repayment. Typically, the remaining balance may become due immediately, or it may be deducted from the employee's final paycheck. Clarity in the agreement helps to manage this situation smoothly.

Can an employee negotiate the terms of the loan?

Yes, employees can negotiate the terms of the loan before signing the agreement. It’s important for both parties to discuss and agree on the terms to ensure that the arrangement is fair and manageable for the employee.

What if the employee cannot make a payment?

If an employee is unable to make a payment, they should communicate with their employer as soon as possible. The agreement may outline options for deferment or restructuring the payment plan. Open communication can help to find a solution that works for both parties.

Is a written agreement necessary?

Yes, a written agreement is essential. It provides legal protection for both the employer and the employee by documenting the terms of the loan. A verbal agreement may lead to misunderstandings and disputes, so having everything in writing is the best practice.