Fill in a Valid Employee Advance Form

Common PDF Forms

Pharmacy Medication Labels - Can ease concerns about potential medication side effects.

For those who frequently rely on deliveries, understanding the FedEx Release Form is essential, particularly for those who might be away during delivery times. This form not only allows recipients to designate a safe location for their packages but also streamlines the delivery process by eliminating the need for a direct hand-off. To learn more about filling out this important document, you can visit smarttemplates.net/fillable-fedex-release, which provides comprehensive guidance on the steps involved in the release process.

Blank Free Printable Cash Drawer Count Sheet - This form supports better decision-making regarding cash flow.

Misconceptions

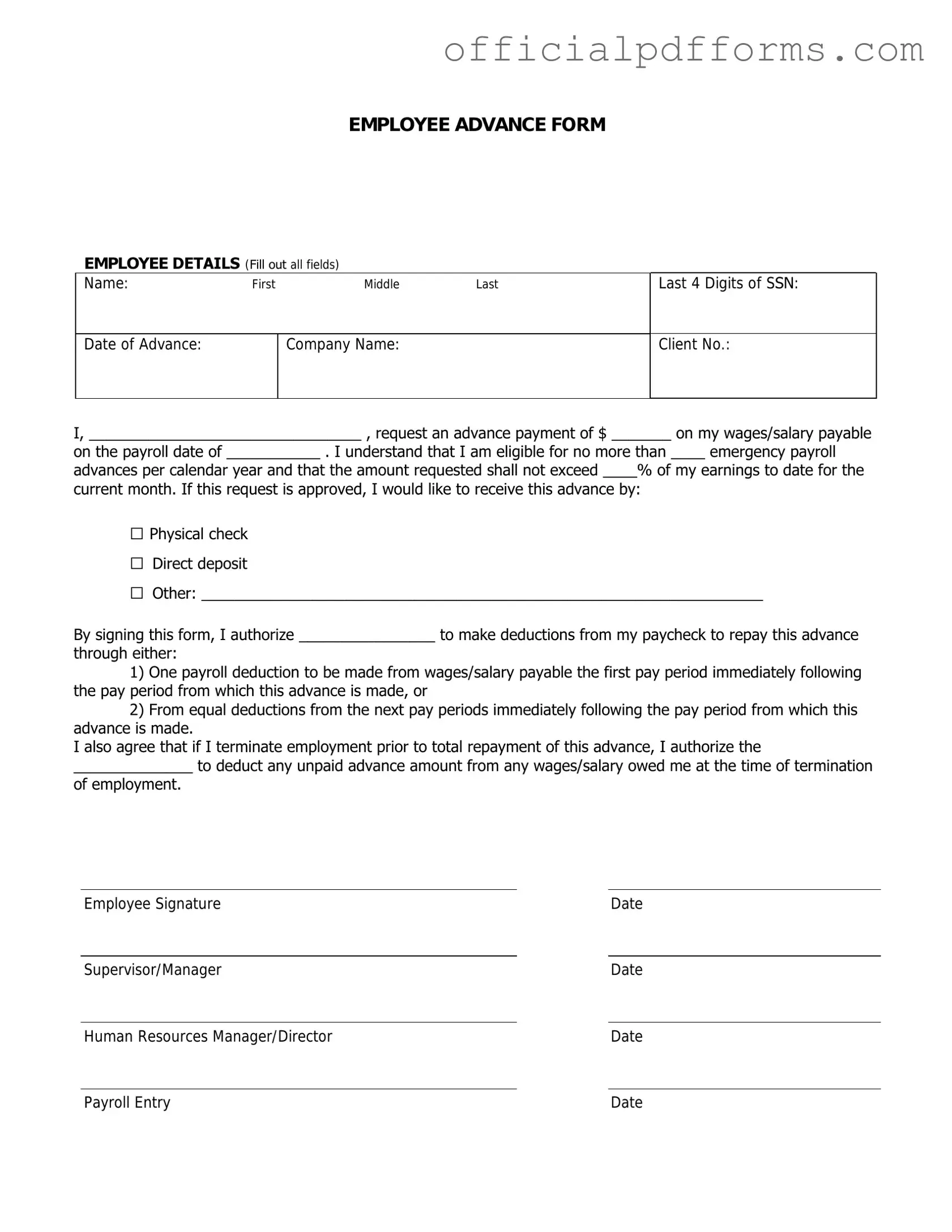

Understanding the Employee Advance form is essential for both employees and employers. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

- Misconception 1: The Employee Advance form is only for emergencies.

- Misconception 2: Submitting the form guarantees approval.

- Misconception 3: All advances are deducted from the next paycheck.

- Misconception 4: The process is overly complicated.

Many believe this form is exclusively for urgent financial needs. In reality, it can be used for various reasons, including planned expenses or work-related costs.

Some employees think that once they submit the form, the advance will automatically be granted. Approval depends on company policy and individual circumstances.

While many companies do deduct advances from the next paycheck, some may offer different repayment options. It's important to clarify this with HR.

Many fear that the application process is lengthy and confusing. In fact, most organizations aim to streamline the process to make it as straightforward as possible.

Documents used along the form

When processing an Employee Advance form, several other documents may be required to ensure a smooth and efficient transaction. Each of these forms serves a specific purpose in the context of employee financial assistance and company policies. Below is a list of commonly used documents that accompany the Employee Advance form.

- Employee Reimbursement Form: This document allows employees to request reimbursement for expenses they have incurred on behalf of the company, ensuring that they are compensated for out-of-pocket costs.

- Payroll Deduction Authorization: Employees must complete this form to authorize deductions from their paychecks, which may be necessary for repaying advances or loans.

- Expense Report: This report details the expenses incurred by an employee during a specific period, providing a comprehensive overview for reimbursement or advance justification.

- Direct Deposit Authorization: Employees fill out this form to set up direct deposit for their payroll checks, streamlining payment processes and ensuring timely access to funds.

- Company Policy Manual: This manual outlines the company's policies regarding employee advances, reimbursements, and other financial matters, serving as a reference for both employees and management.

- Loan Agreement: If the advance is structured as a loan, this document formalizes the terms of the loan, including repayment schedule and interest rates.

- Tax Withholding Form: Employees complete this form to specify how much tax should be withheld from their pay, which can impact the net amount received from advances.

- Financial Hardship Application: In cases where employees are facing financial difficulties, this form allows them to apply for additional assistance or modified repayment terms.

- Power of Attorney: In situations where an employee may be unable to manage their financial affairs, having a OnlineLawDocs.com Power of Attorney may be crucial. This legal document allows another person to make decisions on their behalf, ensuring that their financial interests are taken care of.

- Manager Approval Form: This form is used to obtain managerial approval for the advance, ensuring that the request aligns with company policies and budgetary constraints.

- Termination Notice: If an employee leaves the company, this notice may be necessary to address any outstanding advances or reimbursements owed to the employee.

Understanding these documents and their functions can help streamline the process surrounding employee advances. Proper documentation not only facilitates efficient processing but also fosters transparency and accountability within the organization.

Steps to Filling Out Employee Advance

Completing the Employee Advance form is essential for requesting funds for business-related expenses. After filling out the form, it will be submitted for approval, and you will receive a notification regarding the status of your request.

- Begin by entering your full name in the designated field.

- Provide your employee identification number to help identify your record.

- Fill in the date of the request to indicate when you are submitting the form.

- Specify the amount of the advance you are requesting.

- Clearly outline the purpose of the advance in the provided section.

- Include any relevant details or explanations that may support your request.

- Sign and date the form at the bottom to confirm your request.

- Submit the completed form to your supervisor or the designated department for processing.

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. Missing details can delay the processing of the advance.

-

Incorrect Dates: Some people mistakenly enter the wrong dates for the advance request. This can lead to confusion and potential delays in approval.

-

Insufficient Justification: A common error is failing to provide a clear reason for the advance. Without a strong justification, the request may be denied.

-

Not Following Guidelines: Each company may have specific guidelines for filling out the form. Ignoring these can result in a rejected application.

-

Missing Signatures: Some forget to sign the form or obtain necessary approvals. A missing signature can halt the entire process.

-

Using Incorrect Account Numbers: Providing the wrong account information can cause funds to be sent to the wrong place. Double-checking this detail is crucial.

-

Not Keeping a Copy: Failing to make a copy of the submitted form can lead to issues later. Having a record is essential for tracking the request.

-

Ignoring Submission Deadlines: Some individuals overlook the importance of submitting the form on time. Late submissions can result in missed opportunities for financial assistance.

Get Clarifications on Employee Advance

What is an Employee Advance form?

The Employee Advance form is a document that allows employees to request an advance on their salary or wages. This advance can help employees manage unexpected expenses or financial emergencies. By submitting this form, employees can formally communicate their need for an advance to their employer.

Who is eligible to request an advance?

Generally, all employees who have been with the company for a certain period may be eligible to request an advance. Eligibility criteria can vary by organization, so it’s important to check with your HR department or review the company policy regarding advances.

How do I fill out the Employee Advance form?

To fill out the form, follow these steps:

- Provide your personal information, including your name, employee ID, and department.

- Clearly state the amount of advance you are requesting.

- Explain the reason for the advance in a concise manner.

- Sign and date the form to confirm your request.

Make sure to review your information for accuracy before submitting the form.

What documentation do I need to submit with the form?

Typically, no additional documentation is required when submitting the Employee Advance form. However, some companies may ask for supporting documents, especially if the advance request is for a significant amount. It is advisable to check your company's policy for any specific requirements.

How long does it take to process the advance request?

The processing time for an advance request can vary. Most companies aim to review and respond to requests within a few business days. If your request is approved, the funds may be available in your next paycheck or as a separate payment, depending on company policy.

Will the advance be deducted from my future paychecks?

Yes, in most cases, the amount of the advance will be deducted from your future paychecks. The deduction schedule may differ based on your company's policy. Employees should clarify the repayment terms with HR to understand how and when the deductions will occur.

What if my request for an advance is denied?

If your request is denied, you will typically receive a notification explaining the reason for the denial. It’s important to communicate with your supervisor or HR department for further clarification. If necessary, you can consider reapplying in the future or exploring other financial assistance options available through the company.