Valid Durable Power of Attorney Document

Durable Power of Attorney Forms for Individual US States

Consider More Types of Durable Power of Attorney Documents

Reg 260 - Use this form to ensure all necessary signatures are obtained without the owner's physical presence.

Using the Arizona ATV Bill of Sale form ensures that both parties are legally protected during the transaction process, making it essential for any sale of an all-terrain vehicle. For further assistance, you can find a well-structured template at Legal PDF Documents, which can guide you through completing your bill of sale efficiently.

Notarized Minor Child Power of Attorney Child Guardianship - This arrangement can also foster stronger relationships between the child and the appointed caregiver.

Misconceptions

Understanding the Durable Power of Attorney (DPOA) is essential for anyone considering this important legal document. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

-

Misconception 1: A Durable Power of Attorney only becomes effective when the principal is incapacitated.

This is not always true. A DPOA can be set up to take effect immediately, allowing the agent to act on behalf of the principal right away. Alternatively, it can be drafted to activate only when the principal is unable to make decisions.

-

Misconception 2: The agent can do anything they want with the principal's assets.

This is misleading. The agent must act in the best interest of the principal and follow the guidelines outlined in the DPOA. They cannot misuse their authority for personal gain.

-

Misconception 3: A Durable Power of Attorney is the same as a living will.

These documents serve different purposes. A DPOA focuses on financial and legal matters, while a living will addresses healthcare decisions. Understanding their distinct roles is crucial for proper planning.

-

Misconception 4: Once a Durable Power of Attorney is signed, it cannot be changed or revoked.

This is incorrect. The principal retains the right to revoke or modify the DPOA at any time, as long as they are mentally competent. Regularly reviewing and updating the document is a wise practice.

By clarifying these misconceptions, individuals can make informed decisions regarding their Durable Power of Attorney and ensure their wishes are honored.

Documents used along the form

When considering the Durable Power of Attorney (DPOA), it's essential to understand that this document often works in tandem with several other legal forms. These documents can provide additional clarity and support regarding financial and healthcare decisions. Here are a few commonly associated forms:

- Advance Healthcare Directive: This document outlines your medical preferences in case you become unable to communicate your wishes. It often includes a living will and can designate a healthcare proxy to make decisions on your behalf.

- Financial Power of Attorney: Similar to the DPOA, this form specifically focuses on financial matters. It grants someone the authority to manage your financial affairs, such as paying bills, managing investments, or handling real estate transactions.

- Motor Vehicle Bill of Sale: The Motor Vehicle Bill of Sale form is essential for documenting the sale of a vehicle in Arizona, providing crucial details about the transaction and protecting the interests of both parties.

- Living Will: A living will is a type of advance directive that specifies what medical treatments you would or would not want if you are terminally ill or incapacitated. It provides guidance to your healthcare team and loved ones about your preferences regarding life-sustaining measures.

- HIPAA Release Form: This form allows you to authorize certain individuals to access your medical records and health information. It ensures that your healthcare providers can share necessary information with those you trust, facilitating better decision-making in medical situations.

Understanding these documents can empower individuals to make informed decisions about their health and finances. By using a Durable Power of Attorney alongside these forms, you can ensure that your wishes are respected and that your affairs are managed according to your preferences.

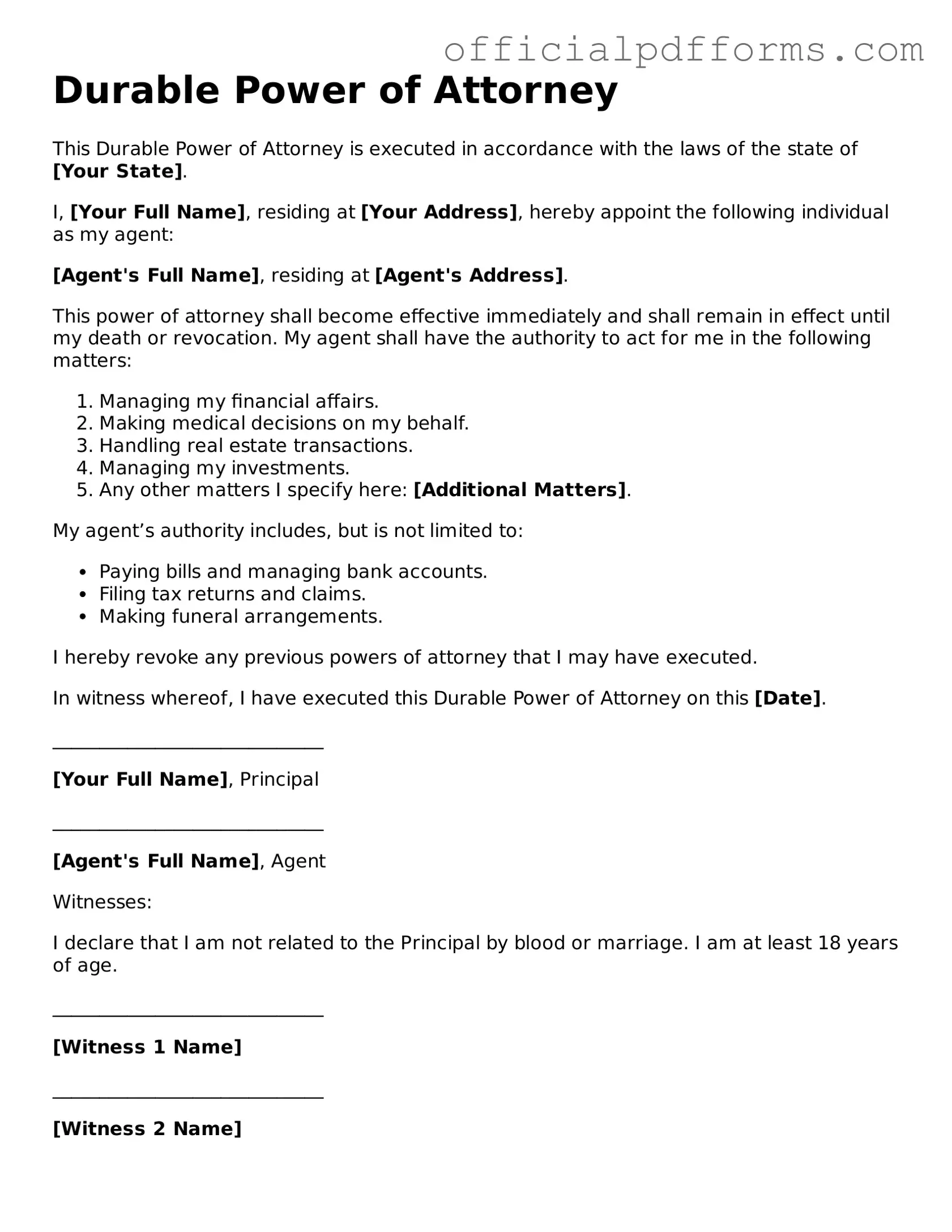

Steps to Filling Out Durable Power of Attorney

Filling out a Durable Power of Attorney form is an important step in planning for future healthcare and financial decisions. After completing the form, it will need to be signed and witnessed according to your state’s requirements. This ensures that your choices are respected and followed when you are unable to make decisions for yourself.

- Obtain a Durable Power of Attorney form. You can find this form online or through legal offices.

- Begin by filling in your name and address at the top of the form. This identifies you as the principal.

- Next, designate an agent. Write the name and contact information of the person you trust to act on your behalf.

- Specify the powers you wish to grant to your agent. This may include financial decisions, healthcare choices, or both.

- Include any limitations or specific instructions regarding the powers granted, if applicable.

- Sign and date the form. Your signature must be clear and legible.

- Have the form witnessed, if required by your state. Some states may also require notarization.

- Provide a copy of the completed form to your agent and keep a copy for your records.

Common mistakes

-

Not Specifying the Powers Granted: Many individuals fail to clearly outline the specific powers they wish to grant their agent. This can lead to confusion and limit the agent's ability to act effectively on behalf of the principal.

-

Choosing the Wrong Agent: Selecting someone who is not trustworthy or capable can result in poor decision-making. It is crucial to choose an agent who understands your wishes and can handle the responsibilities.

-

Not Signing and Dating the Document: A Durable Power of Attorney must be signed and dated by the principal to be valid. Neglecting this step can render the document ineffective.

-

Failing to Have Witnesses or Notarization: Depending on state laws, some Durable Power of Attorney forms require witnesses or notarization. Omitting these can lead to legal challenges later.

-

Not Updating the Document: Life changes, such as marriage, divorce, or the death of an agent, necessitate updates to the Durable Power of Attorney. Failing to revise the document can create complications.

-

Overlooking State-Specific Requirements: Each state has its own laws regarding Durable Power of Attorney forms. Ignoring these requirements can invalidate the document.

Get Clarifications on Durable Power of Attorney

What is a Durable Power of Attorney?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone you trust to make decisions on your behalf if you become unable to do so. This could be due to illness, injury, or any other reason that affects your decision-making capacity. The "durable" aspect means that the authority granted to your agent continues even if you become incapacitated.

Who can be appointed as my agent?

You can choose anyone you trust to be your agent, often referred to as an attorney-in-fact. This could be a family member, friend, or a professional, such as an attorney or financial advisor. It’s important to select someone who understands your values and wishes, as they will be making significant decisions on your behalf.

What decisions can my agent make?

Your agent can make a variety of decisions depending on the powers you grant them. These may include:

- Managing your financial affairs, such as paying bills or managing investments.

- Making healthcare decisions, including medical treatments and end-of-life care.

- Handling real estate transactions, like buying or selling property.

It's crucial to clearly outline the scope of your agent's authority in the DPOA document.

Can I limit the powers granted to my agent?

Yes, you can specify the exact powers you wish to grant your agent. This can include limiting their authority to certain areas, such as only managing your finances, or providing them with broader powers. Clearly defining these limits helps ensure that your wishes are respected.

How do I revoke a Durable Power of Attorney?

If you decide to revoke your DPOA, you can do so at any time as long as you are mentally competent. To revoke the document, you should create a written revocation and notify your agent. It’s also advisable to inform any institutions that may have a copy of your DPOA to prevent any confusion.

Do I need a lawyer to create a Durable Power of Attorney?

While it’s not legally required to have a lawyer assist you in creating a DPOA, it can be beneficial. A lawyer can help ensure that the document meets all legal requirements and accurately reflects your wishes. If you choose to create a DPOA without legal assistance, make sure to follow your state’s guidelines closely.

Is a Durable Power of Attorney the same as a regular Power of Attorney?

No, they are not the same. A regular Power of Attorney typically becomes invalid if you become incapacitated. In contrast, a Durable Power of Attorney remains effective even if you lose the ability to make decisions. This distinction is crucial when planning for your future and ensuring your wishes are honored.