Valid Deed in Lieu of Foreclosure Document

Deed in Lieu of Foreclosure Forms for Individual US States

Consider More Types of Deed in Lieu of Foreclosure Documents

Correction Deed California - The completion of a Corrective Deed is a significant step in property management.

The importance of accurate documentation in business transactions cannot be overstated, making the Free And Invoice PDF form an invaluable resource. This form, which can be easily accessed at https://smarttemplates.net/fillable-free-and-invoice-pdf/, helps ensure that all parties involved have a clear and detailed record of services rendered or goods supplied, fostering trust and clarity in every exchange.

Problems With Transfer on Death Deeds California - Executing this deed can help ensure that your property goes to the people you want directly.

Gift Deed Rules - Family gifts are often subject to different rules than non-family gifts.

Misconceptions

When facing financial difficulties, many homeowners consider alternatives to foreclosure, such as a Deed in Lieu of Foreclosure. However, several misconceptions can cloud understanding of this option. Here are eight common misconceptions:

- It eliminates all debts. A Deed in Lieu of Foreclosure does not automatically erase all debts. Homeowners may still owe money if the property sells for less than the mortgage balance.

- It guarantees credit recovery. While it may be less damaging than a foreclosure, a Deed in Lieu will still impact your credit score. Recovery may take time.

- It’s a simple process. Although it can be more straightforward than foreclosure, a Deed in Lieu involves paperwork and negotiation with the lender.

- All lenders accept it. Not every lender offers this option. Homeowners should check with their lender to see if it's available.

- It’s only for severely distressed homeowners. Homeowners facing various financial challenges may qualify, not just those in dire situations.

- It absolves you from the property’s condition. Homeowners may need to maintain the property in good condition until the deed is transferred.

- It prevents future homeownership. A Deed in Lieu does not permanently bar you from buying a home in the future. With time and effort, homeownership can be possible again.

- It’s a quick fix. While it can speed up the process of leaving a home, it still requires careful consideration and time to negotiate with the lender.

Understanding these misconceptions can help homeowners make informed decisions about their options when facing financial difficulties.

Documents used along the form

A Deed in Lieu of Foreclosure can be an effective way for homeowners to avoid the lengthy foreclosure process. However, it often goes hand-in-hand with other important documents. Here are a few key forms you might encounter during this process.

- Loan Modification Agreement: This document outlines any changes made to the original loan terms. It may include adjustments to the interest rate, monthly payments, or loan duration, helping homeowners manage their financial obligations more effectively.

- Release of Liability: This document protects the borrower from further debt obligations related to the mortgage. It confirms that the borrower is no longer liable for the loan after the property is transferred to the lender. For more information, you can visit OnlineLawDocs.com.

- Property Condition Disclosure: This form provides information about the condition of the property. It helps the lender understand any existing issues, such as repairs needed or other concerns that may affect the property's value.

- Release of Liability: This document frees the homeowner from any further obligations related to the mortgage after the deed is transferred. It ensures that once the deed is signed, the homeowner is no longer responsible for the debt associated with the property.

- Settlement Statement: This statement details all financial transactions involved in the transfer of the property. It includes costs like closing fees, any outstanding mortgage balances, and credits or debits that may apply during the process.

Understanding these documents can help homeowners navigate the Deed in Lieu of Foreclosure process with greater confidence. Each form plays a crucial role in ensuring a smooth transition and protecting the interests of all parties involved.

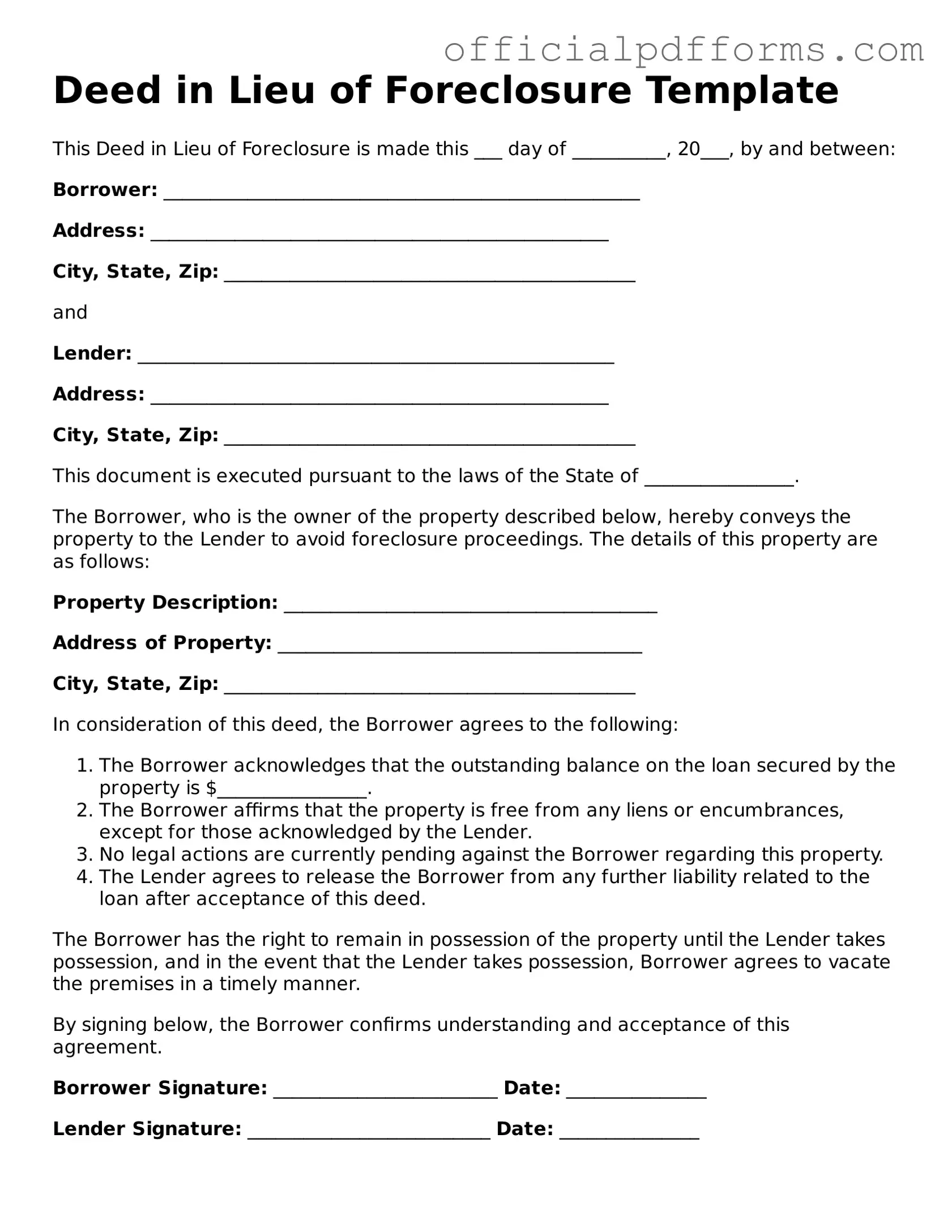

Steps to Filling Out Deed in Lieu of Foreclosure

After completing the Deed in Lieu of Foreclosure form, it’s essential to ensure that all information is accurate and that the document is properly signed and notarized. Once this is done, you will typically submit the form to your lender, who will review it before proceeding with the next steps in the process.

- Obtain the Form: Start by acquiring the Deed in Lieu of Foreclosure form from your lender or a reliable online source.

- Property Information: Fill in the address of the property involved in the foreclosure. Make sure to include the complete address, including the city, state, and zip code.

- Borrower Information: Enter your full name as the borrower. If there are co-borrowers, include their names as well.

- Lender Information: Provide the name of the lender or the institution that holds the mortgage. Include their address and contact information.

- Loan Information: Fill in the details of the loan, including the loan number and the original amount borrowed.

- Transfer of Ownership: Clearly state that you are transferring ownership of the property back to the lender. This section may also require your signature.

- Sign the Document: All parties involved must sign the form. Ensure that you date your signature appropriately.

- Notarization: Have the document notarized. This step is crucial for the form to be legally binding.

- Submit the Form: Send the completed and notarized form to your lender. Keep a copy for your records.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required details. This includes the names of all parties involved, property address, and loan information. Omitting any of this can lead to delays or rejection of the deed.

-

Not Understanding the Consequences: Many individuals do not fully grasp the implications of signing a Deed in Lieu of Foreclosure. It can impact credit scores and future borrowing ability. Understanding these consequences is crucial before proceeding.

-

Neglecting to Consult Professionals: Skipping legal or financial advice can be detrimental. Consulting with a real estate attorney or financial advisor can provide valuable insights and help avoid pitfalls.

-

Failing to Review the Document Thoroughly: Rushing through the form often leads to errors. Each section should be carefully reviewed to ensure accuracy. Mistakes can lead to legal complications down the line.

-

Ignoring State-Specific Requirements: Each state may have unique laws regarding Deeds in Lieu of Foreclosure. Not adhering to these regulations can invalidate the deed or create legal issues. Researching state-specific guidelines is essential.

Get Clarifications on Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement between a homeowner and their lender. In this arrangement, the homeowner voluntarily transfers ownership of the property to the lender to avoid the lengthy and often stressful foreclosure process. This option can be beneficial for both parties, as it allows the homeowner to walk away from the mortgage obligation and the lender to take possession of the property without going through court proceedings.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several advantages to choosing a Deed in Lieu of Foreclosure:

- Less Stressful Process: It can be a more straightforward and less stressful way to resolve mortgage issues compared to a traditional foreclosure.

- Potential for Credit Protection: While it will still impact your credit score, the effects may be less severe than those of a foreclosure.

- Relief from Debt: Homeowners can walk away from their mortgage obligations and any associated debt.

- Speedy Resolution: The process can be quicker than a foreclosure, allowing homeowners to move on more rapidly.

Who qualifies for a Deed in Lieu of Foreclosure?

Not everyone will qualify for a Deed in Lieu of Foreclosure. Generally, lenders look for the following criteria:

- The homeowner must be facing financial hardship, which could include job loss, medical expenses, or other significant financial challenges.

- The property must be in good condition, as lenders are less likely to accept a deed if the property requires extensive repairs.

- The homeowner must have made a genuine effort to sell the property before seeking a Deed in Lieu of Foreclosure.

- There should be no other liens on the property, or the lender must be willing to negotiate with other lienholders.

What steps are involved in completing a Deed in Lieu of Foreclosure?

The process typically involves several steps:

- Contact Your Lender: Reach out to your mortgage lender to discuss your situation and express your interest in a Deed in Lieu of Foreclosure.

- Gather Documentation: Prepare financial documents that demonstrate your hardship and inability to continue making mortgage payments.

- Submit a Request: Formally submit a request to your lender, including the necessary documentation and any forms they may require.

- Negotiate Terms: Work with your lender to negotiate the terms of the deed transfer, including any potential forgiveness of remaining debt.

- Complete the Transfer: Once both parties agree, you will sign the deed, and ownership will be transferred to the lender.