Valid Deed Document

Deed Forms for Individual US States

Fill out Popular Documents

What Does an Operating Agreement Look Like for an Llc - It allows members to set guidelines for withdrawing from the LLC.

A well-drafted Release of Liability form is essential for protecting individuals and organizations from potential legal claims. By utilizing this document, parties can clearly outline the risks involved, ensuring that participants are informed and accepting of the inherent dangers. For more information on creating and managing these legal documents, visit OnlineLawDocs.com.

Free Motorcycle Bill of Sale - It may include disclaimers if the motorcycle is sold "as is."

Bill of Sale for Four Wheeler - Contains mandatory information required for ATV transfers.

Misconceptions

Understanding the Deed form can be challenging due to various misconceptions. Here are five common misunderstandings:

- All Deeds are the Same: Many people believe that all Deeds serve the same purpose. In reality, there are different types of Deeds, such as Warranty Deeds, Quitclaim Deeds, and Special Purpose Deeds. Each type has specific uses and implications.

- A Deed Must be Notarized: Some think that notarization is always required for a Deed to be valid. While notarization can enhance the credibility of the document, not all states require it for the Deed to be legally binding.

- Deeds are Only for Real Estate: Another misconception is that Deeds are exclusively related to real estate transactions. Deeds can also be used for transferring personal property, such as vehicles or valuable items.

- Once a Deed is Signed, it Cannot be Changed: Many believe that a signed Deed is permanent and cannot be altered. However, it is possible to revoke or modify a Deed under certain circumstances, depending on state laws and the type of Deed involved.

- All Deeds Need to be Filed: Some people think that every Deed must be filed with a government office. While it is advisable to record certain types of Deeds for public notice, not all Deeds require filing to be effective.

Clarifying these misconceptions can help individuals navigate the process of using Deeds more effectively.

Documents used along the form

When dealing with property transactions, a Deed form is often accompanied by several other important documents. Each of these documents serves a specific purpose and helps ensure that the transfer of property is conducted smoothly and legally. Below are five common forms and documents that are frequently used alongside the Deed form.

- Title Insurance Policy: This document protects the buyer and lender from potential disputes regarding property ownership. It covers issues that may arise after the purchase, such as claims against the title or undisclosed liens.

- Bill of Sale: This form is used to transfer ownership of personal property associated with the real estate transaction. It provides evidence of the sale and details the items included in the transfer.

- Operating Agreement: To establish clear operational guidelines for your LLC, refer to the essential Operating Agreement document that outlines member roles and responsibilities.

- Property Disclosure Statement: Sellers typically provide this document to inform buyers about the condition of the property. It includes information about any known defects or issues that may affect the property's value.

- Closing Statement: This document outlines the financial details of the transaction, including closing costs, fees, and the final purchase price. It is reviewed and signed by both parties at the closing meeting.

- Power of Attorney: In some cases, a buyer or seller may not be able to attend the closing. A Power of Attorney allows another person to act on their behalf, ensuring that the transaction can proceed without delays.

Each of these documents plays a crucial role in the property transaction process. Understanding their purposes can help buyers and sellers navigate the complexities of real estate dealings more effectively.

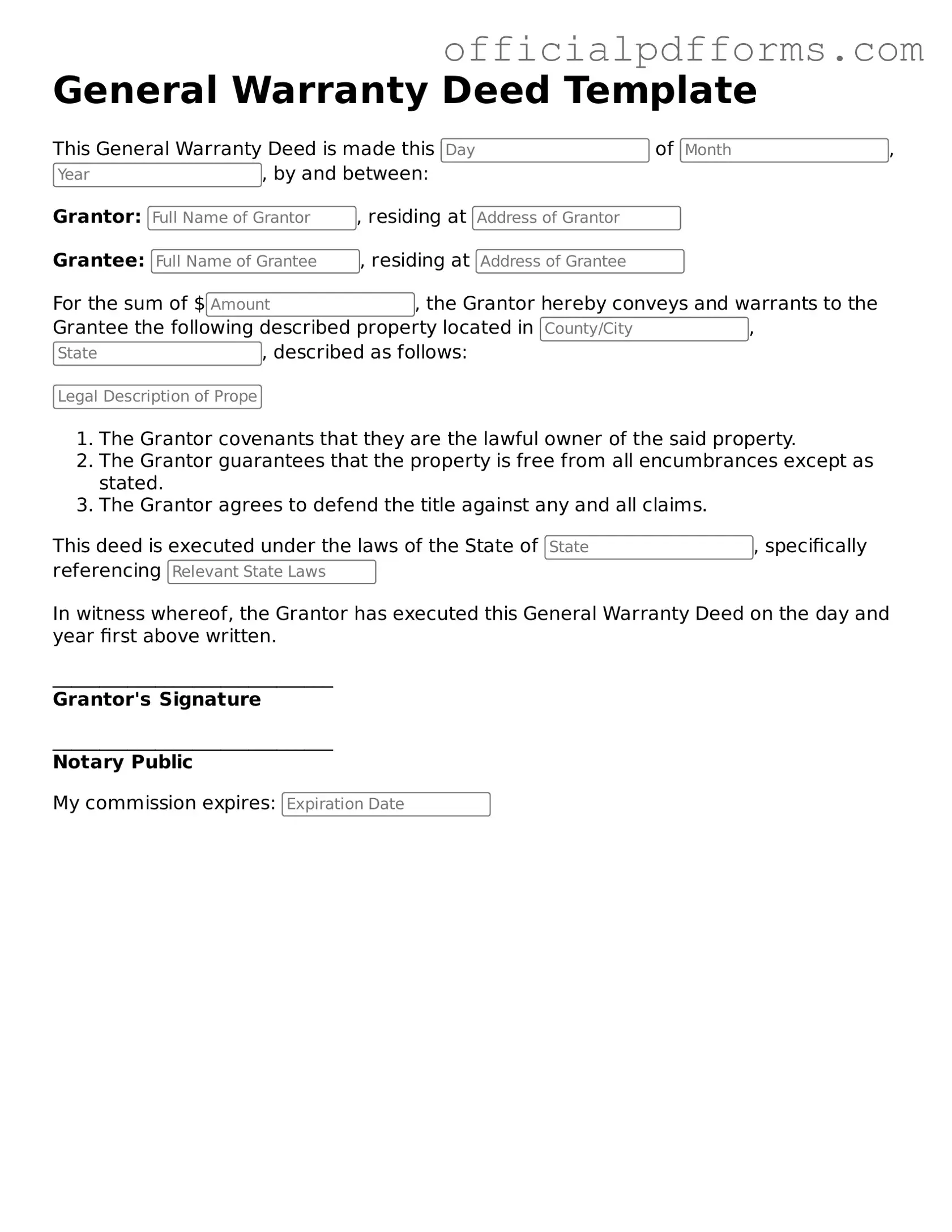

Steps to Filling Out Deed

Filling out a Deed form is an important step in transferring property ownership. Once you have gathered the necessary information, you can proceed to complete the form accurately. Following these steps will help ensure that your Deed is filled out correctly, paving the way for a smooth property transfer.

- Begin by entering the date at the top of the form. This should be the date on which the Deed is being executed.

- Identify the parties involved in the transaction. Clearly write the name of the Grantor (the current owner) and the Grantee (the new owner).

- Provide the complete address of the property being transferred. Include the street number, street name, city, state, and ZIP code.

- Include a legal description of the property. This may involve a lot number, block number, or any specific details that define the property boundaries.

- State the consideration, or payment, for the property. This could be a specific dollar amount or a statement indicating that it is a gift.

- Sign the Deed. The Grantor must sign the document in the presence of a notary public.

- Have the notary public complete their section. They will verify the identity of the Grantor and notarize the document.

- Make copies of the completed Deed for your records. It’s essential to keep a copy for future reference.

- File the Deed with the appropriate county office. This step is crucial for making the transfer official and ensuring that public records reflect the change in ownership.

Common mistakes

-

Incorrect Names: One common mistake is failing to use the correct legal names of all parties involved. This includes ensuring that names are spelled correctly and match the names on official identification documents. Any discrepancies can lead to complications in the future.

-

Omitting Necessary Information: Some individuals neglect to provide all required information. This may include details about the property, such as the legal description or the address. Omitting this information can result in delays or the rejection of the deed.

-

Not Signing or Notarizing: A deed must be signed by the grantor, and in many cases, it must also be notarized. Failing to sign or obtain the necessary notarization can render the deed invalid. It is essential to check the requirements in your state.

-

Using Incorrect Format: Each state may have specific formatting requirements for deeds. Using an incorrect format can lead to confusion or legal issues. It is important to review the requirements or consult a professional to ensure compliance.

Get Clarifications on Deed

What is a Deed Form?

A deed form is a legal document that conveys ownership of property from one party to another. It serves as proof of the transfer of title, ensuring that the new owner has the legal right to the property. Deeds can be used for various types of property, including real estate, vehicles, and other valuable assets. Generally, a deed must be signed, witnessed, and sometimes notarized to be legally binding.

What are the different types of Deed Forms?

There are several types of deed forms, each serving a specific purpose. Here are a few common types:

- Warranty Deed: This type guarantees that the grantor holds clear title to the property and has the right to sell it. It also offers protection against any claims that may arise.

- Quitclaim Deed: This deed transfers whatever interest the grantor has in the property without any warranties. It’s often used between family members or in divorce settlements.

- Special Purpose Deed: These are used for specific situations, such as a trustee deed, which transfers property held in trust.

Do I need a lawyer to create a Deed Form?

While it is not legally required to have a lawyer draft a deed form, consulting one can be highly beneficial. A lawyer can ensure that the deed complies with local laws and regulations, minimizing the risk of future disputes. If you choose to create a deed on your own, be sure to follow all necessary legal requirements for your state, including proper wording and execution.

How do I record a Deed Form?

Recording a deed is an important step in the property transfer process. Here’s how you can do it:

- Complete the deed form accurately, ensuring all necessary information is included.

- Sign the deed in the presence of a notary public, if required by your state.

- Submit the signed deed to your local county recorder's office. There may be a small fee for recording.

- Keep a copy of the recorded deed for your records, as it serves as proof of ownership.