Fill in a Valid Citibank Direct Deposit Form

Common PDF Forms

Da - Proper training on the use of this form can enhance operational efficiency.

For those navigating the complexities of vehicle transactions, understanding the key elements of a Vehicle Purchase Agreement is crucial. This document safeguards both buyer and seller interests while facilitating a transparent sale. If you're looking for guidance, access the complete form by referring to our necessary Vehicle Purchase Agreement documentation.

Gift Card Creator - Details the amount and purpose of the gifted funds.

Misconceptions

Many individuals have questions and misunderstandings about the Citibank Direct Deposit form. Here are seven common misconceptions, along with clarifications to help you understand the process better.

-

Direct deposit is only for payroll.

While many people associate direct deposit with receiving paychecks, it can also be used for government benefits, tax refunds, and other types of payments.

-

Once set up, direct deposit cannot be changed.

You can modify your direct deposit information at any time. Simply fill out a new form and submit it to your employer or the payment provider.

-

Direct deposit is not secure.

In fact, direct deposit is often more secure than receiving a paper check. Funds are electronically transferred, reducing the risk of loss or theft.

-

It takes a long time to set up direct deposit.

The setup process is usually quick and straightforward. Most employers can initiate the process within a single pay cycle.

-

Direct deposits are always available immediately.

While many deposits are available on the scheduled payment date, some may take longer to process, especially if there are holidays or weekends involved.

-

All banks support direct deposit.

While most banks do support direct deposit, it is essential to confirm with your specific bank that they accept it and understand their policies.

-

You cannot use direct deposit if you have a joint account.

Joint accounts can receive direct deposits just like individual accounts. Just ensure that the account holder's name matches the information provided on the direct deposit form.

Documents used along the form

When setting up direct deposit with Citibank, there are several other forms and documents that may be required or helpful in the process. Each of these documents serves a specific purpose and can facilitate a smoother banking experience. Below is a list of common forms and documents associated with the Citibank Direct Deposit form.

- W-4 Form: This form is used by employees to indicate their tax withholding preferences to their employer. It helps determine the amount of federal income tax to be withheld from each paycheck.

- Bank Account Verification Letter: A letter from the bank confirming the account holder's name and account number. This document is often required to ensure that the correct account is linked for direct deposit.

- Texas Real Estate Purchase Agreement Form: This document is crucial for buyers and sellers in Texas, as it specifies the terms of the property sale including price and closing date. Understanding this OnlineLawDocs.com form is essential to avoid ambiguities and ensure a successful transaction.

- Employer Direct Deposit Authorization Form: This form is typically provided by the employer and allows employees to authorize the deposit of their paychecks directly into their bank account.

- Change of Address Form: If an employee has recently moved, this form notifies the employer of the new address to ensure that all correspondence is sent to the correct location.

- Pay Stub: A document that outlines an employee's earnings, deductions, and net pay for a specific pay period. It can serve as proof of income when setting up direct deposit.

- Identification Documents: These may include a driver's license, passport, or Social Security card. Such documents are often required to verify the identity of the account holder.

- Form 1099: This tax form is used for reporting income received from sources other than employment. It may be necessary for independent contractors or freelancers who wish to set up direct deposit for their payments.

- Direct Deposit Change Request Form: If an employee wishes to change their existing direct deposit information, this form must be completed to update the banking details with the employer.

Having these documents prepared can streamline the process of setting up direct deposit with Citibank. Ensuring that all necessary paperwork is in order can help avoid delays and ensure timely access to funds.

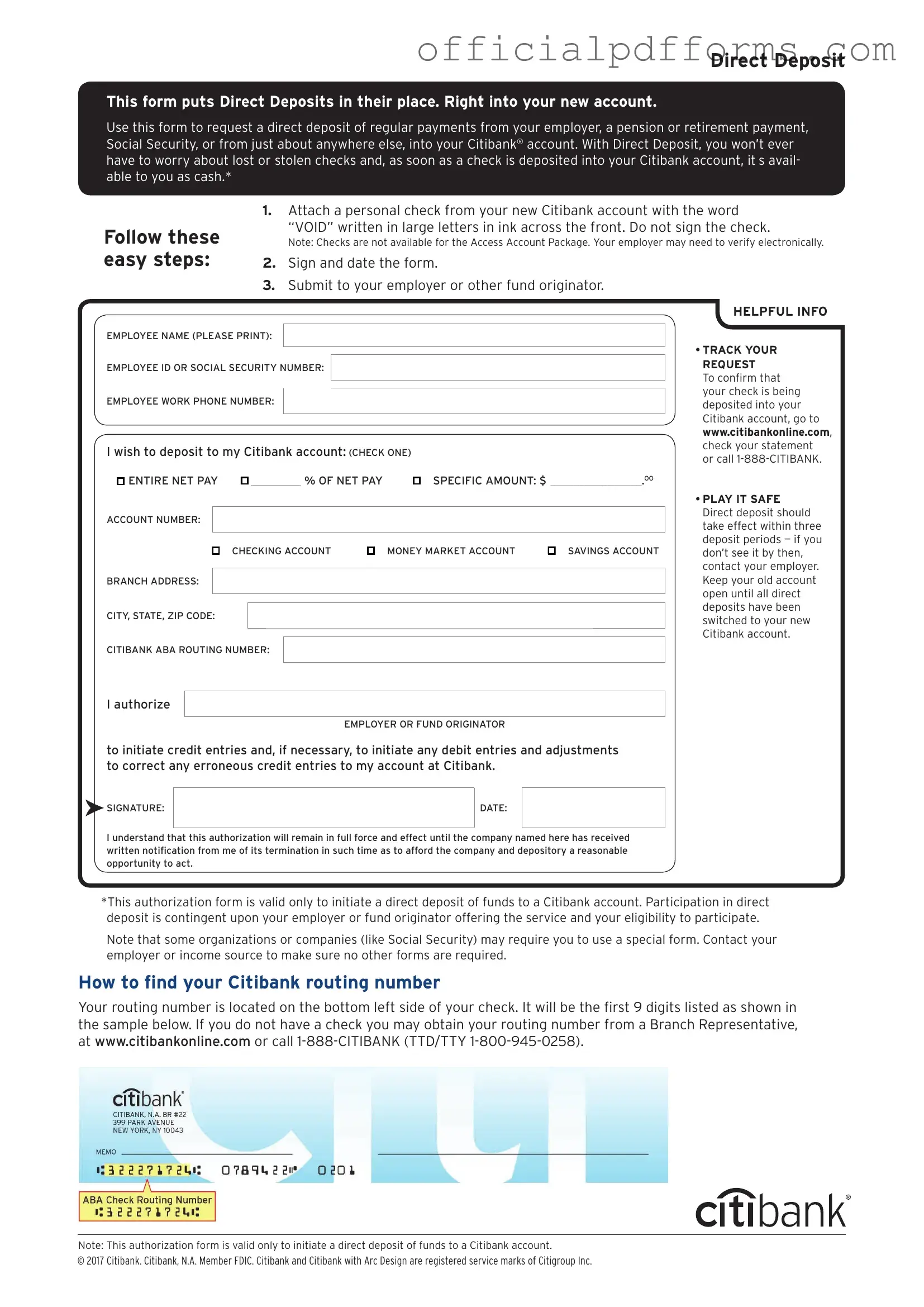

Steps to Filling Out Citibank Direct Deposit

After completing the Citibank Direct Deposit form, you will submit it to your employer or the relevant department to initiate the direct deposit process. This ensures that your funds are deposited directly into your Citibank account on payday, streamlining your financial management.

- Begin by entering your personal information at the top of the form. This includes your full name, address, and contact number.

- Locate the section for your bank details. Here, you will need to provide your Citibank account number and the routing number for Citibank.

- Double-check the accuracy of your account and routing numbers. Mistakes can lead to delays in processing your direct deposit.

- In the next section, indicate the type of account you are using for the deposit. Select either "Checking" or "Savings."

- Sign and date the form at the bottom. Your signature authorizes the direct deposit arrangement.

- Make a copy of the completed form for your records before submitting it.

- Submit the form to your employer or the designated payroll department as instructed.

Common mistakes

-

Incorrect Account Number: One of the most common mistakes is entering the wrong account number. This can lead to funds being deposited into an unintended account. Always double-check the account number for accuracy.

-

Wrong Routing Number: Each bank has a unique routing number. Using the incorrect routing number can result in delays or failures in processing the direct deposit. Verify the routing number with your bank.

-

Failure to Sign the Form: Not signing the form can invalidate the request. A signature is often required to authorize the direct deposit. Ensure that you sign where indicated.

-

Not Providing Employer Information: Some forms require information about your employer. Omitting this information can cause processing issues. Include all requested details to facilitate a smooth setup.

-

Submitting an Outdated Form: Using an old version of the direct deposit form may lead to complications. Always check for the most current version before submission to avoid any issues.

Get Clarifications on Citibank Direct Deposit

What is the Citibank Direct Deposit form?

The Citibank Direct Deposit form is a document that allows individuals to authorize their employer or other income sources to deposit funds directly into their Citibank account. This process streamlines the payment method, ensuring that funds are available immediately without the need for physical checks. It is commonly used for payroll, government benefits, and other regular payments.

How do I fill out the Citibank Direct Deposit form?

Filling out the Citibank Direct Deposit form is straightforward. Follow these steps:

- Obtain the form from your employer or download it from Citibank's website.

- Provide your personal information, including your name, address, and Social Security number.

- Enter your Citibank account number and the routing number for your account. You can find these numbers on your checks or by logging into your online banking account.

- Sign and date the form to authorize the direct deposit.

- Submit the completed form to your employer or the entity responsible for making the deposits.

How long does it take for direct deposits to start?

The time it takes for direct deposits to begin can vary. Generally, it may take one to two pay cycles for the direct deposit to be activated. This delay allows your employer or payment provider to process the information. To ensure a smooth transition, it is advisable to submit the form well in advance of your next expected payment.

What should I do if my direct deposit does not appear?

If your direct deposit does not appear in your account as expected, consider the following steps:

- Check with your employer or payment provider to confirm that they processed the direct deposit.

- Verify that the account and routing numbers you provided on the form were correct.

- Review your bank account statement to ensure the deposit was not made at a different time or under a different description.

- If necessary, contact Citibank customer service for assistance in tracking the deposit.

Can I change my direct deposit information later?

Yes, you can change your direct deposit information at any time. To do so, you will need to fill out a new Citibank Direct Deposit form with your updated account details. Submit the new form to your employer or payment provider to ensure that future deposits are directed to the correct account. It is advisable to keep a copy of the new form for your records.