Fill in a Valid Childcare Receipt Form

Common PDF Forms

I 9 Documents - An accurate completion of this form can expedite verification requests from external parties.

Addendum Tenancy Agreement - Returned checks due to insufficient funds lead to additional fees and demands for payment.

In Texas, utilizing a Motor Vehicle Bill of Sale is essential for ensuring a smooth transaction when buying or selling a vehicle, and for more detailed information on this process, you can visit OnlineLawDocs.com to guide you through the necessary steps involved in drafting this important document.

Baseball Tryout Form - Scoring helps identify top players for competitive play.

Misconceptions

Understanding the Childcare Receipt form is essential for both parents and childcare providers. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

- Misconception 1: The form is only necessary for tax purposes.

- Misconception 2: Any handwritten note can replace the form.

- Misconception 3: The receipt does not need to be signed.

- Misconception 4: The receipt can be filled out at any time.

- Misconception 5: Only licensed providers need to issue receipts.

- Misconception 6: The form is the same for every childcare service.

While it is true that the form can be used for tax deductions, it also serves as a record of payment for parents and providers. It helps maintain transparency and accountability in childcare transactions.

A handwritten note lacks the structure and detail provided by the official receipt. The form includes specific fields that ensure all necessary information is captured, making it more reliable for record-keeping.

A signature from the provider is crucial. It verifies that the payment has been received and adds legitimacy to the transaction. Without it, the receipt may not hold up as proof of payment.

It is best to complete the receipt immediately after payment is made. This practice ensures accuracy and prevents disputes over payment dates or amounts later on.

Regardless of licensing status, all childcare providers should issue receipts for payments received. This practice helps maintain professionalism and provides parents with a clear record of expenses.

While the basic structure remains similar, details may vary depending on the specific services provided. Each receipt should accurately reflect the unique aspects of the childcare arrangement.

Documents used along the form

When managing childcare services, various forms and documents are essential for maintaining clear communication and accurate records. Below is a list of documents that often accompany the Childcare Receipt form, each serving a specific purpose in the childcare process.

- Childcare Agreement: This document outlines the terms and conditions of the childcare services, including fees, hours, and responsibilities of both the provider and the parent.

- Emergency Contact Form: Parents provide emergency contact information for their child. This ensures that caregivers can reach someone quickly in case of an emergency.

- Child Health Information Form: This form contains important health details about the child, including allergies, medications, and any special needs that caregivers should be aware of.

- Real Estate Purchase Agreement: For those engaged in property transactions, consult the comprehensive Real Estate Purchase Agreement details to ensure all terms are clearly defined.

- Attendance Record: This document tracks the days and times the child attends childcare, helping both parents and providers maintain accurate records.

- Payment Agreement: This outlines the payment schedule, methods of payment, and any late fees associated with childcare services.

- Authorization for Pick-Up: Parents use this form to designate individuals authorized to pick up their child, ensuring safety and security.

- Tax Identification Form: This document includes the provider's tax ID number, which parents may need for tax deduction purposes related to childcare expenses.

- Daily Activity Log: Caregivers may maintain this log to record daily activities, meals, and any notable occurrences during the child's time in care.

- Provider License Verification: This verifies that the childcare provider is licensed and meets state regulations, ensuring a safe environment for children.

Each of these documents plays a crucial role in ensuring a smooth and effective childcare experience. Keeping them organized and accessible can help parents and providers maintain a positive relationship and foster a nurturing environment for children.

Steps to Filling Out Childcare Receipt

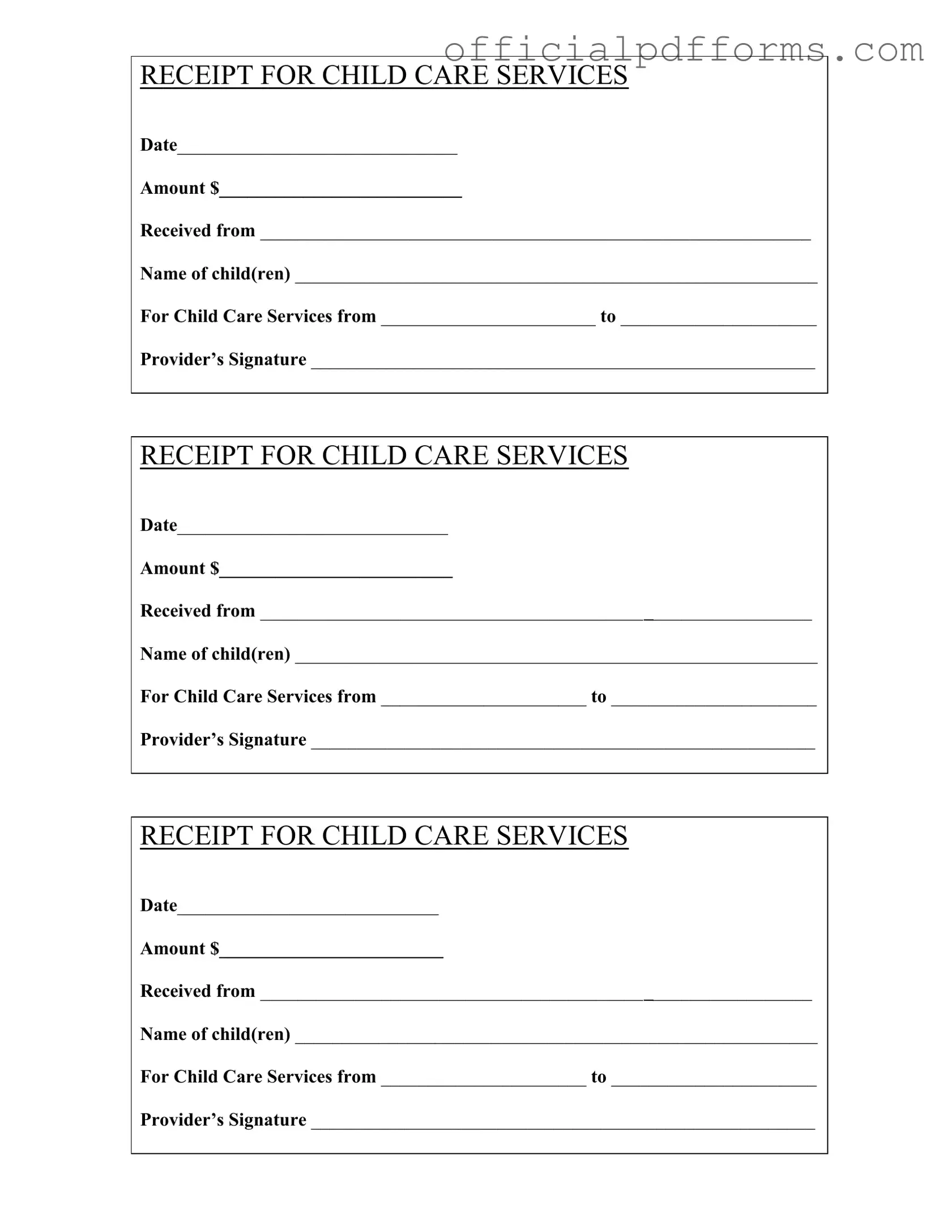

Once you have the Childcare Receipt form, you will need to fill it out accurately to ensure proper documentation of services rendered. Follow the steps below to complete the form correctly.

- Write the current date in the space provided next to "Date."

- Enter the total amount paid for childcare services in the "Amount" field.

- Fill in the name of the person or entity making the payment in the "Received from" section.

- List the names of the child(ren) receiving care in the "Name of child(ren)" section.

- Indicate the start date of the childcare services in the "For Child Care Services from" section.

- Indicate the end date of the childcare services in the "to" section.

- Have the childcare provider sign the form in the "Provider’s Signature" area.

Common mistakes

-

Failing to include the date: The date is crucial for record-keeping. Without it, you may face issues when trying to verify the transaction later.

-

Incorrect amount entry: Ensure that the amount matches what you actually paid. An error here can lead to discrepancies in your financial records.

-

Not specifying the name of the child(ren): Leaving this blank can complicate the process of identifying the services rendered. Always include the full names.

-

Omitting the service period: Clearly stating the start and end dates of the childcare services is essential. This information helps clarify the duration of care provided.

-

Neglecting the provider’s signature: Without the provider's signature, the receipt lacks authenticity. Always ensure that it is signed before submission.

-

Using an outdated form: Make sure you are using the most current version of the Childcare Receipt form. An outdated form may not be accepted.

Get Clarifications on Childcare Receipt

What information is required on the Childcare Receipt form?

The Childcare Receipt form requires several key pieces of information. First, the date of the transaction must be filled in. Next, the amount paid for childcare services should be clearly stated. The form also requires the name of the individual making the payment, as well as the names of the child or children receiving care. Additionally, the period during which the childcare services were provided must be noted, specifying the start and end dates. Finally, the provider's signature is necessary to validate the receipt.

How can I obtain a Childcare Receipt form?

To obtain a Childcare Receipt form, you can typically request it directly from your childcare provider. Many providers have their own standardized forms that they use for this purpose. If your provider does not have a specific form, you can create a simple document that includes all the required information. Alternatively, some online resources may offer downloadable templates that you can fill out. Ensure that all necessary details are included to meet your needs.

Is the Childcare Receipt form necessary for tax purposes?

Yes, the Childcare Receipt form is often necessary for tax purposes. Parents may need to provide proof of childcare expenses when filing their taxes, especially if they are claiming childcare credits or deductions. The receipt serves as documentation of the payment made for childcare services. It is important to keep these receipts organized and accessible, as they may be required by tax authorities or for personal record-keeping.

What should I do if I lost my Childcare Receipt?

If you have lost your Childcare Receipt, the first step is to contact your childcare provider. They may be able to issue a duplicate receipt or provide a new one that includes all necessary details. Be sure to provide them with relevant information, such as the date of service and the amount paid, to facilitate the process. If your provider cannot assist, you may need to keep a detailed record of your payments for your own documentation.