Fill in a Valid Cg 20 10 07 04 Liability Endorsement Form

Common PDF Forms

Dd Form 2870 Army Pubs - DD 2870 facilitates the sharing of personal health data with healthcare providers.

For those interested in real estate transactions, understanding the importance of a thorough Real Estate Purchase Agreement is crucial. This document not only protects all parties involved but also clarifies the terms agreed upon. To learn more about the specifics of this agreement and how it can benefit your property dealings, visit the essential guide on the Real Estate Purchase Agreement.

Financial Affidavit Short Form Florida - Take your time when listing all monthly obligations and liabilities.

Misconceptions

Understanding the CG 20 10 07 04 Liability Endorsement can be challenging. Several misconceptions surround this endorsement, which can lead to confusion among policyholders. Here are eight common misconceptions explained:

- It automatically covers all parties involved. This endorsement only covers the specific additional insureds listed in the schedule. It does not extend coverage to all parties related to a project.

- Coverage is unlimited. The endorsement does not increase the overall limits of insurance. The coverage for additional insureds is capped at the amount specified in the contract or the policy limits, whichever is lower.

- It covers all types of injuries and damages. The endorsement specifically covers "bodily injury," "property damage," and "personal and advertising injury." Other types of claims may not be included.

- It applies even after project completion. Coverage is limited to incidents occurring before all work on the project is completed. Once the project is finished, the coverage no longer applies.

- It covers all operations for the additional insured. The coverage only applies to ongoing operations at the designated locations. Completed operations are not covered under this endorsement.

- It provides broader coverage than required by contract. If a contract specifies coverage requirements, the endorsement will not offer broader protection than what is mandated by that contract.

- It is the same as primary insurance. This endorsement provides additional insured status but does not replace primary coverage. It is secondary to any other applicable insurance.

- All exclusions are the same as the primary policy. The endorsement includes specific exclusions that may differ from the primary policy. It is important to review these exclusions carefully.

Being aware of these misconceptions can help policyholders make informed decisions regarding their insurance coverage and ensure they have the protection they need.

Documents used along the form

The CG 20 10 07 04 Liability Endorsement form is a critical document in the realm of commercial general liability insurance. It serves to add specific individuals or organizations as additional insureds under a policy, thereby extending coverage for certain liabilities. However, this form is often used in conjunction with several other documents that help clarify the terms and conditions of the insurance coverage. Below is a list of such documents, each playing a vital role in the overall insurance framework.

- Commercial General Liability (CGL) Policy: This is the primary insurance policy that provides coverage for bodily injury, property damage, and personal and advertising injury. It outlines the general terms, conditions, and exclusions applicable to the coverage, serving as the foundation upon which endorsements like the CG 20 10 07 04 are added.

- Certificate of Insurance: This document serves as proof of insurance coverage. It summarizes the key aspects of the insurance policy, including the types of coverage, limits, and the insured parties. Often required by clients or other stakeholders, it provides reassurance that the necessary coverage is in place.

- Contractual Agreement: This is a legal document that outlines the terms and obligations between parties involved in a project. It often specifies the insurance requirements, including the need for additional insured endorsements. The terms of this agreement dictate the extent of coverage that must be provided to additional insureds.

- IRS 2553 Form: This form is essential for small businesses electing S corporation status for tax purposes, allowing entities to potentially benefit from tax savings. For more details, visit smarttemplates.net/fillable-irs-2553/.

- Endorsement Schedule: This document lists all endorsements attached to a specific insurance policy, including the CG 20 10 07 04. It details the changes made to the original policy and identifies the additional insureds, ensuring clarity regarding who is covered under the policy's terms.

In summary, the CG 20 10 07 04 Liability Endorsement form works in tandem with these other documents to create a comprehensive insurance package. Understanding each component can significantly enhance the management of liability risks in commercial ventures.

Steps to Filling Out Cg 20 10 07 04 Liability Endorsement

Completing the CG 20 10 07 04 Liability Endorsement form requires careful attention to detail. This endorsement is an important part of the insurance process, and ensuring accuracy will help avoid potential issues later. Follow the steps below to fill out the form correctly.

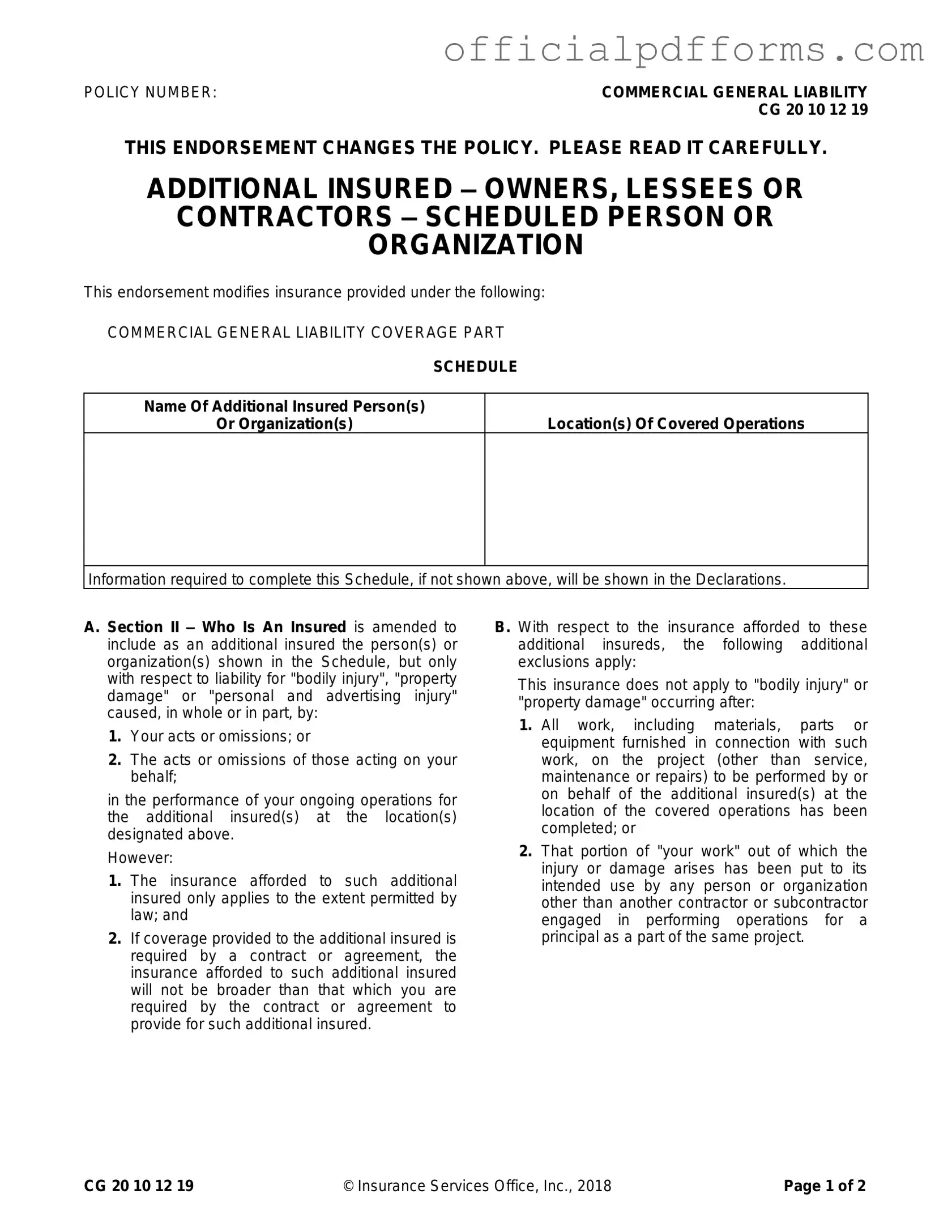

- Locate the POLICY NUMBER section at the top of the form. Enter the policy number associated with your Commercial General Liability coverage.

- In the ADDITIONAL INSURED – OWNERS, LESSEES OR CONTRACTORS – SCHEDULE section, identify the names of the additional insured persons or organizations. List each name clearly.

- Next, in the same section, provide the Location(s) Of Covered Operations. Specify the locations where the covered operations will take place.

- Review the Section II – Who Is An Insured to ensure you understand the implications of adding additional insureds. This section outlines the conditions under which the additional insureds will be covered.

- Check the exclusions mentioned in the form. Pay attention to the specific circumstances under which coverage does not apply, such as after all work has been completed or when the work has been put to its intended use.

- In Section III – Limits Of Insurance, confirm the limits of insurance that apply to the additional insureds. Ensure that you understand the maximum amount that will be paid on behalf of the additional insured.

- Once all sections are filled out, review the entire form for accuracy. Make sure all names, locations, and other details are correct.

- Finally, sign and date the form as required, and submit it to the appropriate party as indicated in your insurance policy.

Common mistakes

-

Leaving out required information: It is crucial to fill in all necessary fields, such as the policy number and the names of additional insured persons or organizations. Omitting any detail can lead to delays or issues with coverage.

-

Incorrectly identifying additional insureds: Make sure to accurately list the names of the additional insureds as they appear in the relevant contracts. Mistakes in names can cause confusion and may invalidate the endorsement.

-

Not specifying the location of operations: Clearly indicate the locations where the coverage applies. Failing to do so might limit the effectiveness of the endorsement, leaving gaps in protection.

-

Misunderstanding the coverage limits: Be aware that the coverage for additional insureds may be limited by the terms of the contract. Review the agreement to ensure the endorsement aligns with the required coverage limits.

-

Ignoring the exclusions: Familiarize yourself with the exclusions that apply to the additional insureds. Not understanding these exclusions can lead to unexpected liabilities down the line.

Get Clarifications on Cg 20 10 07 04 Liability Endorsement

What is the purpose of the CG 20 10 07 04 Liability Endorsement form?

The CG 20 10 07 04 Liability Endorsement form is designed to add specific individuals or organizations as additional insureds under a Commercial General Liability policy. This coverage protects these additional insureds from liabilities related to bodily injury, property damage, or personal and advertising injury that may arise from the actions of the primary insured or their representatives during ongoing operations.

Who qualifies as an additional insured under this endorsement?

Additional insureds are the individuals or organizations listed in the endorsement schedule. They are covered only for liabilities resulting from the acts or omissions of the primary insured or their representatives while performing operations for the additional insured at specified locations.

What limitations apply to the coverage for additional insureds?

Coverage for additional insureds is subject to specific limitations:

- The insurance applies only to the extent permitted by law.

- If required by a contract, the coverage cannot exceed what the primary insured is obligated to provide.

- Coverage does not apply if the injury or damage occurs after the completion of all work related to the project.

- It also excludes incidents arising from work that has been put to its intended use by any party other than another contractor or subcontractor involved in the project.

How does this endorsement affect the limits of insurance?

The endorsement does not increase the overall limits of insurance. If coverage is required by a contract, the maximum payout for the additional insured will be the lesser of the amount specified in the contract or the available limits of the policy.

Can the additional insured status be revoked?

The additional insured status is generally tied to the terms outlined in the endorsement and any related contracts. Revocation can occur if the underlying contract is terminated or if the conditions for coverage are no longer met. It's important to review the specific terms of the contract for details on revocation.

What is the significance of the locations listed in the endorsement?

The locations specified in the endorsement are critical because coverage applies only to liabilities arising from operations conducted at those locations. If operations occur outside of these designated areas, the additional insureds may not be covered under this endorsement.

How should one complete the endorsement schedule?

To complete the endorsement schedule, provide the names of the additional insured persons or organizations and the locations of the covered operations. Ensure that all required information is accurate, as this will determine the extent of coverage provided under the endorsement.