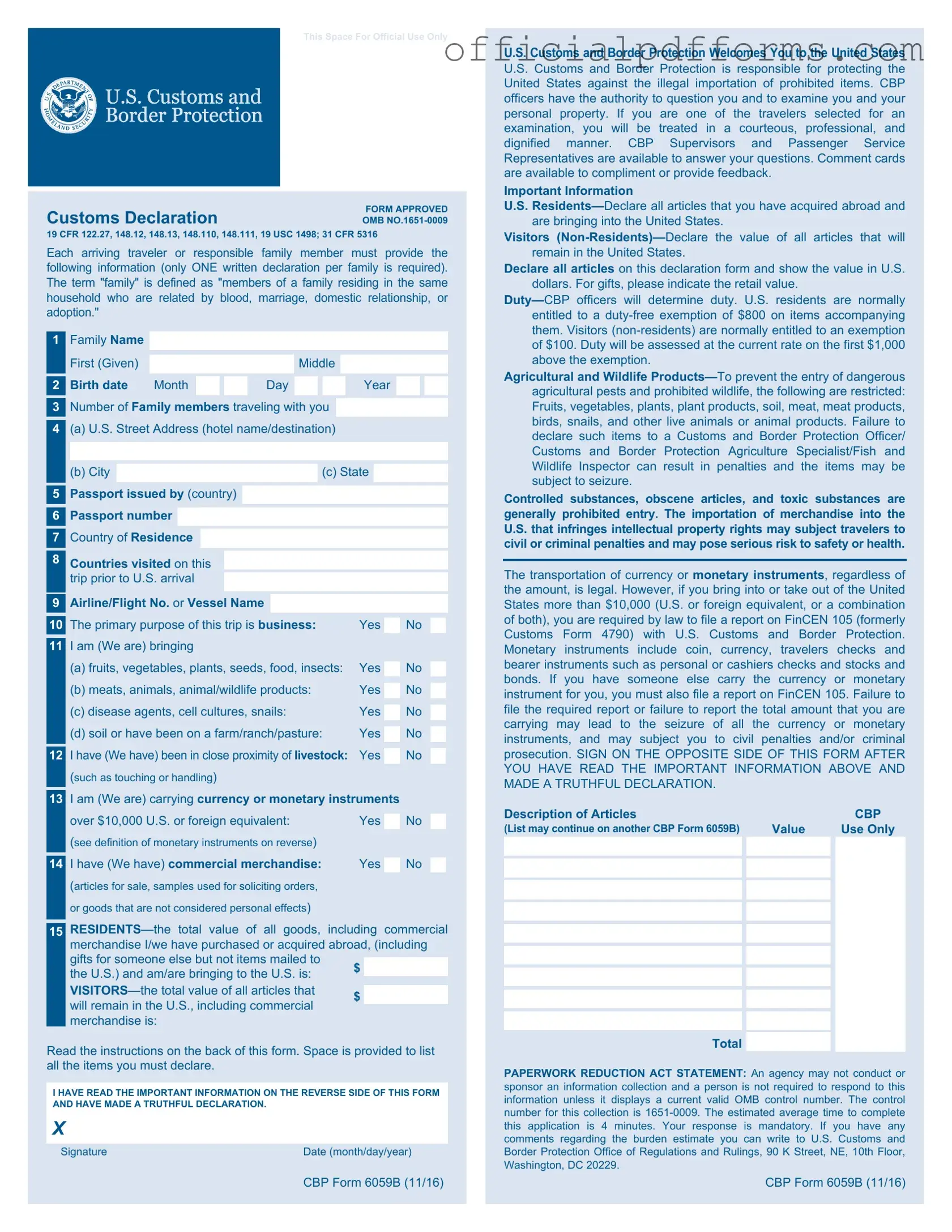

Fill in a Valid CBP 6059B Form

Common PDF Forms

Puppy Missed 3rd Round of Shots - Highlights spay/neuter status of the pet.

The process of selling a mobile home in New York requires careful attention to detail, particularly in the completion of the New York Mobile Home Bill of Sale form, which can be easily accessed at OnlineLawDocs.com. This important document not only verifies the sale and transfer of ownership but also includes vital information such as the identities of the buyer and seller, as well as the agreed sales price, ensuring that all parties are protected during the transaction.

Military Awards After Discharge - The DD 149 forms part of a broader effort to ensure fairness in military service records.

Misconceptions

The CBP 6059B form, also known as the Customs Declaration form, is often misunderstood. Below are ten common misconceptions about this important document, along with clarifications to help you better understand its purpose and requirements.

- Misconception 1: The CBP 6059B form is only for international travelers.

- Misconception 2: Completing the form is optional.

- Misconception 3: The form only requires information about purchased items.

- Misconception 4: There are no penalties for not declaring items.

- Misconception 5: The form is only checked randomly.

- Misconception 6: You can fill out the form after entering the U.S.

- Misconception 7: All items must be declared, regardless of value.

- Misconception 8: The form is the same for all travelers.

- Misconception 9: The CBP 6059B form can be ignored if you are not carrying anything.

- Misconception 10: The information on the form is not shared with other agencies.

While primarily used by travelers entering the United States from abroad, the form is also relevant for those bringing goods back into the country, regardless of their travel status.

In fact, filling out the CBP 6059B form is mandatory for all travelers entering the U.S. who are carrying items subject to declaration.

The CBP 6059B form requires travelers to declare not just purchased items but also gifts, inherited items, and any other goods that may have value.

Failure to declare items can lead to significant fines, confiscation of goods, or even legal consequences. Honesty is crucial.

Customs and Border Protection (CBP) officials may review the form for every traveler, and discrepancies can lead to further inspection.

The CBP 6059B form must be completed before entering the customs area. It is typically collected by CBP officers upon arrival.

While most items should be declared, there are certain exemptions for items under a specific value, often set at $800 for personal goods. However, it’s best to declare anything uncertain.

Different categories of travelers, such as U.S. citizens, residents, and foreign visitors, may have slightly different requirements or instructions on the form.

Even if you believe you have nothing to declare, it is still necessary to complete the form to confirm that you are not bringing in any taxable items.

The information provided on the CBP 6059B form may be shared with other government agencies for security and enforcement purposes.

Understanding these misconceptions can help ensure a smoother entry process into the United States. Always approach the customs declaration process with care and honesty.

Documents used along the form

The CBP 6059B form is an essential document used by travelers entering the United States, providing vital information about their trip and belongings. Alongside this form, several other documents may be required or helpful for a smooth entry process. Below is a list of commonly used forms and documents that complement the CBP 6059B form.

- Passport: A passport is a government-issued document that verifies a person's identity and nationality. It is necessary for international travel and serves as the primary identification for entering the United States.

- Visa: Depending on the traveler’s nationality and purpose of visit, a visa may be required. This document allows individuals to enter, stay, or work in the U.S. for a specified period.

- CBP Declaration Form 6059A: This form is used to declare items being brought into the U.S. It is similar to the 6059B but focuses more on the customs aspect, detailing items that may be subject to duties or restrictions.

- Employment Verification Form: This document is vital to confirm an individual's employment status and is often used in various contexts, including by lenders or landlords. More details can be found at smarttemplates.net/fillable-employment-verification.

- Travel Itinerary: A travel itinerary outlines the details of a traveler’s trip, including flight information, accommodation, and planned activities. While not mandatory, it can help clarify the purpose of the visit to customs officials.

Having these documents prepared can facilitate a smoother entry process into the United States. Travelers should ensure that all forms are filled out accurately and brought along to avoid any delays or complications at the border.

Steps to Filling Out CBP 6059B

Filling out the CBP 6059B form is a straightforward process that requires attention to detail. This form is typically used for travelers entering the United States, and it helps customs officials gather necessary information about your trip. To ensure a smooth experience, follow the steps below carefully.

- Begin by obtaining a copy of the CBP 6059B form. This can usually be found at your point of entry or online.

- Start with the first section, where you will need to provide your full name. Make sure to write it as it appears on your passport.

- Next, fill in your date of birth. Use the format MM/DD/YYYY to avoid any confusion.

- Indicate your nationality by selecting the appropriate option from the list provided on the form.

- In the next section, provide your passport number. Double-check this number for accuracy.

- Fill in the expiration date of your passport, again using the MM/DD/YYYY format.

- Enter your flight information, including the airline name and flight number. This helps customs verify your travel details.

- Provide your address while in the United States. This could be a hotel address or a friend’s residence.

- Answer any additional questions as required, such as whether you are bringing certain items into the country.

- Finally, review the entire form for any mistakes or missing information. Ensure everything is complete before submission.

After completing the form, you will be ready to present it to customs officials upon your arrival in the United States. Make sure to keep a copy for your records, just in case you need to reference it later.

Common mistakes

-

Incorrect Personal Information: Many individuals fail to provide accurate personal details such as their full name, date of birth, or passport number. This can lead to complications at customs.

-

Missing Signature: Some people forget to sign the form. Without a signature, the form is considered incomplete, which can delay the entry process.

-

Inaccurate Travel Information: Travelers often misreport their flight number or destination. Providing incorrect information can cause confusion and delays.

-

Failure to Declare Items: Many individuals do not declare items that need to be reported, such as food, currency over a certain amount, or gifts. This can result in fines or confiscation.

-

Not Understanding the Instructions: Some users overlook the instructions provided with the form. Misunderstanding these guidelines can lead to errors in completion.

-

Using Ineligible Information: Some travelers mistakenly provide information that is not applicable to them, such as details from a previous trip. This can create discrepancies.

-

Neglecting to Check for Updates: The form may be updated periodically. Failing to use the most current version can result in issues during processing.

-

Rushing the Process: In the rush to complete the form, individuals often overlook details. Taking time to review the form can prevent mistakes.

Get Clarifications on CBP 6059B

What is the CBP 6059B form?

The CBP 6059B form is a customs declaration form used by travelers entering the United States. It collects information about items being brought into the country, including goods for personal use and any items that may be subject to customs duties or restrictions.

Who needs to fill out the CBP 6059B form?

Any traveler, including U.S. citizens and foreign visitors, must complete the CBP 6059B form when entering the United States. This includes individuals arriving by air, land, or sea. If you are traveling with family, one form can be completed for the entire group, provided that all individuals are listed.

How do I obtain the CBP 6059B form?

The CBP 6059B form is typically provided by airlines or shipping companies before arrival in the U.S. You can also find it online on the U.S. Customs and Border Protection (CBP) website. Additionally, forms are available at U.S. ports of entry, where you can fill them out upon arrival.

What information is required on the CBP 6059B form?

Travelers must provide various details, including:

- Name and contact information

- Country of residence

- Flight or travel information

- Items being brought into the U.S., including their value

- Any agricultural products or food items

Providing accurate information is crucial to avoid delays or penalties.

What happens if I don’t fill out the CBP 6059B form?

Failure to complete the CBP 6059B form can lead to complications at customs. Travelers may face delays, fines, or even confiscation of undeclared items. It is important to be thorough and honest when filling out the form to ensure a smooth entry process.

Where do I submit the CBP 6059B form?

The CBP 6059B form is submitted to U.S. Customs and Border Protection officials upon arrival in the United States. Travelers will present the form to customs officers, who will review the information and may ask additional questions about the items being declared.