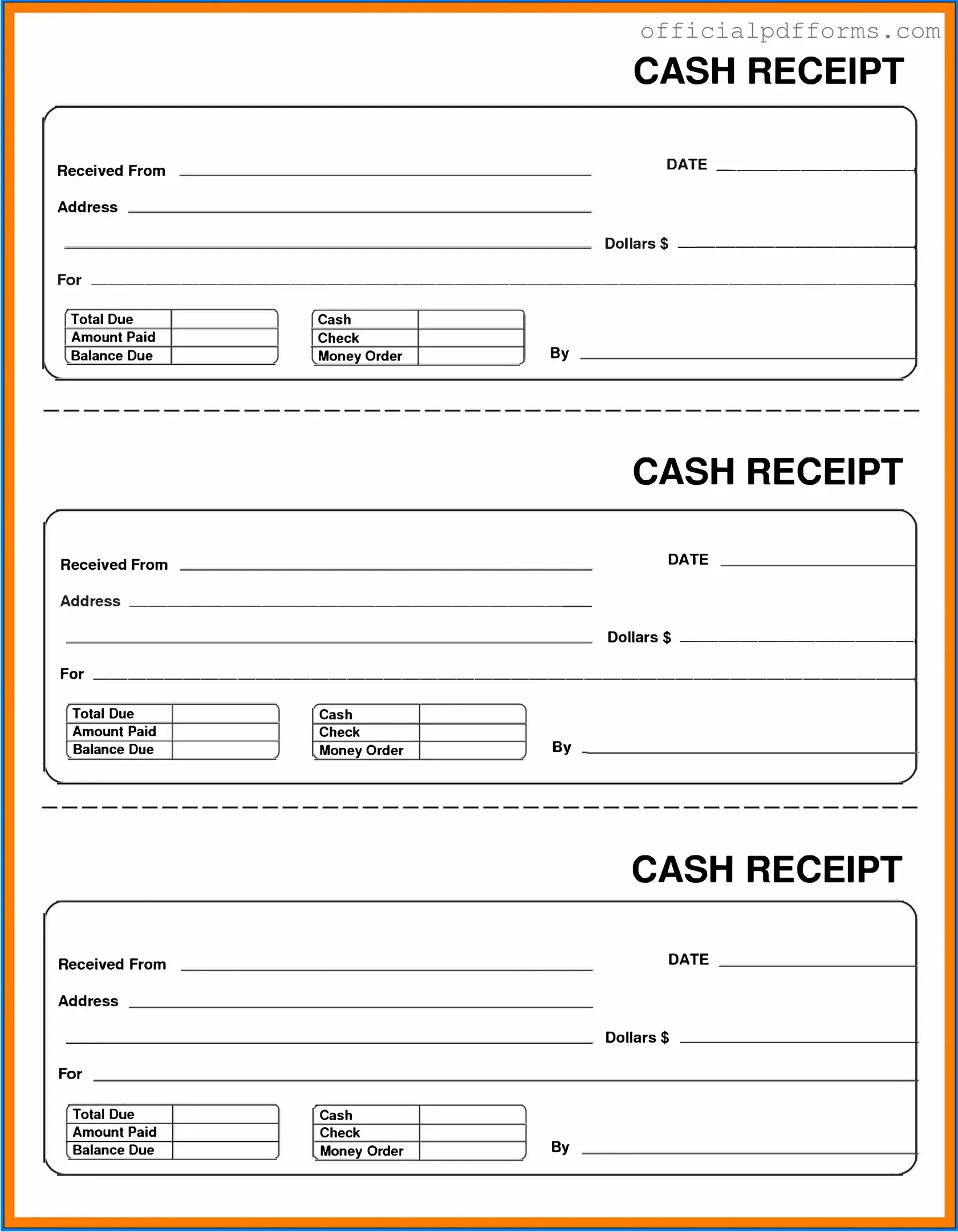

Fill in a Valid Cash Receipt Form

Common PDF Forms

How Do I Find Out How Many College Credits I Have - It's important for students to ensure that all previously attended names are included on the form.

For individuals navigating the process of trailer ownership transfer, understanding the importance of a complete Trailer Bill of Sale document is crucial, as it serves as the official record of the transaction and aids in clarifying ownership rights.

No Trespassing Letter to Neighbor - All individuals are warned against entering this property without permission.

Miscellaneous Information - Businesses must issue a 1099-MISC by January 31 of the year following the payment.

Misconceptions

- Misconception 1: The Cash Receipt form is only necessary for large transactions.

- Misconception 2: Cash Receipt forms are only used in retail settings.

- Misconception 3: A Cash Receipt form is the same as an invoice.

- Misconception 4: Cash Receipt forms are optional for businesses.

- Misconception 5: Only the person who receives the cash needs to fill out the form.

- Misconception 6: Cash Receipt forms do not need to be stored after the transaction.

- Misconception 7: Cash Receipt forms are only for cash payments.

- Misconception 8: The information on a Cash Receipt form is not important.

This is inaccurate. Regardless of the transaction size, a Cash Receipt form provides essential documentation for all cash transactions, ensuring proper record-keeping and accountability.

While common in retail, Cash Receipt forms are utilized across various industries, including services, non-profits, and government entities, to document cash received.

This is not true. An invoice requests payment, while a Cash Receipt form confirms that payment has already been received.

In fact, many businesses are required to maintain accurate financial records, and Cash Receipt forms are a critical part of this process.

It is advisable for both the payer and the receiver to acknowledge the transaction. This ensures transparency and reduces the likelihood of disputes.

On the contrary, businesses should retain these forms for a specified period, as they are essential for auditing and tax purposes.

While primarily associated with cash, these forms can also document other forms of payment, such as checks or money orders, as long as they represent cash equivalents.

Every detail on the form, including date, amount, and purpose, plays a vital role in financial tracking and reporting. Accurate information is crucial for effective financial management.

Documents used along the form

When managing financial transactions, several documents work in tandem with the Cash Receipt form. Each document serves a unique purpose, ensuring clarity and accountability in financial dealings. Below is a list of commonly used forms and documents that complement the Cash Receipt form.

- Invoice: A detailed bill sent to a customer outlining the goods or services provided, including amounts due and payment terms.

- Payment Voucher: A document that authorizes a payment, detailing the reason for the expense and the recipient's information.

- Texas Motorcycle Bill of Sale: This legal document facilitates the transfer of ownership for motorcycles in Texas, documenting essential information such as motorcycle details and transaction particulars, ensuring clarity and accountability in the sale. For more information, visit OnlineLawDocs.com.

- Deposit Slip: A form used to record the details of a cash deposit made to a bank account, often including account numbers and amounts.

- Sales Receipt: A document given to customers upon payment, confirming the transaction and providing a record of the sale.

- Credit Note: Issued when a customer returns goods or when an adjustment is made, indicating the amount credited back to their account.

- Expense Report: A record submitted by employees detailing business-related expenses for reimbursement or accounting purposes.

- Bank Statement: A summary of all transactions in a bank account over a specific period, useful for reconciling cash receipts.

- General Ledger: A comprehensive record of all financial transactions, including cash receipts, providing an overview of a business's financial health.

- Purchase Order: A document created by a buyer to authorize a purchase transaction, detailing items ordered and agreed-upon prices.

Each of these documents plays a vital role in maintaining accurate financial records and ensuring smooth transactions. Together, they create a robust framework for effective financial management.

Steps to Filling Out Cash Receipt

Once you have the Cash Receipt form ready, it is important to complete it accurately to ensure proper processing. Follow these steps carefully to fill out the form correctly.

- Start by entering the date of the transaction in the designated field.

- Write the name of the individual or organization making the payment.

- In the next section, input the amount received in numeric form.

- Below the amount, spell out the payment amount in words to confirm accuracy.

- Specify the payment method used (e.g., cash, check, credit card) in the provided area.

- If applicable, include any reference number associated with the payment, such as a check number.

- Sign the form to validate the receipt.

- Finally, provide your contact information, including your name, phone number, and email address.

Common mistakes

When completing a Cash Receipt form, individuals may encounter various challenges that can lead to mistakes. Here are seven common errors that people often make:

-

Incomplete Information:

Omitting essential details such as the date, amount received, or the name of the payer can create confusion and hinder proper record-keeping.

-

Incorrect Amounts:

Entering the wrong amount can lead to discrepancies. Always double-check the figures before finalizing the form.

-

Failure to Sign:

Neglecting to sign the form can render it invalid. A signature confirms the authenticity of the transaction.

-

Wrong Payment Method:

Not accurately indicating the payment method (cash, check, credit card) can complicate financial tracking and reconciliation.

-

Missing Receipt Copies:

Failing to provide or retain copies of the receipt can result in a lack of documentation for future reference.

-

Incorrect Payer Information:

Providing inaccurate details about the payer can lead to issues in identifying who made the payment. Ensure names and addresses are correct.

-

Neglecting to Date the Receipt:

Not including the date on the receipt can cause confusion regarding when the transaction took place, impacting financial records.

By being mindful of these common mistakes, individuals can ensure that their Cash Receipt forms are filled out accurately and effectively. This attention to detail fosters better financial management and accountability.

Get Clarifications on Cash Receipt

What is a Cash Receipt form?

A Cash Receipt form is a document used to record the receipt of cash payments. It serves as proof of payment for both the payer and the recipient. This form typically includes details such as the date of the transaction, the amount received, the purpose of the payment, and the names of the parties involved.

When should I use a Cash Receipt form?

You should use a Cash Receipt form whenever you receive cash payments for goods or services. This includes transactions such as:

- Sales of products

- Service fees

- Donations

- Any other cash transactions

Using this form helps maintain accurate financial records and provides a clear audit trail.

How do I fill out a Cash Receipt form?

To fill out a Cash Receipt form, follow these steps:

- Enter the date of the transaction.

- Write the name of the payer.

- Specify the amount of cash received.

- Describe the purpose of the payment.

- Sign the form to confirm the transaction.

Ensure all information is accurate to avoid any discrepancies in your records.

Who should keep a copy of the Cash Receipt form?

Both the payer and the recipient should keep a copy of the Cash Receipt form. The payer retains it as proof of payment, while the recipient keeps it for accounting and record-keeping purposes. This practice helps ensure transparency and accountability in financial transactions.

What should I do if I make a mistake on the Cash Receipt form?

If you make a mistake on the Cash Receipt form, do not erase or cross out the error. Instead, draw a single line through the incorrect information and write the correct details next to it. Initial the correction to indicate that it was made by you. This method maintains the integrity of the document and keeps a clear record of the transaction history.