Fill in a Valid Cash Drawer Count Sheet Form

Common PDF Forms

Kink Form - Highlights interest in incorporating fantasy elements into sessions.

When navigating the property market in Texas, understanding the importance of a properly drafted document is crucial. This is where the essential components of a Real Estate Purchase Agreement come into play. For more detailed insights and to access the template, visit our comprehensive guide at your go-to resource for Real Estate Purchase Agreement details.

Chickfila Jobs - Capacity to inspire confidence in customers through service.

Misconceptions

Understanding the Cash Drawer Count Sheet form is essential for effective cash management in any business. However, several misconceptions can lead to confusion. Here are six common misconceptions about this important document:

-

It is only necessary for large businesses.

This is not true. Regardless of size, any business that handles cash should utilize a Cash Drawer Count Sheet to maintain accurate records.

-

It is only used at the end of the day.

While many businesses do perform counts at the end of the day, the form can also be used during shifts or at any time cash is handled to ensure accuracy.

-

It is a complicated document.

The Cash Drawer Count Sheet is straightforward. It typically includes simple fields for recording cash amounts, making it easy to complete.

-

Only managers should fill it out.

In reality, any employee handling cash should be trained to complete the form. This promotes accountability and transparency.

-

It is only for tracking cash.

While its primary purpose is cash tracking, the form can also help identify discrepancies and improve overall financial management.

-

Once filled out, it is not needed again.

This misconception overlooks the importance of retaining these records for audits and financial reviews. Keeping copies is essential for accountability.

By addressing these misconceptions, businesses can better utilize the Cash Drawer Count Sheet form to enhance their cash management practices.

Documents used along the form

The Cash Drawer Count Sheet form is an important document used in retail and service industries to track cash transactions. Alongside this form, several other documents are commonly utilized to ensure accurate financial reporting and accountability. Below is a list of related forms and documents that often accompany the Cash Drawer Count Sheet.

- Daily Sales Report: This document summarizes the total sales for a given day, including cash, credit, and other payment methods. It helps in reconciling cash on hand with sales recorded.

- Cash Deposit Slip: This form is used when depositing cash into a bank account. It details the amount of cash being deposited and serves as a record for both the business and the bank.

- Motor Vehicle Bill of Sale: This important document serves as proof of transfer of ownership and includes necessary details about the vehicle, sale price, and date of sale. It is essential for completing the registration process under the new owner's name, and can be obtained from OnlineLawDocs.com.

- Transaction Log: This log records each transaction made during a business day. It includes details such as the date, time, amount, and method of payment, aiding in tracking sales and identifying discrepancies.

- Expense Report: This document outlines the expenses incurred by the business, including cash disbursements. It helps in budgeting and financial planning by providing a clear view of outgoing funds.

These documents work together to provide a comprehensive overview of a business's financial activities. Proper management of these forms can enhance accuracy in financial reporting and improve overall operational efficiency.

Steps to Filling Out Cash Drawer Count Sheet

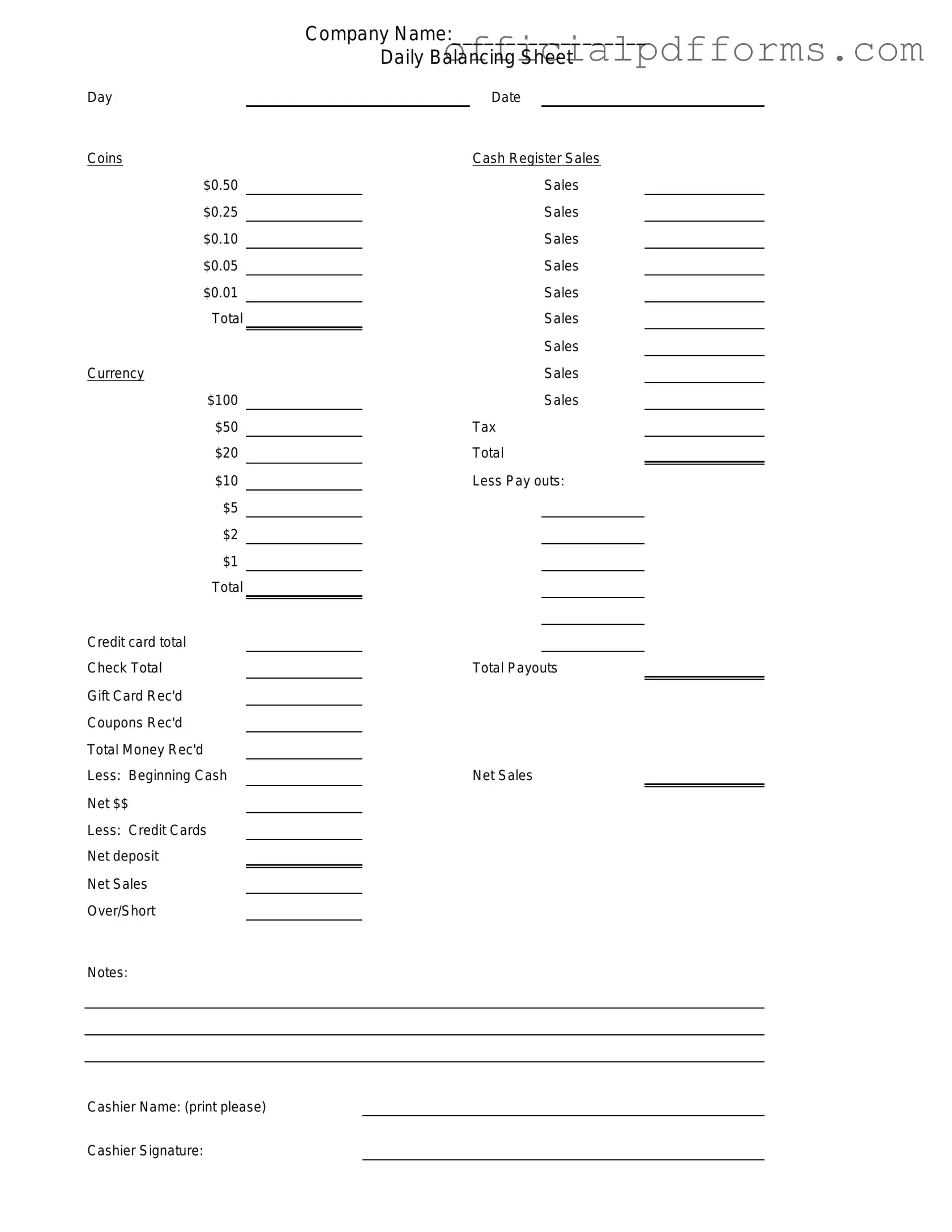

After gathering the necessary information, you are ready to fill out the Cash Drawer Count Sheet. This form is essential for accurately documenting the cash in your drawer, ensuring accountability and transparency in your financial processes.

- Start by entering the date at the top of the form. Make sure to use the current date for accurate record-keeping.

- Next, write your name or the name of the person responsible for counting the cash.

- In the designated section, list the denominations of cash you have in the drawer. This typically includes bills and coins.

- For each denomination, enter the quantity you have counted. Be sure to double-check your counts to avoid errors.

- Calculate the total amount for each denomination by multiplying the quantity by the value of the denomination. Write these totals in the appropriate column.

- Add up all the totals to find the grand total cash amount in the drawer. Write this figure at the bottom of the form.

- If necessary, include any notes or comments that may be relevant to the cash count. This could include discrepancies or special circumstances.

- Finally, sign and date the form to confirm that the count is complete and accurate.

Common mistakes

When filling out the Cash Drawer Count Sheet form, it's easy to make mistakes that can lead to discrepancies in cash management. Here’s a list of common errors to avoid:

-

Inaccurate Cash Count:

Failing to count the cash accurately can lead to significant errors. Always double-check your count before recording it.

-

Missing Signatures:

Not signing the form can create accountability issues. Ensure that both the preparer and the reviewer sign the document.

-

Incorrect Date:

Writing the wrong date can cause confusion during audits. Always verify the date before submission.

-

Omitting Details:

Leaving out important information, such as transaction types or notes, can hinder clarity. Provide all necessary details.

-

Not Using the Correct Form:

Using an outdated or incorrect version of the form can lead to compliance issues. Always ensure you have the latest version.

-

Errors in Calculations:

Mathematical errors in totaling cash can lead to discrepancies. Double-check all calculations for accuracy.

-

Failing to Record Non-Cash Transactions:

Neglecting to document credit card or check transactions can create an incomplete financial picture. Make sure to include all transaction types.

-

Not Storing the Form Properly:

Improper storage of the completed form can lead to loss or damage. Keep it in a secure and organized location for future reference.

By being mindful of these common mistakes, individuals can ensure that their Cash Drawer Count Sheet is accurate and reliable, ultimately leading to better cash management practices.

Get Clarifications on Cash Drawer Count Sheet

What is a Cash Drawer Count Sheet?

The Cash Drawer Count Sheet is a tool used to track the amount of cash in a cash drawer at the end of a business day or shift. It helps ensure that the cash on hand matches the sales recorded, facilitating accountability and reducing discrepancies.

Why is it important to use a Cash Drawer Count Sheet?

Using a Cash Drawer Count Sheet is crucial for several reasons:

- It provides a clear record of cash transactions.

- It helps identify any cash shortages or overages.

- It promotes transparency and accountability among staff.

- It aids in financial reporting and audits.

How do I complete the Cash Drawer Count Sheet?

To complete the Cash Drawer Count Sheet, follow these steps:

- Start by recording the date and your name on the sheet.

- Count the cash in the drawer, including bills and coins.

- List the denominations and their corresponding amounts.

- Calculate the total cash amount and write it in the designated area.

- Compare the total cash amount with the expected amount based on sales records.

- Sign and date the form to confirm accuracy.

What should I do if I find a discrepancy?

If a discrepancy occurs, take the following steps:

- Double-check your count to ensure accuracy.

- Review sales records for any missed transactions.

- Discuss the discrepancy with your supervisor or manager.

- Document any findings on the Cash Drawer Count Sheet.

How often should I complete the Cash Drawer Count Sheet?

The Cash Drawer Count Sheet should be completed at the end of each shift or business day. This practice ensures that cash is consistently monitored and discrepancies can be addressed promptly.

Can I use the Cash Drawer Count Sheet for multiple drawers?

Yes, the Cash Drawer Count Sheet can be adapted for multiple drawers. Simply create separate sections for each drawer on the same sheet or use multiple sheets as needed. Ensure that each drawer's totals are clearly labeled to maintain clarity.