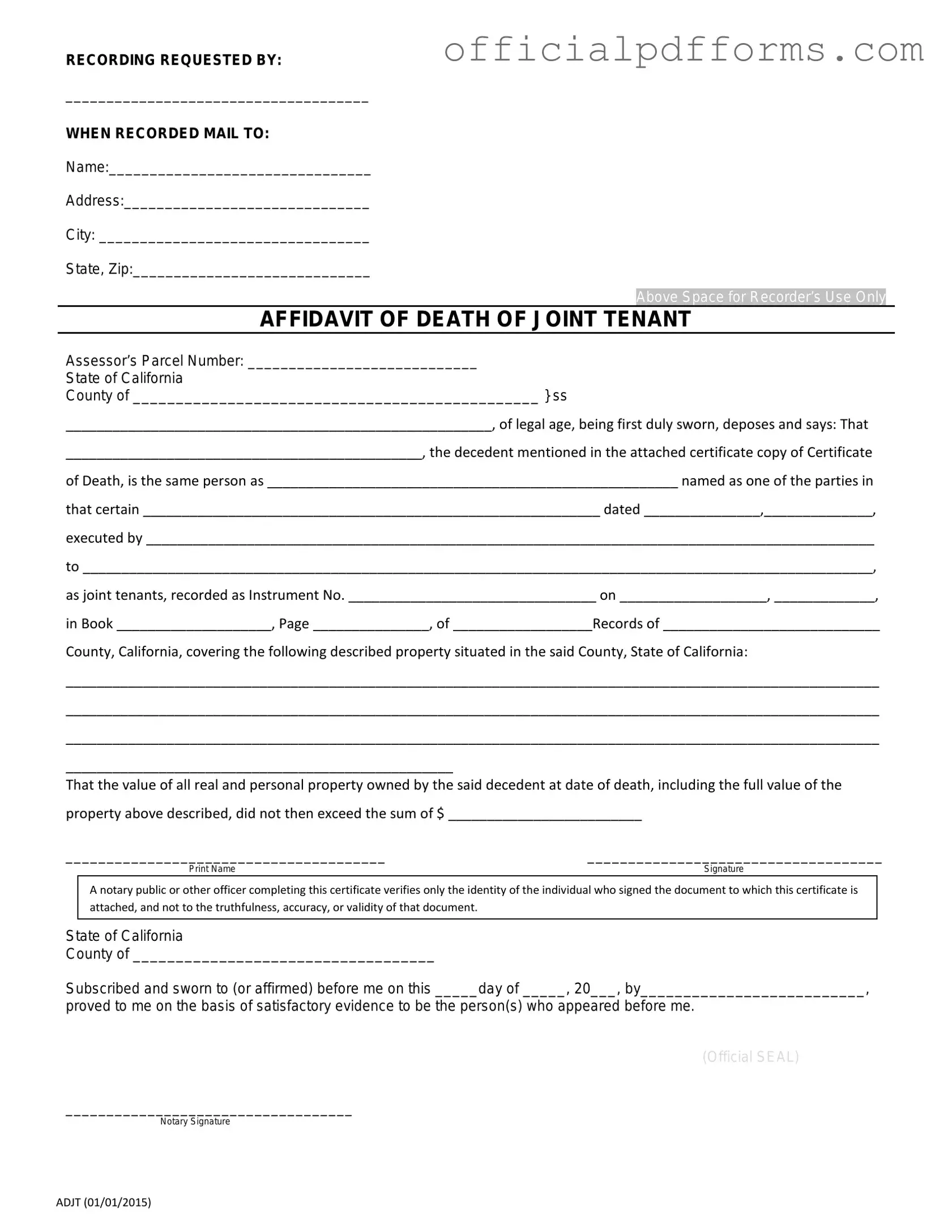

Fill in a Valid California Death of a Joint Tenant Affidavit Form

Common PDF Forms

How to Make Self Employed Pay Stubs - Aids in budgeting and financial planning for freelance professionals.

For anyone considering a purchase or sale, an organized approach is important, so having a guide featuring a Motorcycle Bill of Sale template can simplify the process significantly.

Employment Status Change Form - Use this form to record promotions, demotions, or transfers of employees.

Misconceptions

The California Death of a Joint Tenant Affidavit form is often misunderstood. Here are six common misconceptions about this legal document:

- It is only for married couples. Many believe that this affidavit is exclusively for spouses. In reality, any joint tenants, regardless of their relationship, can use this form to transfer property upon the death of one tenant.

- It automatically transfers all property to the surviving tenant. While the affidavit facilitates the transfer of property, it does not automatically include all assets. Only the property held in joint tenancy is affected.

- Filing the affidavit is optional. Some individuals think that filing the affidavit is not necessary if there is a will. However, if property is held in joint tenancy, the affidavit must be filed to legally transfer ownership to the surviving tenant.

- Any document can serve as an affidavit. There is a misconception that any written statement can act as an affidavit. In fact, the California Death of a Joint Tenant Affidavit must meet specific legal requirements to be valid.

- The form is only needed in California. Many assume that this form is only relevant in California. However, similar affidavits exist in other states, though they may have different names and requirements.

- It can be filed without a death certificate. Some people believe they can submit the affidavit without a death certificate. However, a certified copy of the death certificate is typically required to validate the affidavit.

Understanding these misconceptions can help individuals navigate the process of property transfer more effectively.

Documents used along the form

The California Death of a Joint Tenant Affidavit form is an important document used when a joint tenant passes away. However, there are other forms and documents that may accompany it to ensure a smooth transition of property ownership. Below are some of the most common documents used in conjunction with this affidavit.

- Death Certificate: This official document verifies the death of the joint tenant. It is often required to prove the passing of the individual when filing the affidavit.

- Grant Deed: A grant deed transfers ownership of real property. After the death of a joint tenant, this document may be needed to formally transfer the deceased's interest in the property to the surviving tenant.

- Affidavit of Death: This document is similar to the Death of a Joint Tenant Affidavit but is used in different contexts. It provides proof of death and can be used for various legal purposes, including settling estates.

- Operating Agreement: This essential document outlines the operating procedures and ownership structure of an LLC, similar to how the New York Operating Agreement form functions in New York. For more information, visit OnlineLawDocs.com.

- Property Tax Records: These records help establish the ownership and tax obligations of the property. They may be required to update the tax records after the transfer of ownership due to the death of a joint tenant.

Using these documents together with the California Death of a Joint Tenant Affidavit can help clarify the situation and facilitate the necessary changes in property ownership. Always ensure that you have the right paperwork to avoid complications during this process.

Steps to Filling Out California Death of a Joint Tenant Affidavit

After you complete the California Death of a Joint Tenant Affidavit form, you will need to file it with the appropriate county recorder's office. This step is important to ensure that the transfer of property ownership is officially recognized. Make sure you have all the necessary documents ready before you start filling out the form.

- Begin by downloading the California Death of a Joint Tenant Affidavit form from a reliable source or obtain a hard copy from your local county recorder's office.

- In the top section, fill in the name of the deceased joint tenant. Include their date of death and any relevant information regarding the property.

- Next, provide your name and contact information as the surviving joint tenant. This identifies you as the person completing the form.

- In the designated area, describe the property. Include the address and any legal descriptions needed to clearly identify it.

- Sign and date the affidavit. Your signature confirms that the information you provided is accurate.

- If required, have the form notarized. This adds an extra layer of verification to your affidavit.

- Finally, submit the completed form to your local county recorder's office. Make sure to keep a copy for your records.

Common mistakes

-

Failing to include the correct decedent's name. It's crucial to ensure that the name matches the one on the property title.

-

Not providing the date of death. This information is essential to establish the timeline of ownership transfer.

-

Omitting the property address. Without a complete address, the affidavit may be considered incomplete.

-

Using an incorrect form version. Always check that you are using the most current version of the affidavit.

-

Failing to have the affidavit notarized. A signature without notarization may lead to rejection by the county recorder's office.

-

Not including all joint tenants. If there are multiple joint tenants, all must be listed on the form.

-

Incorrectly stating the relationship to the decedent. This detail should be accurate to avoid complications.

-

Forgetting to sign the form. A missing signature can delay the processing of the affidavit.

-

Not providing supporting documentation. Attach any necessary documents, such as a death certificate, to validate the affidavit.

-

Submitting the affidavit to the wrong county office. Ensure you are filing with the correct county recorder's office where the property is located.

Get Clarifications on California Death of a Joint Tenant Affidavit

- The name of the deceased joint tenant

- The date of death

- The property address

- The names of the surviving joint tenants

- A statement confirming that the property was held as joint tenants

What is the California Death of a Joint Tenant Affidavit form?

The California Death of a Joint Tenant Affidavit form is a legal document used to transfer the interest in property when one of the joint tenants passes away. This form helps to clarify ownership and facilitates the transfer of property rights without going through probate.

Who should use this form?

This form is intended for joint tenants who need to establish the death of one of the owners. It is particularly useful for surviving joint tenants who want to claim full ownership of the property after the death of their co-owner.

What information is required to complete the form?

To complete the affidavit, you will need the following information:

Do I need to have the affidavit notarized?

Yes, the California Death of a Joint Tenant Affidavit must be notarized. This ensures that the document is legally valid and can be accepted by the county recorder's office when transferring property ownership.

Where do I file the affidavit?

The completed and notarized affidavit should be filed with the county recorder's office in the county where the property is located. This step is essential for updating the public record and confirming the change in ownership.

Is there a filing fee for the affidavit?

Yes, there is typically a filing fee associated with submitting the affidavit to the county recorder's office. Fees can vary by county, so it is advisable to check with your local office for the exact amount.

What happens if there are multiple joint tenants?

If there are multiple joint tenants and one passes away, the surviving joint tenants can still use the affidavit to transfer the deceased tenant's interest. The form should include the names of all surviving joint tenants and confirm their status as joint owners.

Can I use this form if the deceased tenant left a will?

Yes, you can still use the California Death of a Joint Tenant Affidavit if the deceased had a will. However, if the will specifies different instructions for the property, those instructions must be followed instead of using the affidavit.

What if the deceased tenant had debts?

The property owned as joint tenants typically passes directly to the surviving tenant without going through probate. However, any debts of the deceased may still need to be addressed. It's advisable to consult with an attorney if there are concerns about debts or liabilities associated with the property.

How long do I have to file the affidavit after the tenant's death?

While there is no strict deadline for filing the affidavit, it is generally recommended to do so as soon as possible after the death of the joint tenant. Prompt filing helps prevent complications and ensures that the property records are up to date.