Valid Business Purchase and Sale Agreement Document

Fill out Popular Documents

How to Get Acord Insurance Certificate - This document is crucial for accurate record-keeping in workplaces.

The importance of understanding the vehicle release of liability process cannot be overstated, as it ensures both parties fulfill their obligations during a vehicle transfer, safeguarding against possible future disputes.

Hazardous Material Bill of Lading - Offers a standardized process for hazardous material transportation logistics.

Navpers 1336 3 - Clear communication through this form is vital for operational efficiency.

Misconceptions

There are several misconceptions surrounding the Business Purchase and Sale Agreement form. Understanding these can help clarify its purpose and importance in business transactions.

- It is only necessary for large transactions. Many believe that only significant purchases require a formal agreement. In reality, any business transaction can benefit from a written agreement to ensure clarity and protection for both parties.

- It is a standard form that requires no customization. While templates exist, each agreement should be tailored to the specific details of the transaction. Customization addresses unique circumstances and needs of the parties involved.

- Verbal agreements are sufficient. Some individuals think that verbal agreements are enough to finalize a sale. However, without a written contract, misunderstandings can arise, leading to disputes that could have been avoided.

- Only the buyer needs to sign the agreement. This misconception overlooks the fact that both the buyer and seller must sign the document for it to be legally binding. Each party has rights and obligations that need acknowledgment.

- The agreement is only about price. While price is a critical component, the agreement also covers terms of payment, warranties, and conditions of sale. It provides a comprehensive outline of the transaction.

- Once signed, the agreement cannot be changed. Parties can negotiate modifications to the agreement before closing the deal. Changes should be documented in writing to maintain clarity.

- It is only relevant at the time of sale. The agreement can have long-term implications. It may outline post-sale obligations or restrictions, making it relevant even after the transaction is complete.

- Legal counsel is not necessary. Some individuals believe they can navigate the agreement without legal advice. Consulting with a legal professional can provide valuable insights and help avoid potential pitfalls.

- It guarantees a successful transaction. While a well-drafted agreement can minimize risks, it does not guarantee the success of a business transaction. Due diligence and proper planning are equally important.

Documents used along the form

When engaging in the purchase or sale of a business, the Business Purchase and Sale Agreement is a critical document. However, it is often accompanied by other important forms and documents that help clarify terms, protect the interests of both parties, and ensure a smooth transaction. Below are some commonly used documents that complement the Business Purchase and Sale Agreement.

- Letter of Intent (LOI): This document outlines the preliminary understanding between the buyer and seller before the formal agreement is drafted. It typically includes key terms such as purchase price, payment structure, and any contingencies. While not legally binding, it sets the stage for negotiations and helps both parties align their expectations.

- Due Diligence Checklist: This checklist serves as a guide for the buyer to conduct a thorough examination of the business being purchased. It often includes items such as financial statements, tax returns, employee contracts, and customer agreements. Completing this checklist is essential for identifying potential risks and ensuring that the buyer makes an informed decision.

- Bill of Sale: Once the purchase is finalized, a Bill of Sale is used to transfer ownership of the business's tangible assets from the seller to the buyer. This document provides proof of the transaction and typically includes details about the assets being sold, such as equipment, inventory, and intellectual property.

- Motor Vehicle Bill of Sale: This essential document serves as a record of the sale and transfer of ownership of a motor vehicle. It verifies the transaction between the buyer and the seller, detailing the vehicle's information, sale price, and the date of sale. For more information, visit OnlineLawDocs.com.

- Non-Disclosure Agreement (NDA): To protect sensitive information during the negotiation process, parties often sign an NDA. This agreement ensures that confidential information shared between the buyer and seller remains private and cannot be disclosed to third parties. It fosters trust and encourages open communication during the transaction.

These documents play a vital role in the business acquisition process. By understanding their purpose and importance, both buyers and sellers can navigate the complexities of a transaction with greater confidence and clarity.

Steps to Filling Out Business Purchase and Sale Agreement

Filling out a Business Purchase and Sale Agreement form is an important step in the process of transferring ownership of a business. This agreement outlines the terms and conditions of the sale, ensuring both parties are clear on their obligations. Follow these steps to complete the form accurately.

- Identify the parties involved: Clearly state the names and addresses of the buyer and seller. Make sure to include any relevant business entities if applicable.

- Describe the business: Provide a detailed description of the business being sold. Include its name, location, and any relevant licenses or permits.

- Specify the purchase price: Clearly indicate the total purchase price for the business. Break down the payment terms, including any deposits or financing arrangements.

- List included assets: Enumerate all assets included in the sale. This may include equipment, inventory, intellectual property, and real estate.

- Outline liabilities: Specify any liabilities that the buyer will assume as part of the sale. This could include debts or ongoing contracts.

- Set closing date: Indicate the date on which the sale will be finalized. This is important for both parties to prepare for the transfer.

- Include contingencies: Note any conditions that must be met for the sale to proceed, such as financing approval or regulatory compliance.

- Signatures: Ensure both the buyer and seller sign and date the agreement. Consider having witnesses or a notary if required.

Common mistakes

-

Neglecting to Include All Parties Involved: It is crucial to list all parties involved in the transaction. Omitting a party can lead to disputes later on.

-

Failing to Clearly Define Terms: Ambiguous language can create confusion. Clearly define terms such as "purchase price," "assets included," and "closing date."

-

Not Specifying Payment Terms: Outline how the payment will be made. This includes whether it will be a lump sum or installment payments, and any interest rates applicable.

-

Overlooking Contingencies: Contingencies protect both parties. Failing to include conditions, such as financing or inspections, can lead to complications.

-

Ignoring Legal Compliance: Ensure that the agreement complies with local, state, and federal laws. Ignorance of legal requirements can invalidate the agreement.

-

Not Addressing Liabilities: Clearly outline who is responsible for existing debts or liabilities. This prevents misunderstandings after the sale.

-

Forgetting to Include Confidentiality Clauses: Protect sensitive information by including confidentiality clauses. This is especially important when proprietary information is involved.

-

Neglecting to Seek Professional Advice: Consulting with legal and financial professionals can provide valuable insights. Skipping this step may lead to costly mistakes.

-

Not Reviewing the Agreement Thoroughly: Take the time to review the entire document. Mistakes or overlooked details can have significant consequences.

Get Clarifications on Business Purchase and Sale Agreement

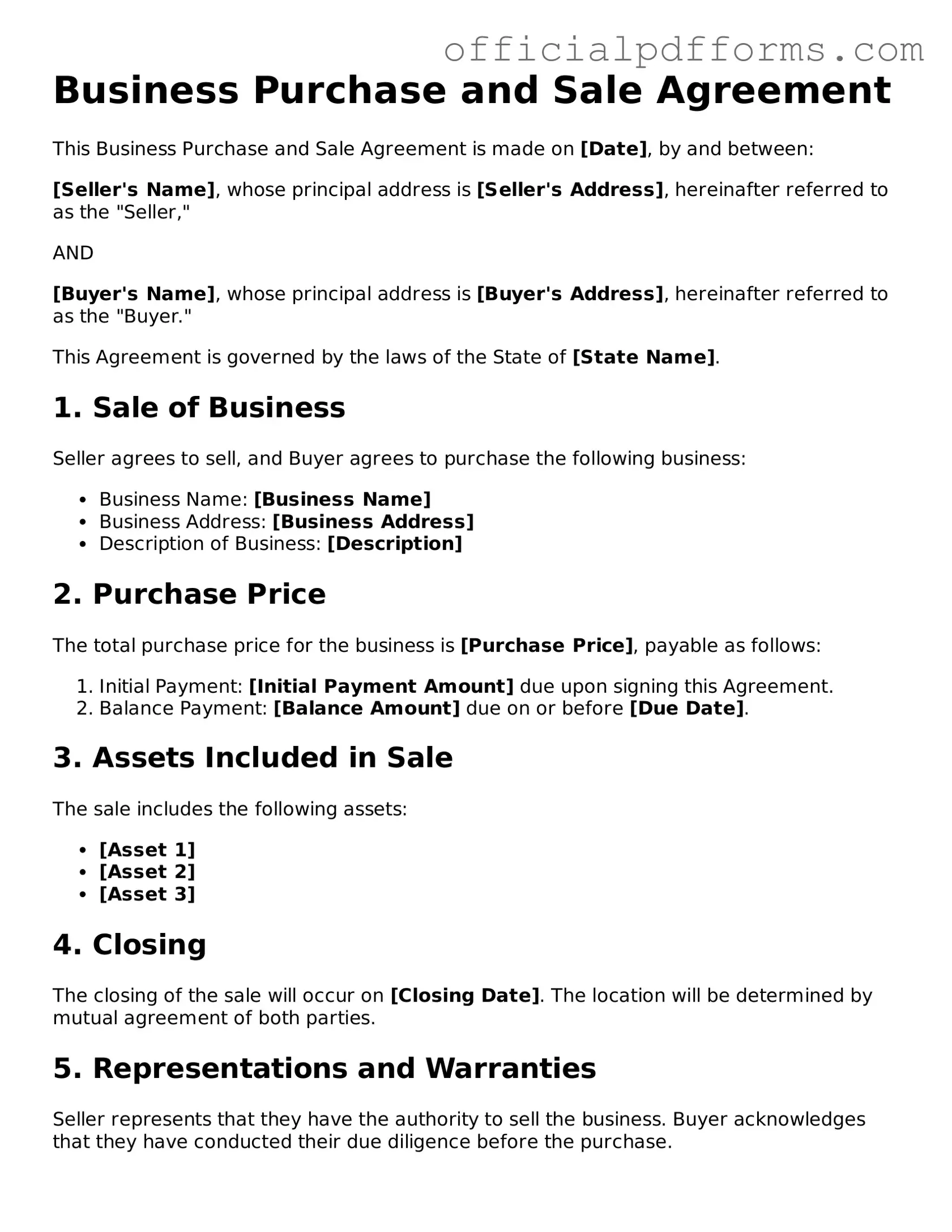

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions of a transaction in which one party sells a business to another. It details the assets being sold, the purchase price, and any other relevant terms that both parties must agree upon.

Why is a Business Purchase and Sale Agreement important?

This agreement is crucial because it protects both the buyer and the seller. It helps ensure that all parties understand their rights and obligations. A well-drafted agreement can prevent misunderstandings and disputes after the sale is completed.

What should be included in the agreement?

The following items are typically included in a Business Purchase and Sale Agreement:

- The names and addresses of the buyer and seller

- A description of the business being sold

- The purchase price and payment terms

- Details about any assets included in the sale, such as equipment or inventory

- Any liabilities that the buyer will assume

- Conditions that must be met before the sale can be completed

- Representations and warranties made by both parties

- Confidentiality clauses, if applicable

How is the purchase price determined?

The purchase price can be determined through various methods, including negotiations between the buyer and seller. Factors such as the business's financial performance, market conditions, and the value of its assets often play a significant role in setting the price.

Can the agreement be modified after it is signed?

Yes, the agreement can be modified, but both parties must agree to any changes. It is important to document any modifications in writing to avoid confusion later on.

What happens if one party breaches the agreement?

If one party fails to fulfill their obligations under the agreement, the other party may have legal remedies available. This can include seeking damages or, in some cases, enforcing the agreement through the courts. It is advisable to consult with a legal professional if a breach occurs.

Is it necessary to have a lawyer review the agreement?

While it is not legally required, having a lawyer review the agreement is highly recommended. A legal professional can ensure that the terms are fair, compliant with applicable laws, and protect your interests.

How long does it take to finalize the agreement?

The time it takes to finalize a Business Purchase and Sale Agreement can vary. Factors such as the complexity of the transaction, the responsiveness of both parties, and the need for due diligence can all affect the timeline. Generally, it can take anywhere from a few days to several weeks.