Fill in a Valid Business Credit Application Form

Common PDF Forms

How to Make Payroll Checks - This form streamlines the payroll check issuing process.

Free Printable Blank Invoice - The form is free, so you can manage your invoices while keeping costs low.

To facilitate your transactions, consider utilizing a trusted online resource for a convenient Alabama bill of sale document. For further information, visit this comprehensive Alabama bill of sale form.

Marriage Records Sacramento Ca - Partial submissions may result in rejection of the application.

Misconceptions

Understanding the Business Credit Application form can be challenging. Here are five common misconceptions that may lead to confusion:

- It is only for large businesses. Many people believe that only large corporations can apply for business credit. In reality, small businesses and startups can also benefit from this application. Credit options are available for businesses of all sizes.

- Personal credit is not considered. Some applicants think that their personal credit history does not affect their business credit application. However, lenders often review personal credit scores, especially for new businesses without an established credit history.

- All applications are approved. There is a misconception that submitting a Business Credit Application guarantees approval. Approval depends on various factors, including creditworthiness and financial stability. Each application is assessed individually.

- Only financial information is required. Applicants may assume that only financial data is necessary for the application. In fact, lenders may also request information about business structure, ownership, and operational history to make informed decisions.

- The process is quick and easy. Many believe that completing the Business Credit Application is a straightforward process. While it can be simple, gathering the required documentation and waiting for approval can take time, depending on the lender's policies.

Clarifying these misconceptions can help applicants navigate the Business Credit Application process more effectively.

Documents used along the form

When applying for business credit, several documents often accompany the Business Credit Application form. These documents help lenders assess your business's financial health and creditworthiness. Below is a list of common forms and documents that may be required.

- Personal Guarantee: This document states that an individual, usually a business owner, agrees to be personally responsible for the debt if the business defaults.

- Business Plan: A detailed outline of your business goals, strategies, and financial projections. It provides lenders with insight into your business's future.

- Financial Statements: These include balance sheets, income statements, and cash flow statements. They give a snapshot of your business's financial condition.

- Tax Returns: Typically, lenders will request the last two to three years of business tax returns to verify income and financial stability.

- Bank Statements: Recent bank statements help lenders assess cash flow and overall financial management.

- Trade References: A list of suppliers or vendors who can vouch for your payment history and creditworthiness can strengthen your application.

- Aaa International Driving Permit Application Form: This document allows U.S. citizens to drive legally in many countries and is recognized internationally. For more information, you can visit Fast PDF Templates.

- Business License: Proof that your business is legally registered and authorized to operate in your state or locality.

Gathering these documents can streamline the credit application process and improve your chances of approval. Make sure everything is accurate and up to date before submission.

Steps to Filling Out Business Credit Application

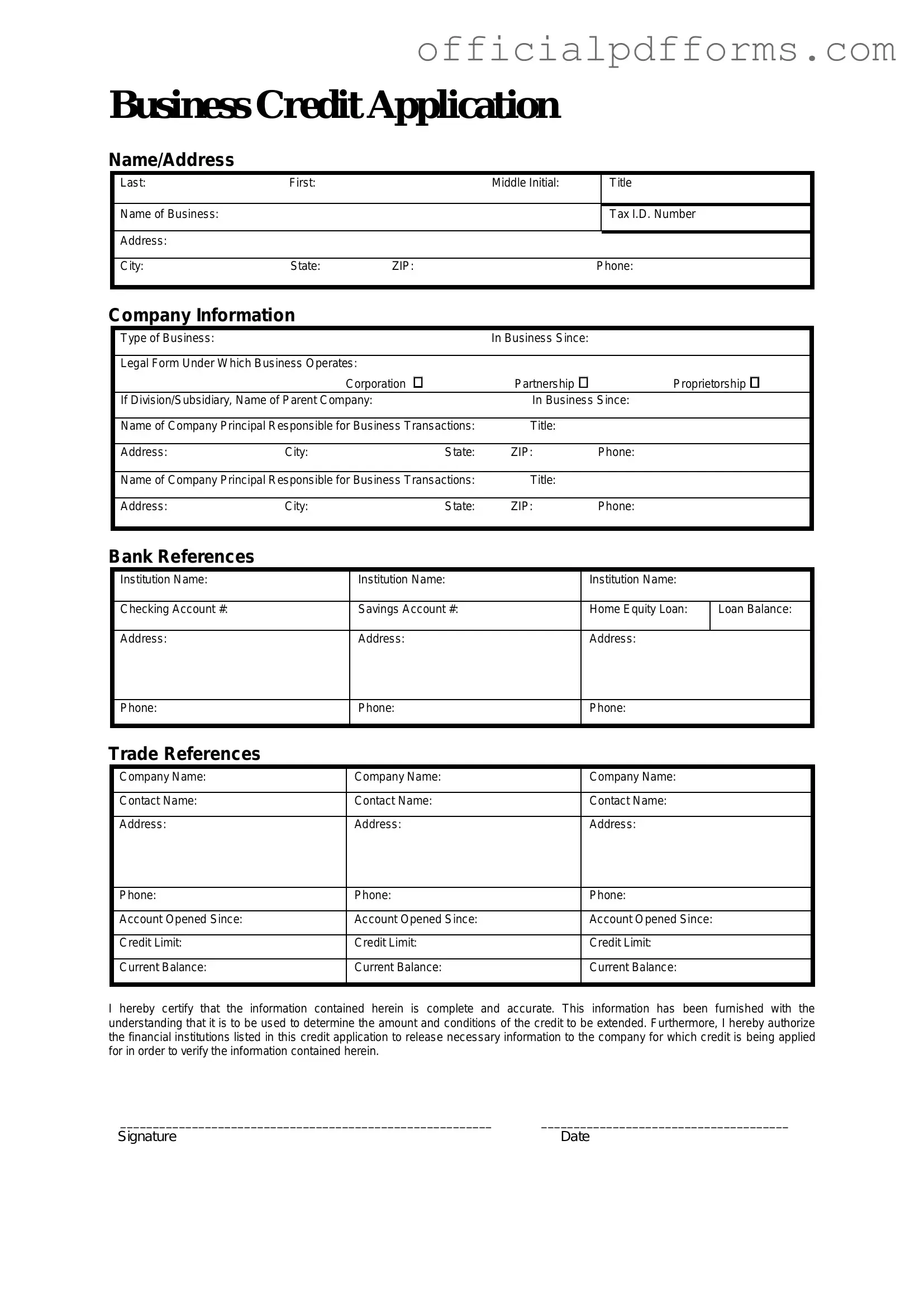

Completing the Business Credit Application form is an important step in establishing credit for your business. After you fill out the form, it will be reviewed by the lender to assess your eligibility for credit. Follow these steps to ensure that you provide all the necessary information accurately.

- Begin with the Business Information section. Enter your business name, address, and contact details.

- Provide the Owner Information. List the names of the owners or partners, along with their contact information.

- Fill out the Business Structure section. Indicate whether your business is a sole proprietorship, partnership, corporation, or LLC.

- In the Financial Information section, include your business's annual revenue and net profit. If applicable, provide the business tax ID number.

- Complete the Bank References section. List your primary bank and any additional banks you work with, including account numbers and contact information.

- In the Trade References section, provide the names and contact details of at least three suppliers or vendors that extend credit to your business.

- Sign and date the application at the bottom. Make sure to review all the information for accuracy before submitting.

Common mistakes

-

Incomplete Information: Many applicants fail to provide all the necessary details. This includes missing out on sections like business address, contact information, or financial details. Incomplete forms can lead to delays in processing.

-

Incorrect Financial Statements: Some individuals submit outdated or inaccurate financial statements. This can misrepresent the business's financial health, resulting in denial of credit or unfavorable terms.

-

Failure to Review Terms: Applicants often overlook the terms and conditions associated with the credit. Ignoring these details can lead to misunderstandings about repayment schedules and interest rates.

-

Neglecting to Sign: A common mistake is forgetting to sign the application. Without a signature, the application is considered invalid and cannot be processed.

Get Clarifications on Business Credit Application

What is a Business Credit Application form?

A Business Credit Application form is a document that businesses fill out to apply for credit from a lender or supplier. This form collects essential information about the business, including its financial history, ownership structure, and creditworthiness. Completing this form is a crucial step in establishing a credit line or securing financing.

Who should fill out the Business Credit Application form?

The Business Credit Application form should be completed by authorized representatives of the business, such as owners, partners, or financial officers. It is important that the person filling out the form has a good understanding of the company's financial situation and can provide accurate information.

What information is typically required on the form?

Common information required on a Business Credit Application form includes:

- Business name and address

- Type of business entity (e.g., LLC, corporation, sole proprietorship)

- Tax identification number (TIN)

- Business ownership details

- Financial statements (e.g., balance sheets, income statements)

- Bank references

- Trade references

How is the information on the form used?

The information provided on the Business Credit Application form is used by lenders or suppliers to assess the creditworthiness of the business. They evaluate the financial health and stability of the company to determine whether to approve the credit application and what terms to offer.

How long does it take to process a Business Credit Application?

The processing time for a Business Credit Application can vary widely depending on the lender or supplier. Generally, it may take anywhere from a few days to several weeks. Factors influencing the timeline include the complexity of the application and the thoroughness of the information provided.

What happens if the application is denied?

If a Business Credit Application is denied, the lender or supplier is typically required to provide a reason for the denial. Common reasons may include insufficient credit history, poor financial performance, or discrepancies in the information provided. Businesses can often address these issues and reapply in the future.

Can I appeal a denial of my Business Credit Application?

Yes, businesses can appeal a denial of their Business Credit Application. This usually involves contacting the lender or supplier to discuss the reasons for the denial and providing additional documentation or clarification that may support a reconsideration of the application.

Is there a fee associated with submitting the application?

Some lenders or suppliers may charge a fee for processing a Business Credit Application, while others do not. It is essential to review the terms and conditions associated with the application to understand any potential costs involved.

How often should I update my Business Credit Application?

It is advisable to update your Business Credit Application regularly, especially if there are significant changes in your business's financial situation, ownership, or structure. Keeping the information current can improve your chances of obtaining credit and maintaining a good relationship with lenders and suppliers.

Where can I obtain a Business Credit Application form?

Business Credit Application forms can typically be obtained directly from lenders, suppliers, or financial institutions. Many organizations also provide downloadable versions of the form on their websites, making it easy to access and complete.