Valid Business Bill of Sale Document

Consider More Types of Business Bill of Sale Documents

Printable Simple Mobile Home Purchase Agreement - Completing the Mobile Home Bill of Sale ensures both parties have a clear understanding of the transaction.

To ensure a smooth transaction, it is essential to use a proper Texas Bill of Sale form, which can be found at OnlineLawDocs.com. This document not only safeguards the interests of both parties involved but also serves as an essential piece of evidence in case of disputes or legal matters arising from the sale.

Misconceptions

The Business Bill of Sale form is a crucial document in the process of transferring ownership of a business. However, several misconceptions often arise regarding its purpose and use. Below are six common misconceptions about the Business Bill of Sale form, along with clarifications.

- It is only necessary for large businesses. Many believe that only large businesses require a Bill of Sale. In reality, any business transaction involving the transfer of ownership, regardless of size, benefits from this document.

- It is not legally binding. Some people think that a Bill of Sale is merely a formality and lacks legal standing. In fact, when properly executed, it serves as a legally binding contract that protects both the buyer and seller.

- It is only for tangible assets. There is a misconception that the Bill of Sale is only applicable to physical items. However, it can also be used for intangible assets, such as business goodwill or intellectual property.

- All states have the same requirements. Many assume that the requirements for a Bill of Sale are uniform across the United States. In truth, each state may have different laws and requirements regarding the execution and notarization of this document.

- It replaces a purchase agreement. Some believe that a Bill of Sale can replace a comprehensive purchase agreement. While it serves as a record of the transaction, it does not encompass all the terms and conditions that a purchase agreement would include.

- It is not necessary if the payment is made in full. There is a notion that if the buyer pays the full amount upfront, a Bill of Sale is unnecessary. This is not true. A Bill of Sale provides proof of the transaction and protects both parties, regardless of payment terms.

Understanding these misconceptions can help individuals make informed decisions when engaging in business transactions. Proper documentation, including a Business Bill of Sale, is essential for ensuring clarity and protection in any sale.

Documents used along the form

A Business Bill of Sale is an important document that facilitates the transfer of ownership of a business from one party to another. However, it is often accompanied by other forms and documents to ensure a smooth transaction. Below is a list of commonly used documents that may accompany a Business Bill of Sale.

- Purchase Agreement: This document outlines the terms and conditions of the sale, including the purchase price, payment terms, and any contingencies. It serves as a formal contract between the buyer and seller.

- Asset List: An itemized list of the assets being sold, such as equipment, inventory, and intellectual property. This helps clarify what is included in the sale.

- Non-Disclosure Agreement (NDA): This agreement protects sensitive business information from being disclosed to third parties. It is often signed before negotiations begin.

- Transfer of Ownership Documents: These documents are necessary for transferring ownership of specific business assets, such as vehicles or real estate, ensuring proper legal title is conveyed.

- Tax Clearance Certificate: This certificate verifies that the seller has paid all applicable taxes related to the business. It assures the buyer that there are no outstanding tax liabilities.

- Financing Agreement: If the buyer is financing the purchase, this document outlines the terms of the loan, including interest rates and repayment schedules.

- Bill of Sale for Equipment: If the sale includes equipment, a separate bill of sale may be created specifically for those items, detailing their condition and value.

- Employee Contracts: If employees are part of the sale, their contracts should be reviewed and possibly transferred to the new owner, ensuring continuity of employment.

- General Bill of Sale Form: When transferring ownership of personal items, consult our comprehensive General Bill of Sale form guide to ensure the process is legally sound.

- Business License Transfer Application: This application is necessary to transfer the business license from the seller to the buyer, allowing the new owner to legally operate the business.

Having these documents prepared and organized can help ensure a successful transaction. Each document plays a vital role in protecting the interests of both the buyer and the seller, providing clarity and legal backing to the sale process.

Steps to Filling Out Business Bill of Sale

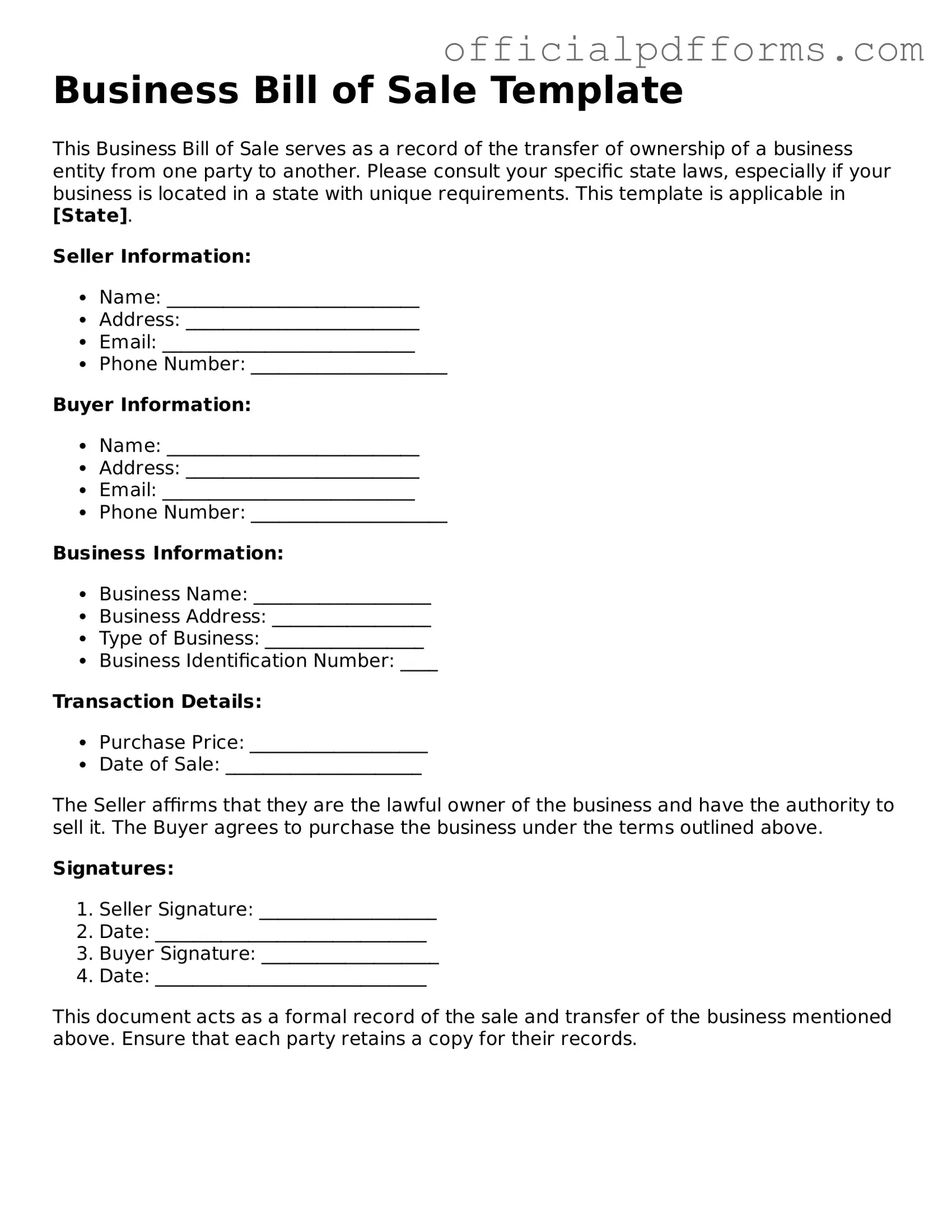

Completing the Business Bill of Sale form is an important step in the transfer of ownership for a business. This document serves as proof of the transaction between the seller and the buyer. Ensure that all details are accurate and clearly stated to avoid any potential disputes in the future.

- Obtain the form: Download the Business Bill of Sale form from a reliable source or obtain a physical copy.

- Fill in the date: Write the date of the transaction at the top of the form.

- Provide seller information: Enter the full name, address, and contact information of the seller.

- Provide buyer information: Enter the full name, address, and contact information of the buyer.

- Describe the business: Clearly describe the business being sold, including its name, location, and any relevant details.

- State the purchase price: Write the total purchase price agreed upon by both parties.

- List any included assets: Specify any assets included in the sale, such as equipment, inventory, or intellectual property.

- Signatures: Both the seller and the buyer must sign and date the form to validate the transaction.

- Make copies: After completing the form, make copies for both parties to retain for their records.

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. Missing details can lead to confusion or disputes later on.

-

Incorrect Business Name: It's crucial to ensure that the business name is spelled correctly and matches the legal documents. Errors here can complicate ownership verification.

-

Omitting the Sale Price: Not including the sale price can create ambiguity regarding the transaction. This detail is essential for both parties and for tax purposes.

-

Neglecting Signatures: Both the seller and the buyer must sign the document. A lack of signatures can render the bill of sale invalid.

-

Failure to Date the Document: A date is important for establishing when the sale occurred. Without a date, it can be challenging to prove when the transfer of ownership took place.

-

Not Including a Description of the Business: A clear description of the business being sold is vital. This should include assets, liabilities, and any other relevant information.

-

Ignoring Local Laws: Each state may have different requirements for a business bill of sale. Not adhering to local regulations can lead to legal issues down the line.

-

Using Incorrect Terminology: Misunderstanding terms related to the sale can lead to misinterpretations. It’s important to use clear and accurate language.

-

Not Keeping Copies: Failing to keep copies of the completed bill of sale can create problems if either party needs to reference the document in the future.

Get Clarifications on Business Bill of Sale

What is a Business Bill of Sale?

A Business Bill of Sale is a legal document used to transfer ownership of a business from one party to another. It outlines the terms of the sale, including the purchase price and any assets included in the transaction. This document serves as proof of the sale and can be important for both the buyer and the seller for legal and tax purposes.

What information is typically included in a Business Bill of Sale?

A Business Bill of Sale generally includes the following information:

- The names and addresses of the buyer and seller

- A detailed description of the business being sold

- The purchase price and payment terms

- A list of assets included in the sale, such as equipment, inventory, and intellectual property

- Any liabilities or debts being assumed by the buyer

- The date of the sale

Is a Business Bill of Sale required by law?

While a Business Bill of Sale is not always legally required, it is highly recommended. Having a written record of the transaction can help protect both parties in case of disputes or misunderstandings in the future. Some states may have specific requirements for business sales, so it’s advisable to check local regulations.

How does a Business Bill of Sale protect the buyer?

The Business Bill of Sale protects the buyer by providing clear documentation of the transaction. It ensures that the buyer receives the agreed-upon assets and that the seller has the legal right to sell the business. Additionally, it can help the buyer avoid potential liabilities associated with the business that were not disclosed during negotiations.

How does a Business Bill of Sale protect the seller?

For the seller, the Business Bill of Sale provides proof that the business has been sold and that ownership has been transferred. This document can help the seller avoid future claims related to the business, as it serves as evidence that the seller is no longer responsible for its operations or liabilities after the sale.

Can a Business Bill of Sale be modified after it is signed?

Once a Business Bill of Sale is signed, it becomes a binding agreement. However, if both parties agree to changes, they can create an amendment to the original document. It is important to ensure that any modifications are documented in writing and signed by both parties to maintain clarity and legality.

What should be done after the Business Bill of Sale is signed?

After signing the Business Bill of Sale, both parties should keep a copy for their records. The buyer may need to file the document with local authorities or notify relevant agencies, depending on the nature of the business. It is also advisable for the buyer to conduct any necessary due diligence to ensure a smooth transition of ownership.

Where can I obtain a Business Bill of Sale form?

A Business Bill of Sale form can be obtained from various sources, including legal document preparation services, online legal form providers, or local business associations. It is important to ensure that the form complies with state laws and is tailored to fit the specific details of the transaction.