Fill in a Valid Broker Price Opinion Form

Common PDF Forms

What Does It Mean to Be Exempt From Withholding - Punctuality tracks the employee's ability to arrive on time and meet deadlines.

When preparing to ship with FedEx, it's important to understand the significance of the form used for the process. The FedEx Bill of Lading form not only serves as a contract between the shipper and FedEx but also provides essential details regarding the shipment's journey and applicable charges. For those seeking more information or a fillable template for their shipping needs, the form is available online at smarttemplates.net/fillable-fedex-bill-of-lading/.

Aia A305 Form Pdf - The form allows for a clear presentation of a contractor’s capabilities.

Misconceptions

- Misconception 1: A Broker Price Opinion (BPO) is the same as an appraisal.

- Misconception 2: BPOs are only used for distressed properties.

- Misconception 3: A BPO guarantees a sale price.

- Misconception 4: The BPO process is quick and requires little effort.

- Misconception 5: BPOs can be completed without visiting the property.

- Misconception 6: All BPOs are the same.

- Misconception 7: BPOs are only useful for lenders and banks.

While both a BPO and an appraisal aim to determine property value, they differ significantly. An appraisal is a formal assessment conducted by a licensed appraiser, often required for mortgage lending. In contrast, a BPO is typically prepared by a real estate broker or agent and is less formal, often used for quick evaluations.

This is not entirely true. Although BPOs are commonly used for properties in foreclosure or short sales, they can also be utilized for various real estate transactions, including traditional sales. Their versatility makes them valuable in different market scenarios.

A BPO provides an estimated value based on current market conditions and comparable properties, but it does not guarantee that a property will sell for that price. Market dynamics can change, and buyer interest can fluctuate, affecting the final sale price.

While the BPO can be completed faster than a full appraisal, it still requires thorough research and analysis. Factors such as market conditions, property features, and comparable sales must be carefully considered to provide an accurate opinion.

Although some BPOs may be conducted using only online data, a physical inspection is often necessary. Observing the property’s condition and surroundings can provide crucial insights that data alone cannot capture.

BPOs can vary significantly depending on the broker or agent conducting them, the methodology used, and the specific requirements of the client. Each BPO may reflect different approaches to evaluating a property's value.

While lenders and banks often use BPOs for decision-making regarding loans, they are also valuable for homeowners, real estate agents, and investors. Understanding property value can assist in pricing strategies, investment decisions, and market analysis.

Documents used along the form

When preparing a Broker Price Opinion (BPO), several other forms and documents may be necessary to provide a comprehensive assessment. These documents help ensure that all relevant information is captured and analyzed effectively. Below are five commonly used forms alongside the BPO.

- Comparative Market Analysis (CMA): This document evaluates similar properties in the area to determine a fair market value. It includes details about recent sales, current listings, and property features, helping agents make informed pricing decisions.

- Property Condition Report: This report outlines the physical condition of the property, noting any repairs or maintenance issues. It is essential for understanding the potential costs involved in bringing the property to market standards.

- Trailer Bill of Sale: This essential document records the transfer of ownership of a trailer and is necessary for registration in New York. For more information, visit OnlineLawDocs.com.

- Listing Agreement: This contract establishes the relationship between the property owner and the broker. It outlines the terms of the listing, including commission rates and duration, and is critical for formalizing the sale process.

- Disclosure Statements: These documents inform potential buyers of any known issues with the property, such as structural problems or environmental hazards. Transparency is vital in real estate transactions to avoid legal disputes later.

- Appraisal Report: An appraisal provides an independent valuation of the property, conducted by a licensed appraiser. This document is often required by lenders and can help validate the BPO findings.

Utilizing these forms in conjunction with the Broker Price Opinion can enhance the accuracy of property evaluations and streamline the selling process. Each document serves a unique purpose, contributing to a well-rounded understanding of the property's marketability and value.

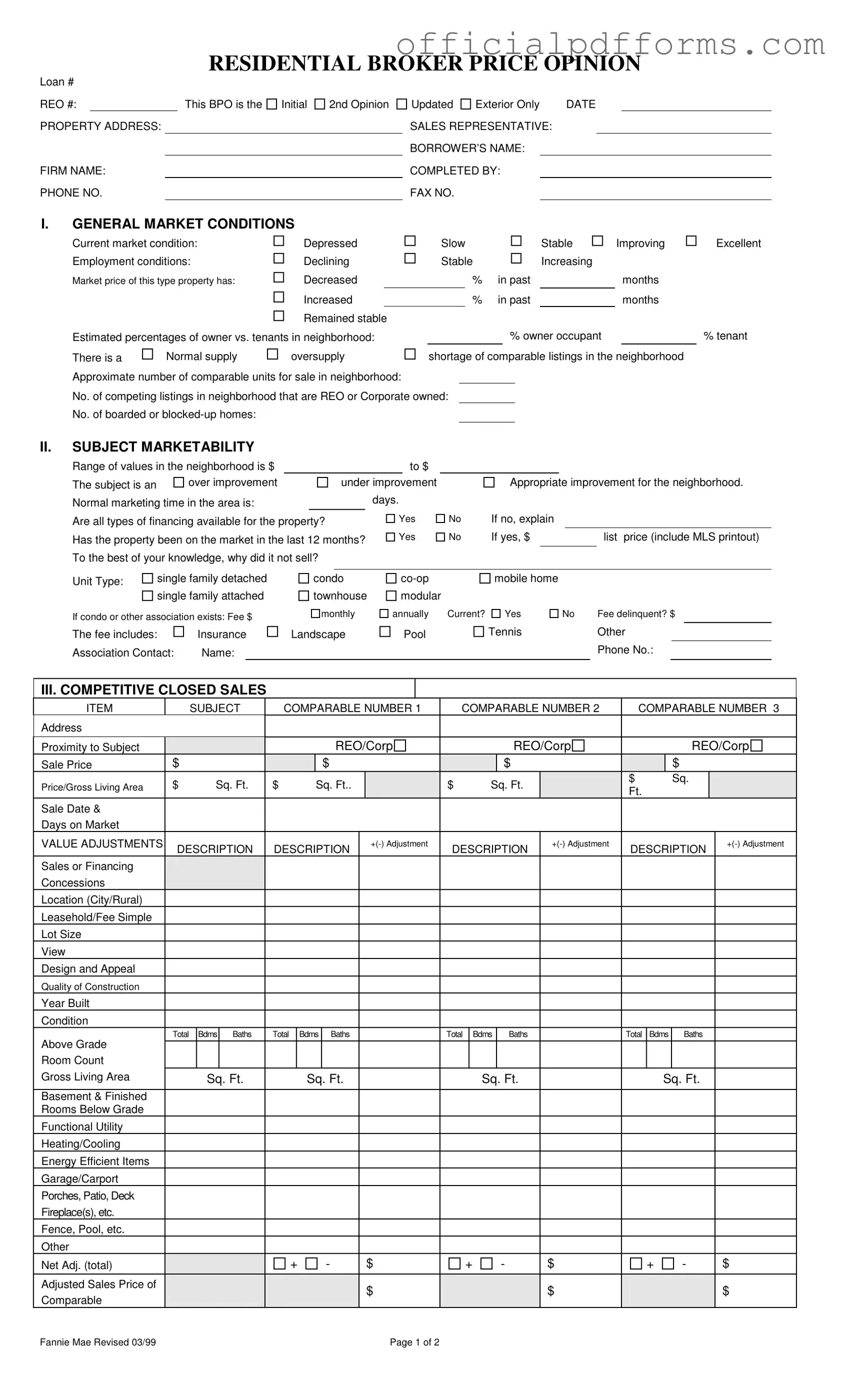

Steps to Filling Out Broker Price Opinion

Completing the Broker Price Opinion (BPO) form requires careful attention to detail. Each section of the form gathers important information about the property and its market conditions. By following these steps, you can ensure that all necessary information is accurately recorded.

- Begin by entering the Loan # and REO # at the top of the form.

- Fill in the PROPERTY ADDRESS, FIRM NAME, PHONE NO., and the SALES REPRESENTATIVE name.

- Indicate whether this is an Initial, 2nd Opinion, or Updated BPO, and if it is for Exterior Only.

- Provide the DATE and the BORROWER’S NAME.

- In the GENERAL MARKET CONDITIONS section, assess the current market condition by selecting from Depressed, Slow, Stable, or Improving.

- Evaluate the employment conditions as Declining, Stable, or Increasing.

- Indicate the market price trend for the property type: Decreased, Increased, or Remained stable.

- Estimate the percentage of owner-occupants in the neighborhood and enter it in the provided space.

- Assess the supply of comparable listings in the neighborhood and select from Normal, Oversupply, or Shortage.

- Enter the approximate number of comparable units for sale and the number of REO or corporate-owned listings.

- Note the number of boarded or blocked-up homes.

- In the SUBJECT MARKETABILITY section, provide the range of values in the neighborhood.

- Evaluate if the subject property is an over improvement, under improvement, or has appropriate improvement for the neighborhood.

- Indicate the normal marketing time in days.

- Confirm whether all types of financing are available for the property.

- If the property has been on the market in the last 12 months, provide the list price and reasons for it not selling.

- Specify the unit type: single family detached, condo, co-op, mobile home, single family attached, townhouse, or modular.

- If applicable, fill in the association fee details and contact information.

- In the COMPETITIVE CLOSED SALES section, list comparable properties with their addresses, proximity to the subject, sale prices, and other relevant details.

- Make necessary value adjustments for each comparable property.

- Complete the MARKETING STRATEGY section, indicating whether the property is As-is or requires Minimal Lender Required Repairs.

- Provide the occupancy status and most likely buyer type.

- Itemize all repairs needed to bring the property to average marketable condition and total the costs.

- In the COMPETITIVE LISTINGS section, provide details for comparable listings, including address, list price, and adjustments.

- Finally, determine the market value and suggested list price, both AS IS and REPAIRED.

- Include any additional comments about the property, such as positives, negatives, or concerns.

- Sign and date the form at the bottom.

Common mistakes

-

Inaccurate Market Condition Assessment: Many individuals fail to accurately assess the current market conditions. This includes not recognizing whether the market is depressed, stable, or improving. Misjudging these conditions can lead to incorrect pricing.

-

Neglecting to Update Information: Some people forget to update key details about the property. For instance, if the property has been on the market previously, the list price and reasons for its unsold status should be current. Outdated information can mislead potential buyers.

-

Ignoring Comparable Sales: A common mistake is not thoroughly researching comparable sales in the area. Without accurate comparisons, the suggested price may be too high or too low. This can negatively impact the marketing strategy.

-

Overlooking Repair Needs: Failing to itemize all necessary repairs can result in an inaccurate assessment of the property’s value. It’s essential to clearly list repairs needed to bring the property to a marketable condition. This helps in setting realistic expectations for potential buyers.

Get Clarifications on Broker Price Opinion

What is a Broker Price Opinion (BPO)?

A Broker Price Opinion is an estimate of the value of a property, typically prepared by a licensed real estate broker. This document is often used by lenders, investors, or financial institutions to determine the market value of a property for various purposes, such as foreclosure or short sales. The BPO provides a detailed analysis of the property, including its condition, market conditions, and comparable sales in the area.

What information is included in a BPO form?

The BPO form contains several key sections that provide a comprehensive overview of the property. These include:

- General Market Conditions: An assessment of the current market environment, including employment conditions and supply of comparable listings.

- Subject Marketability: An evaluation of the property's marketability, including its condition and any necessary repairs.

- Competitive Closed Sales: A comparison of the subject property with similar properties that have recently sold.

- Marketing Strategy: Recommendations for selling the property, including any repairs needed to enhance marketability.

- Market Value: A suggested list price based on the analysis of comparable sales.

How is the market value determined in a BPO?

The market value in a BPO is determined by analyzing recent sales of comparable properties in the area. The broker considers various factors, such as:

- Location and proximity to the subject property

- Sale prices of comparable properties

- Condition and features of the properties

- Current market trends and economic conditions

After a thorough comparison, adjustments may be made to account for differences in features, location, and condition, leading to an adjusted sales price that reflects the property's market value.

Who typically requests a Broker Price Opinion?

Broker Price Opinions are commonly requested by lenders, banks, or investors who need a reliable estimate of a property's value. This request may arise in various situations, such as:

- Foreclosure proceedings

- Short sales

- Property assessments for investment purposes

By obtaining a BPO, these parties can make informed decisions regarding the property in question.

How long does it take to complete a BPO?

The time required to complete a Broker Price Opinion can vary depending on several factors, including the complexity of the property and the broker's workload. Generally, a BPO can take anywhere from a few hours to a couple of days. Once the broker has gathered all necessary data and completed the analysis, the BPO will be submitted to the requesting party promptly.