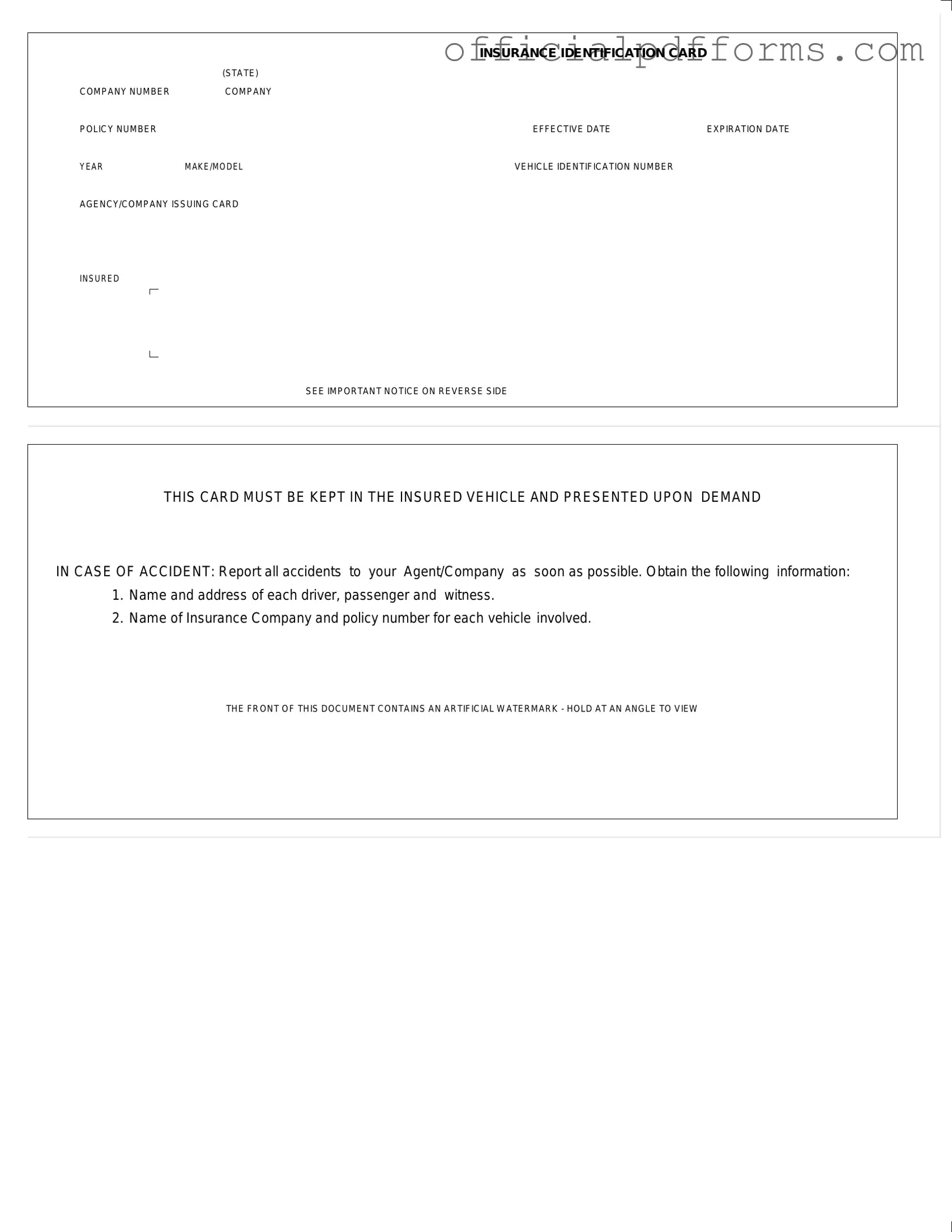

Fill in a Valid Auto Insurance Card Form

Common PDF Forms

Western Union Receipt - Available worldwide for your financial needs.

For those interested in acquiring a trailer, understanding the necessary documentation is crucial. Utilizing a reliable Texas Trailer Bill of Sale template can streamline the process and ensure all pertinent information is covered for a smooth transfer. This form legitimizes the sale, offering both the buyer and seller peace of mind during the transaction.

How to Estimate Roof Replacement Cost - What resources can we provide to assist with your decision?

Misconceptions

Understanding your auto insurance card is essential, but several misconceptions can lead to confusion. Here are four common myths:

- Misconception 1: The insurance card is only necessary during an accident.

- Misconception 2: The expiration date is not important.

- Misconception 3: The card is only for the vehicle owner.

- Misconception 4: The watermarked card is not legitimate.

Many people believe that they only need to show their insurance card if they're involved in an accident. In reality, you must present it upon demand, which can happen during traffic stops or at other times.

Some think that as long as they have an insurance card, it doesn’t matter if it’s expired. However, an expired card may not provide valid proof of insurance, which can lead to penalties.

People often assume that only the vehicle owner needs to carry the card. However, any authorized driver should have access to it in case they need to show proof of insurance.

Some individuals mistakenly believe that a card with an artificial watermark is a sign of fraud. In fact, this watermark is a security feature designed to protect against counterfeiting.

Documents used along the form

When navigating the world of auto insurance, several forms and documents complement the Auto Insurance Card. Each serves a specific purpose and can be vital in ensuring that you are adequately protected and informed. Below is a list of commonly used documents alongside the Auto Insurance Card.

- Insurance Policy Document: This comprehensive document outlines the terms and conditions of your insurance coverage. It details what is included in your policy, such as liability limits, coverage for damages, and any exclusions that may apply.

- Claims Form: In the event of an accident or damage, this form is necessary to report the incident to your insurance provider. It typically requires details about the accident, including the date, time, location, and parties involved.

- Proof of Financial Responsibility: This document serves as evidence that you can cover costs related to accidents or damages. It may be required by law in certain states and can be presented in various forms, such as a bond or a certificate of insurance.

- Vehicle Registration: This form confirms that your vehicle is registered with the state. It includes important information such as the vehicle identification number (VIN), the owner's name, and the registration expiration date.

- Texas Motorcycle Bill of Sale form: This legal document records the transaction between a seller and a buyer, specifically for the transfer of ownership of a motorcycle in Texas. For more information, visit OnlineLawDocs.com.

- Accident Report: After an accident, this report is often filed with local law enforcement. It provides an official account of the incident and can be crucial for insurance claims and legal proceedings.

- Driver's License: A valid driver's license is essential for operating a vehicle legally. It is often required when presenting your insurance card or when filing a claim.

Understanding these documents can help you manage your auto insurance effectively. Keeping them organized and accessible will ensure you are prepared in case of an incident. Always review your coverage and stay informed about your rights and responsibilities as a policyholder.

Steps to Filling Out Auto Insurance Card

Filling out the Auto Insurance Card form is a straightforward process. It’s important to ensure that all information is accurate and complete. This card serves as proof of insurance and must be kept in your vehicle.

- Locate the INSURANCE IDENTIFICATION CARD (STATE) section at the top of the form.

- Fill in the COMPANY NUMBER provided by your insurance company.

- Enter your COMPANY POLICY NUMBER in the designated space.

- Input the EFFECTIVE DATE of your insurance policy.

- Provide the EXPIRATION DATE of your insurance policy.

- List the YEAR, MAKE/MODEL of your vehicle.

- Fill in the VEHICLE IDENTIFICATION NUMBER (VIN).

- Indicate the AGENCY/COMPANY ISSUING CARD.

- Review the form for accuracy and completeness before finalizing.

Once you have completed the form, keep it in your vehicle. It’s essential to present it upon demand in case of an accident. Remember to report any accidents to your insurance agent as soon as possible, gathering necessary information about all parties involved.

Common mistakes

-

Leaving out crucial details: It’s essential to fill in every section of the form. Missing information like the effective date or policy number can lead to complications down the road.

-

Using incorrect vehicle information: Make sure to accurately enter the make/model and vehicle identification number (VIN). Errors here can cause issues with coverage and claims.

-

Failing to update the form: If you change vehicles or switch insurance companies, it’s crucial to update your auto insurance card. An outdated card can lead to penalties or coverage gaps.

-

Not keeping the card in the vehicle: Remember, this card must be kept in your car. If you’re pulled over or involved in an accident, having it handy is not just a good idea; it’s the law.

-

Ignoring the important notice: The back of the card contains vital information regarding what to do in case of an accident. Ignoring this could hinder your ability to file a claim effectively.

-

Not double-checking for accuracy: Before submitting, take a moment to review your entries. A quick check can save you from potential headaches later.

-

Forgetting to present the card: In the event of an accident, it’s important to present your insurance card when asked. Not doing so can complicate the situation and may lead to fines.

Get Clarifications on Auto Insurance Card

What is an Auto Insurance Card and why is it important?

An Auto Insurance Card is a document that serves as proof of insurance coverage for your vehicle. It contains essential information such as your insurance company’s name, your policy number, and the effective and expiration dates of your coverage. Keeping this card in your vehicle is crucial because it must be presented upon request, especially during traffic stops or in the event of an accident. Having it readily available can help you avoid penalties and ensure that you comply with state laws regarding vehicle insurance.

What information is included on the Auto Insurance Card?

Your Auto Insurance Card typically includes several key pieces of information:

- Insurance Company Name: The name of the company that provides your auto insurance.

- Policy Number: A unique identifier for your insurance policy.

- Effective and Expiration Dates: These dates indicate when your coverage begins and ends.

- Vehicle Information: Details such as the year, make, model, and Vehicle Identification Number (VIN) of the insured vehicle.

- Agency/Company Issuing Card: The agency or company responsible for issuing the insurance card.

This information is vital for both you and law enforcement in case of an incident.

What should I do if I lose my Auto Insurance Card?

If you lose your Auto Insurance Card, it’s important to act quickly. First, contact your insurance provider to request a replacement card. Most companies can send you a new card via email or regular mail. In some cases, you may also be able to access a digital version of your card through the insurance company’s website or mobile app. Remember, driving without proof of insurance can lead to fines or legal issues, so ensure you have a replacement as soon as possible.

What should I do in case of an accident?

- Ensure everyone is safe and call for medical assistance if needed.

- Exchange information with other drivers involved, including names, addresses, and insurance details.

- Collect contact information for any witnesses.

- Document the scene by taking photos and noting any important details.

- Report the accident to your insurance agent or company as soon as possible.

Being prepared and knowing what to do can help you navigate the situation more smoothly.