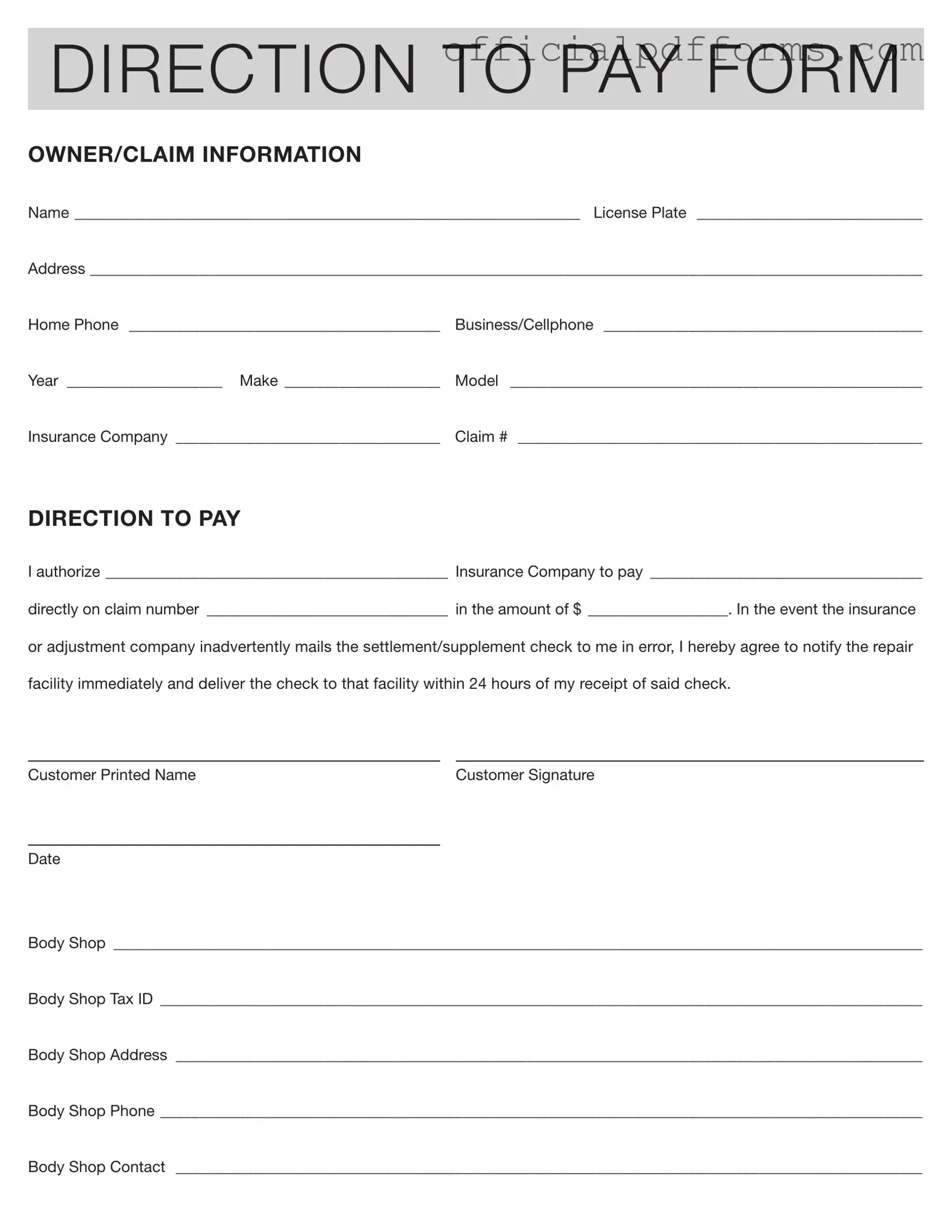

Fill in a Valid Authorization And Direction Pay Form

Common PDF Forms

Return to Work Doctors Note Pdf - The work release form encourages individuals to contribute positively to society through work.

Blank Ncoer Support Form - Timeliness in completing the form is crucial for effective personnel management.

To better understand the requirements and importance of the New York Operating Agreement form, it's advisable to consult resources like OnlineLawDocs.com, which offer comprehensive guidance on creating this essential document for your LLC.

What Countries Require International Driving Permit - Applicants need to provide their contact information for communication purposes.

Misconceptions

Misconceptions about the Authorization and Direction Pay form can lead to confusion and delays in processing claims. Here are nine common misunderstandings:

- It is only for auto insurance claims. Many believe this form is exclusive to auto insurance. In reality, it can be used for various types of insurance claims, including property and liability.

- Only the policyholder can fill it out. While the policyholder typically completes the form, authorized representatives, such as repair shops, can also submit it with proper consent.

- It guarantees payment from the insurance company. Submitting this form does not guarantee payment. It simply directs the insurance company to pay the specified repair facility.

- It must be notarized. There is no requirement for notarization. A signature from the policyholder is sufficient for the form to be valid.

- It can be used after repairs are completed. This form should be submitted before repairs begin. Using it after may complicate payment arrangements.

- All insurance companies accept this form. While many do, some insurance companies have their own specific forms or procedures. Always check with the insurer.

- It is the same as a direct payment authorization. Although similar, this form specifically directs payment to a repair facility, while direct payment authorizations may apply to various services.

- It is a one-time use form. This form can be used multiple times for different claims or repairs, as long as it is filled out correctly each time.

- Filling it out is unnecessary if the repair shop is approved by the insurer. Even if the repair shop is approved, the form is still essential to ensure the payment process is streamlined and authorized.

Documents used along the form

The Authorization and Direction to Pay form is an essential document in the claims process, particularly in the context of insurance settlements. However, it is often accompanied by several other forms and documents that help facilitate the transaction and ensure all parties are on the same page. Below is a list of commonly used documents that may accompany the Authorization and Direction to Pay form.

- Claim Form: This is the initial document submitted to the insurance company to report a loss or damage. It provides essential details about the incident, including the date, location, and nature of the claim.

- Repair Estimate: This document outlines the anticipated costs for repairs to the damaged vehicle. It is typically prepared by a certified repair facility and serves as a basis for the settlement amount.

- Proof of Ownership: This document, often a title or registration, verifies that the claimant is the rightful owner of the vehicle involved in the claim. It is crucial for preventing fraudulent claims.

- Recommendation Letter: A toptemplates.info provides templates and tips for crafting a compelling recommendation letter that highlights an individual's skills and achievements.

- Insurance Policy Declaration Page: This page summarizes the coverage details of the insurance policy in effect at the time of the incident. It provides important information about the limits and types of coverage available to the claimant.

- Release of Liability: This document is signed by the claimant to release the insurance company from any further obligations once the settlement has been paid. It ensures that the claimant cannot pursue additional claims related to the same incident.

- Medical Release Form: If injuries are involved, this form allows the insurance company to access medical records related to the claim. It is essential for verifying the extent of injuries and associated costs.

- Subrogation Agreement: This agreement allows the insurance company to recover costs from a third party responsible for the loss. It outlines the rights of the insurer to pursue reimbursement after paying the claim.

Understanding these accompanying documents can streamline the claims process and help ensure that all parties fulfill their obligations. When properly managed, the documentation leads to a smoother resolution of claims, benefiting both claimants and insurers alike.

Steps to Filling Out Authorization And Direction Pay

After completing the Authorization And Direction Pay form, it will be submitted to the insurance company for processing. Make sure all information is accurate to avoid delays. Follow the steps below to fill out the form correctly.

- Start by filling in your Name at the top of the form.

- Next, write down your License Plate number.

- Provide your Address, ensuring it is complete and accurate.

- Enter your Home Phone number.

- If applicable, include your Business/Cellphone number.

- Fill in the Year, Make, and Model of your vehicle.

- List your Insurance Company name.

- Write your Claim # in the designated space.

- In the DIRECTION TO PAY section, authorize your insurance company by filling in their name.

- Specify the amount of payment by writing it in the space provided.

- If the insurance company sends a check to you by mistake, agree to notify the repair facility immediately and deliver the check within 24 hours.

- Print your Customer Printed Name and sign the form.

- Include the Date of signing.

- Fill in the Body Shop name and address details.

- Provide the Body Shop Tax ID and Phone number.

- Lastly, enter the name of the Body Shop Contact.

Common mistakes

-

Incomplete Information: Failing to fill in all required fields, such as name, address, or claim number, can delay processing. Each section needs to be completed accurately.

-

Incorrect Insurance Company Name: Writing the wrong insurance company name can lead to payment issues. Ensure the name matches the one on your policy documents.

-

Missing Signature: Not signing the form can render it invalid. Always double-check that you have signed and dated the document before submission.

-

Improper Amount Specification: Entering an incorrect payment amount can cause confusion. Clearly state the total amount to be paid to the body shop.

-

Neglecting Body Shop Information: Omitting details about the body shop, such as its tax ID or contact information, may complicate the payment process. Include all necessary details.

-

Ignoring Notification Agreement: Failing to acknowledge the responsibility to notify the repair facility if a check is received can lead to misunderstandings. Be aware of this obligation.

-

Providing Outdated Information: Using old addresses or phone numbers can create delays. Always verify that your information is current and accurate.

-

Not Keeping Copies: Forgetting to make a copy of the completed form for your records can lead to difficulties later. Always retain a copy for your personal documentation.

Get Clarifications on Authorization And Direction Pay

What is the purpose of the Authorization And Direction Pay form?

The Authorization And Direction Pay form is used to direct an insurance company to pay a specific amount directly to a repair facility for services rendered. This form ensures that the repair shop receives payment promptly, facilitating quicker repairs for the vehicle owner.

Who needs to fill out this form?

This form should be completed by the vehicle owner who has filed a claim with their insurance company. It is essential for anyone who wants to ensure that their repair facility receives payment directly from the insurer. The form requires information about the vehicle, the insurance company, and the repair shop.

What information is required on the form?

The form requires several key pieces of information, including:

- The owner's name and contact details.

- The vehicle's license plate number, year, make, and model.

- The insurance company’s name and claim number.

- The amount to be paid to the repair facility.

- The repair shop’s name, address, tax ID, and contact information.

Providing accurate information is crucial to avoid delays in processing the payment.

What should I do if I receive a check from the insurance company?

If the insurance company mistakenly sends the settlement check to you instead of the repair facility, you must notify the repair shop immediately. You are required to deliver the check to the shop within 24 hours of receiving it. This helps ensure that repairs can proceed without unnecessary delays.

Is my signature required on the form?

Yes, your signature is necessary on the Authorization And Direction Pay form. By signing, you confirm your authorization for the insurance company to pay the specified amount directly to the repair facility. This signature also signifies your agreement to notify the repair shop if you receive the check in error.

Can I change the repair facility after submitting the form?

Changing the repair facility after submitting the form may complicate matters. If you wish to switch repair shops, you should contact your insurance company to discuss the implications. It may be necessary to complete a new Authorization And Direction Pay form with the updated repair shop's information.