Valid Articles of Incorporation Document

Articles of Incorporation Forms for Individual US States

Fill out Popular Documents

How to Fill Out Straight Bill of Lading - Its design encourages transparency in the shipping process, benefiting all parties involved.

Eagle Scout Recommendation Letter Sample - Highlighting both personal and group accomplishments, this recommendation paints a holistic picture of the candidate’s achievements.

An Employment Verification form serves as a critical document that confirms a person's employment status, position, and income. It is often used by lenders, landlords, or future employers to assess an individual's financial reliability and job stability. This simple yet significant piece of paper bridges the gap between trust and confirmation in various professional and personal dealings. For more details, you can visit https://smarttemplates.net/fillable-employment-verification/.

How Can I Get a Free Birth Certificate - The document can serve as a backup when official birth certificates are lost or damaged.

Misconceptions

When it comes to the Articles of Incorporation form, many people hold misconceptions that can lead to confusion. Understanding these common misunderstandings can help clarify the process of incorporating a business.

- Misconception 1: The Articles of Incorporation are only necessary for large corporations.

- Misconception 2: Filing the Articles of Incorporation guarantees business success.

- Misconception 3: The Articles of Incorporation are the same as the bylaws.

- Misconception 4: Once filed, the Articles of Incorporation cannot be changed.

- Misconception 5: You can file Articles of Incorporation at any time without restrictions.

This is not true. Any business that wants to operate as a corporation, regardless of size, must file Articles of Incorporation. This includes small businesses and startups.

While filing the Articles is a crucial step in establishing a corporation, it does not ensure that the business will succeed. Success depends on various factors, including market conditions, management, and business strategy.

These are distinct documents. The Articles of Incorporation establish the existence of the corporation and outline basic details, while the bylaws govern the internal operations and management of the corporation.

This is incorrect. Amendments can be made to the Articles of Incorporation after they are filed, but the process for making changes typically requires additional paperwork and possibly a vote from the board of directors.

While you can file at various times, there may be specific requirements and deadlines depending on your state. It’s important to check local regulations to ensure compliance.

Documents used along the form

When forming a corporation, the Articles of Incorporation is a crucial document that outlines the basic structure and purpose of the company. However, several other forms and documents are often needed to ensure compliance with state laws and to facilitate smooth operations. Here’s a brief overview of five important documents that may accompany the Articles of Incorporation.

- Bylaws: These are the internal rules that govern the management of the corporation. Bylaws outline how decisions are made, the roles of officers, and procedures for meetings. They provide a framework for how the corporation operates on a day-to-day basis.

- Initial Board of Directors Resolution: This document formally appoints the initial board of directors. It typically includes the names of the directors and their responsibilities. This resolution is essential for establishing leadership and governance from the outset.

- Employer Identification Number (EIN) Application: An EIN is required for tax purposes and is used to identify the corporation in financial matters. This application can be submitted to the IRS and is necessary for opening a bank account and hiring employees.

- State Business License: Depending on the state and the nature of the business, a specific license may be required to legally operate. This document ensures that the corporation complies with local regulations and can vary widely based on industry and location.

- New York Motorcycle Bill of Sale: This document is essential when selling a motorcycle in New York, as it provides a formal record of the transaction and is crucial for the buyer's registration process. For more information, visit OnlineLawDocs.com.

- Shareholder Agreement: If there are multiple shareholders, this agreement outlines the rights and responsibilities of each shareholder. It can cover aspects such as share transfers, voting rights, and what happens if a shareholder wants to exit the business.

These documents, along with the Articles of Incorporation, play a vital role in establishing a corporation. They help clarify the governance structure, ensure compliance with regulations, and protect the interests of the owners and shareholders. Taking the time to prepare these documents carefully can set a strong foundation for future success.

Steps to Filling Out Articles of Incorporation

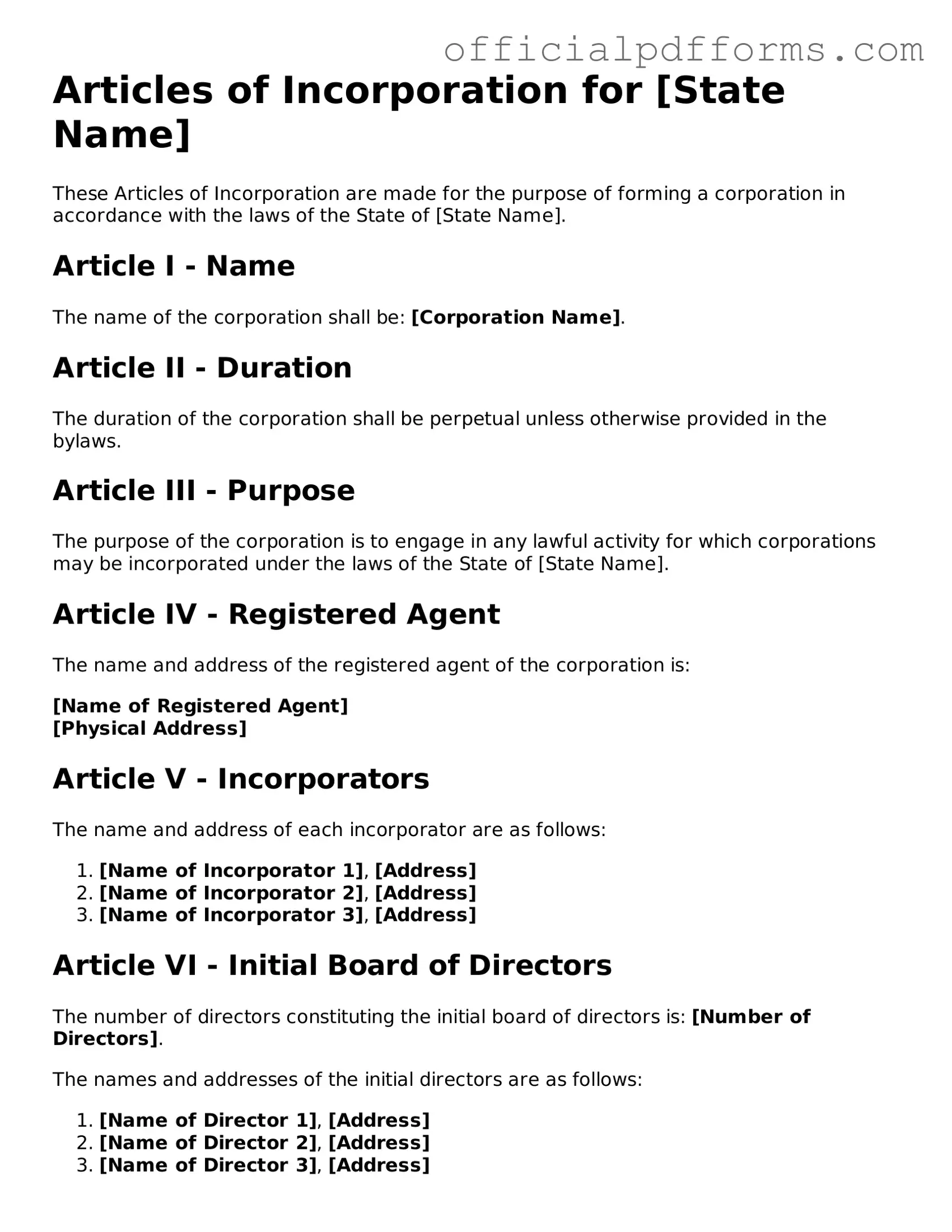

Once you have the Articles of Incorporation form ready, you will need to fill it out accurately. This process is essential for establishing your business as a legal entity. Follow these steps to ensure that you complete the form correctly.

- Obtain the Form: Download the Articles of Incorporation form from your state’s Secretary of State website or request a physical copy.

- Business Name: Enter the name of your corporation. Ensure it complies with state naming rules and is unique.

- Principal Office Address: Provide the complete address of your corporation’s main office.

- Registered Agent: Name a registered agent who will receive legal documents on behalf of the corporation. Include their address.

- Incorporator Information: List the names and addresses of the incorporators. These are the individuals who are forming the corporation.

- Purpose of the Corporation: Briefly describe the purpose of your corporation. Be clear and concise.

- Stock Information: If applicable, specify the number of shares your corporation is authorized to issue and their par value.

- Duration: Indicate whether the corporation is set up for a specific duration or perpetual existence.

- Sign and Date: The incorporators must sign and date the form. Ensure all signatures are legible.

- Review: Double-check all entries for accuracy and completeness before submission.

After completing the form, you will need to submit it to the appropriate state office along with any required fees. Keep a copy for your records.

Common mistakes

-

Not providing a clear business name. The name must be unique and not already in use by another business in the state.

-

Failing to include the correct address. A physical address is required, and a P.O. Box is not acceptable.

-

Omitting the purpose of the business. Clearly stating the purpose helps define the scope of the corporation's activities.

-

Not listing the registered agent. A registered agent is necessary for receiving legal documents on behalf of the corporation.

-

Incorrectly identifying the incorporators. All incorporators must be listed, and their information must be accurate.

-

Neglecting to include the number of shares. Specify how many shares the corporation is authorized to issue.

-

Forgetting to sign the document. All required parties must sign the Articles of Incorporation before submission.

-

Not checking state-specific requirements. Each state may have additional requirements that must be met.

-

Submitting the form without reviewing it. Mistakes can be costly, so it’s important to double-check all information.

Get Clarifications on Articles of Incorporation

What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation. They outline the basic information about the business, such as its name, purpose, and structure. Filing these documents is a crucial step in forming a corporation.

Why do I need to file Articles of Incorporation?

Filing Articles of Incorporation is necessary to create a legal entity. This protects the owners from personal liability for the corporation's debts and obligations. It also allows the corporation to conduct business legally in its state.

What information is typically required in the Articles of Incorporation?

The information usually includes:

- The name of the corporation

- The purpose of the corporation

- The registered agent's name and address

- The number of shares the corporation is authorized to issue

- The names and addresses of the incorporators

Where do I file the Articles of Incorporation?

Articles of Incorporation must be filed with the Secretary of State or a similar agency in the state where you plan to incorporate. Each state has its own filing process and requirements, so it’s important to check your state’s specific guidelines.

How much does it cost to file Articles of Incorporation?

The filing fee varies by state. Generally, it can range from $50 to several hundred dollars. Additional fees may apply for expedited processing or other services. Always check your state’s official website for the most accurate information.

How long does it take for the Articles of Incorporation to be processed?

Processing times can differ based on the state and whether you choose expedited service. Typically, it can take anywhere from a few days to several weeks. It's advisable to file early to avoid delays in starting your business.

Can I amend my Articles of Incorporation after filing?

Yes, you can amend your Articles of Incorporation. If there are changes to the corporation's name, purpose, or structure, you will need to file an amendment with the state. This usually involves a separate form and possibly a fee.

Do I need a lawyer to file Articles of Incorporation?

While it’s not legally required to have a lawyer, consulting one can be beneficial. A lawyer can help ensure that the Articles are completed correctly and comply with state laws, which can prevent issues down the line.

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are filed and approved, your corporation is officially formed. You will receive a certificate of incorporation, which serves as proof of your corporation's existence. You can then proceed with other steps, such as obtaining an EIN and setting up corporate bylaws.

What are the ongoing requirements after incorporation?

After incorporation, you must comply with ongoing requirements, which may include:

- Filing annual reports

- Paying franchise taxes

- Holding regular board meetings

- Maintaining proper records

Failure to meet these requirements can lead to penalties or even dissolution of the corporation.