Fill in a Valid Alabama Mvt 20 1 Form

Common PDF Forms

Odometer Disclosure Texas - The information on the form is vital for future buyers to assess the vehicle's condition.

To further understand the importance of the FedEx Release Authorization form, it's essential to recognize how it caters to the needs of recipients who may not be home to receive their deliveries. By designating a safe location for package drop-off, the form enhances the overall delivery experience while adhering to necessary security protocols, such as requiring a valid signature. For additional resources and insights on this process, you can visit toptemplates.info/.

State Disability Insurance - Filling out the EDD DE 2501 is a key step in accessing much-needed financial support.

Misconceptions

Here are eight common misconceptions about the Alabama Mvt 20 1 form, along with clarifications to help you understand its purpose and requirements.

- This form can be used for transferring vehicle ownership. The Mvt 20 1 form is strictly for recording or transferring a lien on a vehicle, not for ownership transfers.

- Any type of vehicle can be processed using this form. This form is only applicable to vehicles with an outstanding Alabama title. Certain vehicles, like those over 35 years old, may be exempt from titling altogether.

- You can submit a personal check for the application fee. The form requires a $15.00 fee in certified funds only. Personal checks and cash are not accepted.

- Illegible forms will still be processed. Forms must be typed or printed clearly. Illegible submissions will be returned, causing delays.

- It is acceptable to modify owner information on the form. Changes to owner information are not allowed, except for address updates. All other details must match the surrendered Alabama title.

- Anyone can submit this form on behalf of the lienholder. Only designated agents can use a different form (MVT 5-1E) for recording liens. This form is specifically for lienholders.

- Supporting documents are optional. The application must be accompanied by the current Alabama title for the vehicle. Without it, the application cannot be processed.

- All lienholders need to sign the form. Only the primary lienholder must sign. If there is a second lienholder, their information is required, but they do not need to sign unless specified.

Documents used along the form

The Alabama MVT 20 1 form is primarily used to apply for a certificate of title to record or transfer a lien on a vehicle. When dealing with vehicle titles and liens, several other forms and documents may be necessary to ensure compliance with state regulations. Below is a list of commonly associated documents.

- MVT 5-1E: This form is used by designated agents to record liens. Unlike the MVT 20 1, it is specifically designed for agents acting on behalf of the vehicle owner.

- California Motor Vehicle Bill of Sale: This important document details the transaction between a buyer and seller during a vehicle sale in California, ensuring essential information is captured and both parties are protected. For more information, view the document.

- Current Alabama Title: This document must accompany the MVT 20 1 form. It serves as proof of ownership and is required for the processing of any lien applications.

- Bill of Sale: A bill of sale provides evidence of the transaction between the buyer and seller. It is often necessary to establish the transfer of ownership prior to recording a lien.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters. If a lienholder is filing on behalf of the owner, this form may be required.

- Verification of Lien: This document verifies the existence of a lien against the vehicle. It may be needed to confirm that the lien is valid before recording it with the state.

- Application for Duplicate Title: If the original title is lost or damaged, this form is needed to apply for a duplicate. It is crucial for ensuring that the title records remain accurate and up-to-date.

Understanding the forms and documents required in conjunction with the Alabama MVT 20 1 form is essential for a smooth process in recording or transferring a lien. Ensuring all necessary paperwork is completed accurately and submitted promptly can help avoid delays and complications.

Steps to Filling Out Alabama Mvt 20 1

Once the Alabama MVT 20 1 form is completed, it must be submitted along with the required documents and fee to the Alabama Department of Revenue. Ensure that all information is accurate and legible to avoid delays in processing.

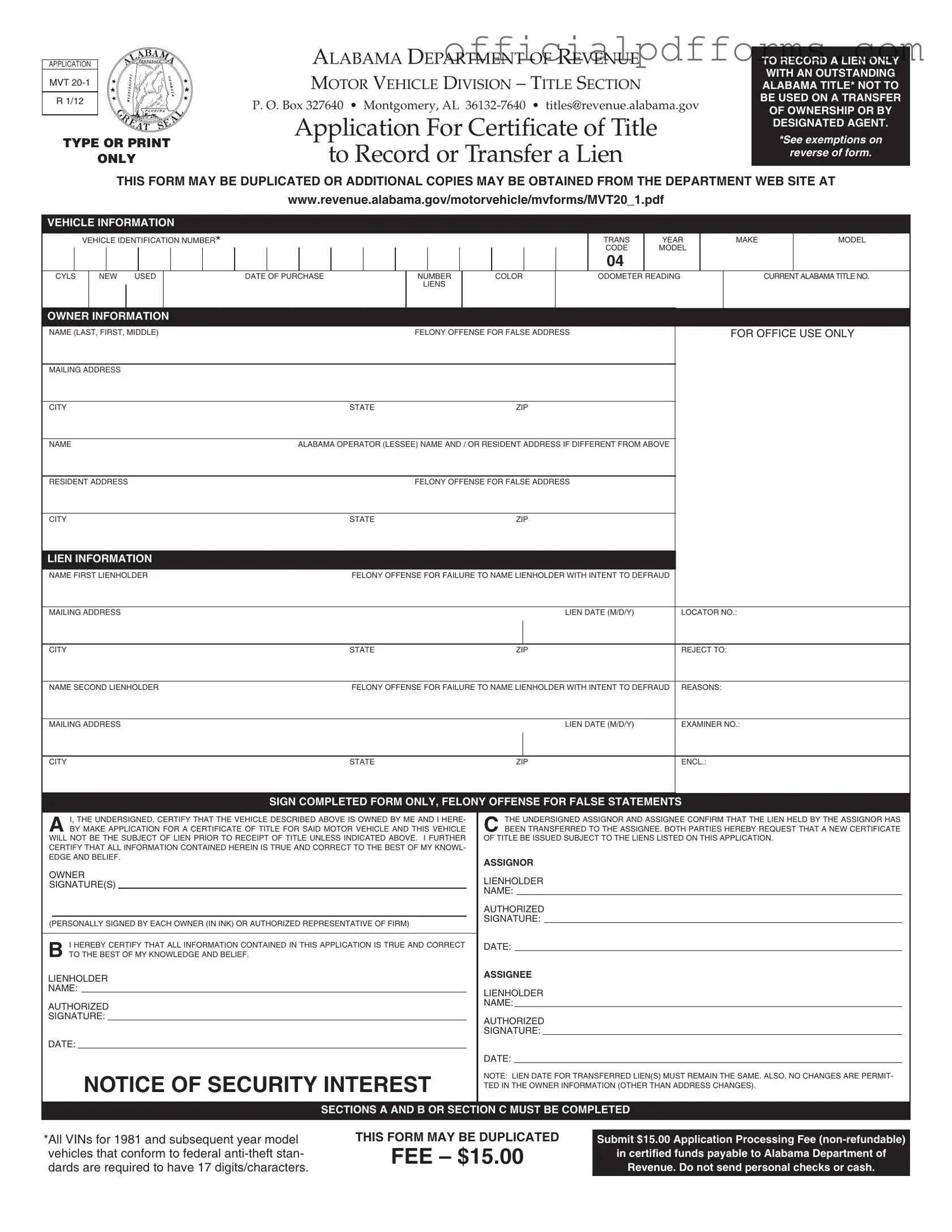

- Obtain the form: Download the Alabama MVT 20 1 form from the Alabama Department of Revenue website or make a copy of the form.

- Fill out vehicle information: Enter the Vehicle Identification Number (VIN), year, make, model, color, and odometer reading. Indicate whether the vehicle is new or used.

- Provide current title number: Enter the current Alabama title number for the vehicle.

- Complete owner information: Fill in the owner's name, mailing address, city, state, and ZIP code. If the owner is different from the lessee, provide that information as well.

- List lien information: Enter the name and mailing address of the first lienholder, along with the lien date. If there is a second lienholder, provide their information as well.

- Sign the form: The owner and lienholder must sign the form. Ensure that all signatures are in ink and dated.

- Prepare supporting documents: Attach the current Alabama title and any other required documents to the completed form.

- Submit the application: Send the completed form, supporting documents, and a $15 application processing fee in certified funds to the Alabama Department of Revenue.

Common mistakes

-

Illegible handwriting: Filling out the form in a way that is difficult to read can lead to processing delays. It is essential to type or print the information clearly.

-

Incorrect Vehicle Identification Number (VIN): Providing an incorrect VIN can result in the application being rejected. Ensure the VIN matches the one on the current Alabama title.

-

Missing signature: Failing to sign the form can halt the entire process. Each owner or authorized representative must sign in ink.

-

Inaccurate owner information: The name and address must match the information on the surrendered Alabama title. Any discrepancies can lead to rejection.

-

Not including the current Alabama title: Submitting the application without the current title is a common mistake. The title must accompany the form.

-

Incorrect lienholder information: If you are listing a lienholder, ensure their name and address are accurate. Errors here can create complications.

-

Missing processing fee: The application requires a $15.00 processing fee in certified funds. Personal checks or cash are not accepted.

-

Failure to indicate lien dates: When transferring a lien, the lien date must remain the same. This detail is crucial and often overlooked.

-

Not following exemption rules: Understanding which vehicles are exempt from titling is important. Failing to recognize these exemptions can lead to unnecessary applications.

-

Incomplete sections: Ensure that all required sections are filled out. Leaving any part blank can result in the form being returned.

Get Clarifications on Alabama Mvt 20 1

What is the purpose of the Alabama Mvt 20 1 form?

The Alabama Mvt 20 1 form is used to apply for a certificate of title to record or transfer a lien on a motor vehicle. This form is specifically for situations where there is an outstanding Alabama title and does not apply to transfers of ownership or designated agents.

Who should use the Mvt 20 1 form?

This form should be used by lienholders who need to record a lien on a vehicle owned by someone else. It is essential that the vehicle has an outstanding Alabama title. Individuals looking to transfer ownership should use a different form, specifically the MVT 5-1E.

What information is required on the form?

The form requires detailed vehicle information, including:

- Vehicle Identification Number (VIN)

- Year, make, model, and color of the vehicle

- Odometer reading

- Current Alabama title number

Additionally, owner and lienholder information must be provided, including names, addresses, and lien dates.

What is the fee for submitting the Mvt 20 1 form?

The application processing fee is $15.00, which must be paid in certified funds made payable to the Alabama Department of Revenue. Personal checks and cash are not accepted.

Can the Mvt 20 1 form be duplicated?

Yes, the Mvt 20 1 form can be duplicated. Additional copies can also be obtained from the Alabama Department of Revenue website.

What supporting documents are needed with the application?

The application must be accompanied by the current Alabama title for the vehicle and the title fee in certified funds. This ensures that all necessary information is available for processing the lien.

Are there any exemptions for using the Mvt 20 1 form?

Yes, there are several exemptions. For example:

- No title will be issued for manufactured homes, trailers, or vehicles more than 20 years old.

- Motor vehicles older than 35 years are also exempt from titling.

- Low-speed vehicles, defined by specific criteria, do not require a title.

These exemptions mean that if a vehicle falls into these categories, a title cannot be issued.

What happens if the form is filled out incorrectly?

If the form is illegible or contains errors, it will be returned. It is crucial to ensure that all information is accurate and clearly printed or typed to avoid delays in processing.

How should the form be submitted?

The completed form, along with the required documents and payment, should be mailed to the Alabama Department of Revenue, Motor Vehicle Division, at the address provided on the form. Ensure that all components are included to facilitate timely processing.