Fill in a Valid Advance Beneficiary Notice of Non-coverage Form

Common PDF Forms

Aws Welder Certification - Documentation of guided mechanical testing ensures proper oversight during qualification events.

Filling out the IRS W-9 form accurately is crucial for both payers and recipients to maintain compliance with tax regulations. To assist individuals and entities in this process, resources such as smarttemplates.net/fillable-irs-w-9 provide valuable information and tools that can simplify the completion of this important document.

Return to Work Doctors Note Pdf - This document serves to outline the conditions under which an individual may seek temporary leave for work.

Simple Job Application Form - Engage employers with your qualifications through this form.

Misconceptions

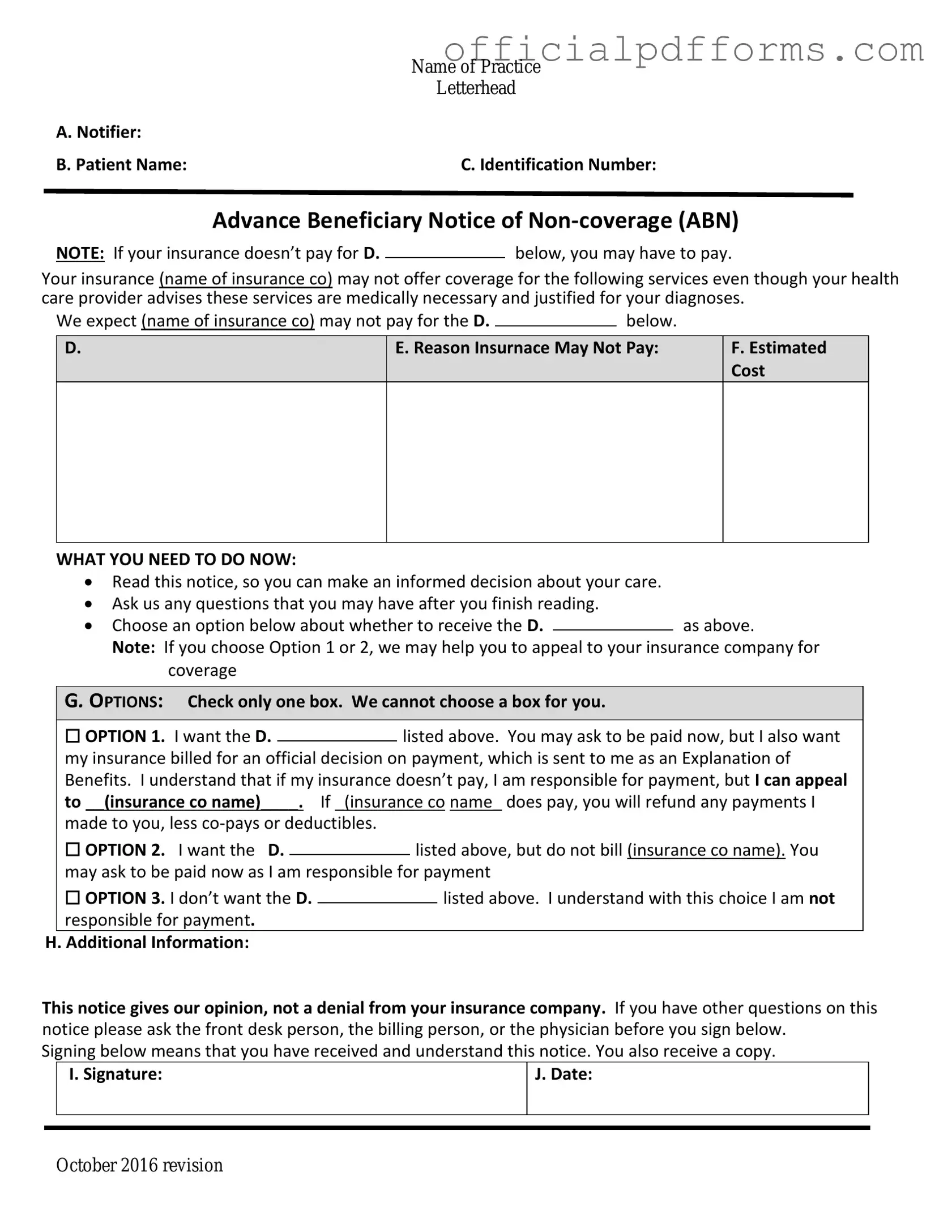

The Advance Beneficiary Notice of Non-coverage (ABN) form is a critical document in the Medicare system, yet several misconceptions surround its purpose and use. Below is a list of ten common misconceptions, along with explanations to clarify each point.

-

All Medicare services require an ABN.

Not all services require an ABN. The form is specifically used when a provider believes that a service may not be covered by Medicare. If a service is likely to be covered, an ABN is unnecessary.

-

An ABN guarantees payment for services.

Receiving an ABN does not guarantee that Medicare will pay for the service. It simply informs the beneficiary that payment may not be covered and that they may be responsible for the cost.

-

Signing an ABN means you have to pay for the service.

Signing an ABN indicates that you understand the potential for non-coverage, but it does not obligate you to pay. You can still appeal if Medicare denies coverage.

-

ABNs are only for outpatient services.

While ABNs are commonly associated with outpatient services, they can also apply to certain inpatient services under specific circumstances.

-

Providers must always issue an ABN.

Providers are only required to issue an ABN when they believe a service may not be covered. If coverage is expected, they do not need to provide one.

-

ABNs are only relevant for elderly beneficiaries.

ABNs apply to all Medicare beneficiaries, regardless of age. Anyone enrolled in Medicare may encounter situations where an ABN is issued.

-

Once signed, the ABN cannot be revoked.

Beneficiaries can revoke their consent to pay for a service after signing an ABN. It is advisable to communicate any concerns with the provider.

-

ABNs are the same as consent forms.

ABNs and consent forms serve different purposes. An ABN addresses potential non-coverage, while consent forms typically relate to agreement for treatment or procedures.

-

Providers cannot bill you if you do not sign the ABN.

If a beneficiary refuses to sign an ABN, the provider may still bill for the service, but the beneficiary may not be informed of the potential for non-coverage.

-

ABNs are only necessary for high-cost services.

ABNs can be issued for any service that a provider believes may not be covered by Medicare, regardless of the cost. Coverage decisions are not solely based on price.

Documents used along the form

The Advance Beneficiary Notice of Non-coverage (ABN) is an important document that notifies patients when a service may not be covered by Medicare. In addition to the ABN, several other forms and documents may be relevant in various healthcare contexts. Below is a list of such documents, each serving a unique purpose in the patient care and billing process.

- Medicare Summary Notice (MSN): This document provides beneficiaries with a summary of services billed to Medicare during a specific period. It details what Medicare paid, what the patient owes, and any services that were not covered.

- Dog Bill of Sale: This legal document formalizes the sale and transfer of ownership of a dog, detailing the dog's description, sale price, and the identities of the buyer and seller, ensuring both parties have a verifiable record of the transaction, which can be found at https://onlinelawdocs.com/.

- Claim Form (CMS-1500): Used by healthcare providers to bill Medicare and other insurers, this form captures information about the patient, the provider, and the services rendered. It is essential for processing insurance claims.

- Notice of Exclusion from Medicare Benefits (NEMB): This notice informs beneficiaries that a specific service is not covered by Medicare. It is often used for services that are excluded from coverage under Medicare guidelines.

- Patient Authorization Form: This document allows healthcare providers to obtain consent from patients to share their medical information with third parties, such as insurance companies or family members.

- Medicare Enrollment Form: Beneficiaries must complete this form to enroll in Medicare. It collects personal information necessary for processing enrollment and determining eligibility for benefits.

- Advanced Care Planning Documents: These documents include advance directives and living wills. They outline a patient's preferences for medical treatment in case they are unable to communicate their wishes in the future.

- Financial Responsibility Agreement: This agreement outlines the patient's financial obligations for services rendered. It clarifies what costs the patient is responsible for, especially if services are not covered by insurance.

- Coordination of Benefits (COB) Form: Used when a patient has multiple insurance plans, this form helps determine which insurer is primary and responsible for payment, ensuring proper processing of claims.

Understanding these documents can help patients navigate their healthcare experiences more effectively. Each form plays a role in ensuring transparency and clarity in the billing and coverage processes, ultimately supporting better patient care.

Steps to Filling Out Advance Beneficiary Notice of Non-coverage

After receiving the Advance Beneficiary Notice of Non-coverage form, you will need to fill it out carefully. This document is essential for understanding your financial responsibilities regarding certain services. Follow the steps below to ensure that you complete the form accurately.

- Begin by entering your personal information. This includes your name, address, and Medicare number at the top of the form.

- Identify the service or item that may not be covered. Clearly state what service you are receiving or plan to receive.

- In the next section, provide the date of the service. This helps to establish when the service was provided or is scheduled.

- Explain why you believe the service should be covered. Provide a brief description of the medical necessity or reason for the service.

- Review the information you have entered. Ensure that all details are correct and complete.

- Sign and date the form at the bottom. Your signature confirms that you understand the information provided.

Once you have completed the form, submit it as directed. Keep a copy for your records. This will help you track your services and any potential costs associated with them.

Common mistakes

-

Failing to provide accurate patient information. Ensure that the name, Medicare number, and other identifying details are correct.

-

Not specifying the service or item in question. Clearly describe what service or item the notice pertains to.

-

Ignoring the explanation of benefits. Review the Medicare guidelines to understand why the service may not be covered.

-

Leaving out the date of service. Include the date when the service was provided to avoid confusion.

-

Not signing the form. The patient or their representative must sign the form to acknowledge receipt and understanding.

-

Failing to provide a reason for non-coverage. Clearly state why the service is believed to be non-covered.

-

Submitting the form without a copy for personal records. Keep a copy of the completed form for future reference.

-

Overlooking the timeline for filing appeals. Be aware of deadlines for any appeals related to non-coverage decisions.

Get Clarifications on Advance Beneficiary Notice of Non-coverage

What is the Advance Beneficiary Notice of Non-coverage (ABN)?

The Advance Beneficiary Notice of Non-coverage, commonly referred to as the ABN, is a form used by healthcare providers to inform Medicare beneficiaries that a specific service or item may not be covered by Medicare. This notice provides beneficiaries with the opportunity to make informed decisions about their care and potential financial responsibilities before receiving the service.

When should an ABN be issued?

An ABN should be issued when a healthcare provider believes that Medicare may not pay for a service or item. This typically occurs in situations where:

- The service is deemed not medically necessary.

- The provider believes that the service is not covered under Medicare rules.

- The patient has already received similar services that were not covered.

Providers are required to give the ABN before the service is rendered to ensure beneficiaries understand their potential financial liability.

What information is included in the ABN?

The ABN includes several key pieces of information, such as:

- A description of the service or item in question.

- The reason why the provider believes Medicare may not cover the service.

- The estimated cost of the service if it is not covered by Medicare.

- A section for the beneficiary to indicate whether they wish to proceed with the service despite the notice.

This information helps beneficiaries make informed choices regarding their healthcare options.

What happens if I do not sign the ABN?

If a beneficiary does not sign the ABN, the provider may still proceed with the service, but Medicare may deny coverage. In such cases, the beneficiary could be responsible for the full cost of the service. Signing the ABN indicates that the beneficiary understands the potential for non-coverage and agrees to accept financial responsibility if Medicare does not pay.