Fill in a Valid Adp Pay Stub Form

Common PDF Forms

Profit and Loss Statement Template Pdf - This document can highlight operational efficiencies or inefficiencies.

In addition to the critical details needed for the ownership transfer, using the Bill of Sale for a Four Wheeler ensures that all aspects of the transaction are covered, providing both parties with peace of mind and legal protection.

Netspend Dispute Documents - Clearer details about the transactions can lead to quicker resolutions.

Dr-835 - You can revoke the power of attorney at any time with proper notice.

Misconceptions

-

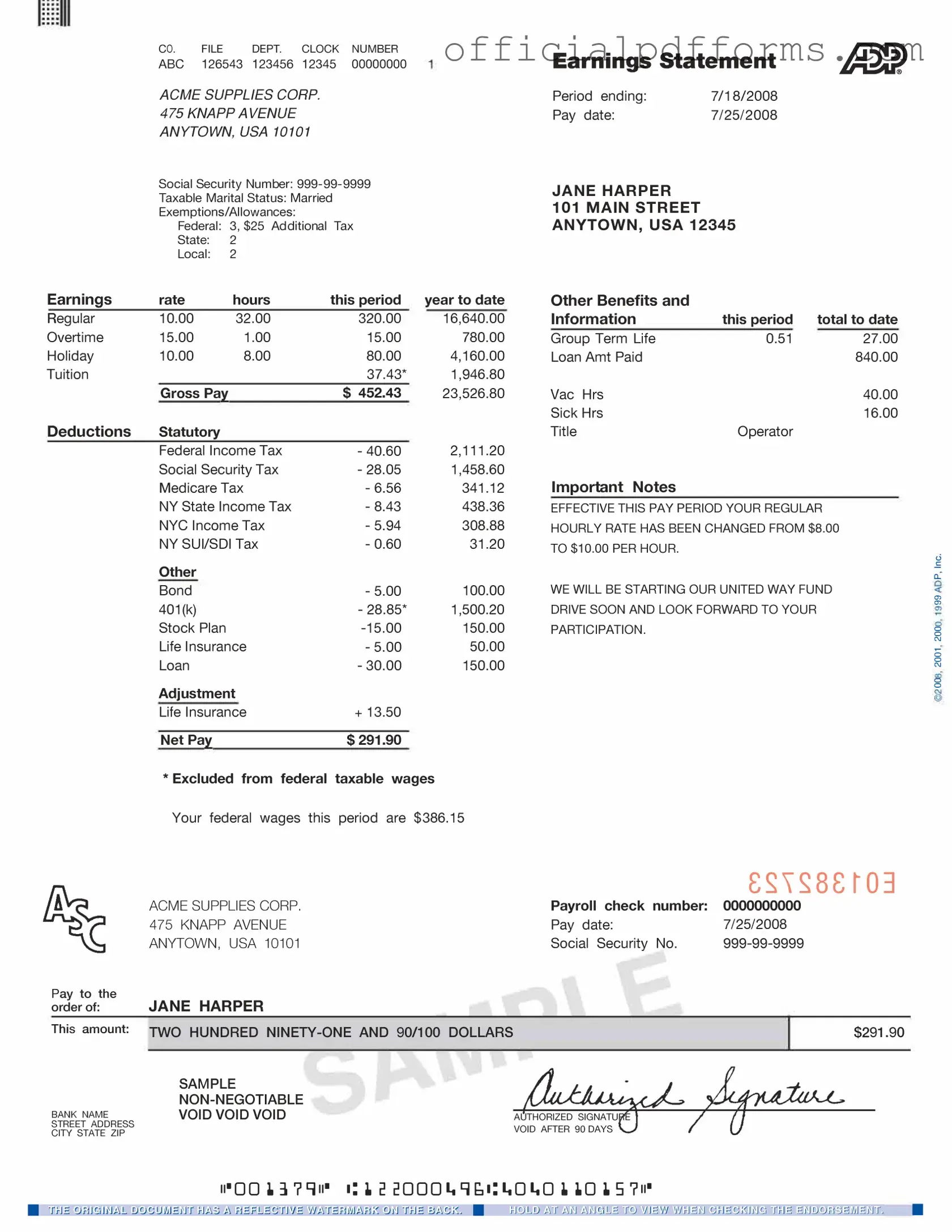

Misconception 1: The ADP pay stub only shows gross pay.

This is not true. The ADP pay stub provides a detailed breakdown of earnings, including gross pay, deductions, and net pay. Employees can see exactly how much they earned before and after deductions.

-

Misconception 2: Pay stubs are only for salaried employees.

In reality, both hourly and salaried employees receive pay stubs. Regardless of how you are paid, you should receive a pay stub that outlines your earnings and deductions.

-

Misconception 3: The deductions listed are always accurate.

While ADP strives for accuracy, mistakes can happen. It's important for employees to review their pay stubs regularly and report any discrepancies to their employer.

-

Misconception 4: Pay stubs are not important for tax purposes.

This is a common misunderstanding. Pay stubs are essential documents for tracking income and deductions throughout the year. They can help when filing taxes and ensuring that you have reported your earnings accurately.

-

Misconception 5: You can only access pay stubs if you are at work.

Many employers using ADP offer online access to pay stubs. Employees can log in from anywhere, making it easy to view and download their pay stubs at any time.

Documents used along the form

The ADP Pay Stub form is a crucial document for employees, providing a detailed breakdown of earnings, deductions, and net pay for a specific pay period. However, several other forms and documents often accompany the pay stub, each serving a unique purpose. Below is a list of these documents, along with a brief description of each.

- W-2 Form: This form summarizes an employee's annual wages and the taxes withheld. Employers must provide it to employees by January 31 each year for tax filing purposes.

- Bill of Sale Form: A legal document essential for proving transactions between buyers and sellers. If you're ready to finalize your transaction, Fill PDF Forms.

- W-4 Form: Employees use this form to indicate their tax withholding preferences. It helps employers determine the amount of federal income tax to withhold from an employee's paycheck.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their pay directly into their bank account, ensuring timely and secure payment.

- Time Sheet: A record of hours worked by an employee during a specific pay period. It is often used to calculate wages for hourly employees.

- Payroll Register: This internal document lists all employees, their earnings, and deductions for a specific pay period. It helps employers keep track of payroll expenses.

- Benefits Enrollment Form: Employees complete this form to enroll in company-sponsored benefits, such as health insurance or retirement plans. It outlines the options available to them.

- Leave Request Form: This document allows employees to formally request time off. It typically includes details about the type of leave, duration, and reason for the absence.

- Employee Handbook: This guide outlines company policies, procedures, and benefits. It serves as a resource for employees to understand their rights and responsibilities.

- Tax Documents: Various forms, such as 1099s or state tax forms, may be required depending on the employee's situation. These documents assist in reporting income and tax obligations.

Understanding these documents can help employees navigate their financial and employment situations more effectively. Each form plays a role in ensuring accurate payroll processing, compliance with tax regulations, and clarity regarding benefits and leave policies.

Steps to Filling Out Adp Pay Stub

Filling out the ADP Pay Stub form is an essential task for ensuring accurate payroll records. It requires attention to detail and a clear understanding of the information needed. Follow these steps to complete the form accurately.

- Begin by entering your employee information. This includes your full name, employee ID, and the department you work in.

- Next, fill in the pay period. Specify the start and end dates for the pay period you are documenting.

- Indicate your hours worked during that pay period. Include regular hours, overtime hours, and any other relevant categories.

- Record your hourly wage or salary. Make sure this matches your employment agreement.

- Calculate your gross pay. This is the total amount earned before any deductions are made.

- List any deductions that apply, such as taxes, health insurance, or retirement contributions.

- Subtract the total deductions from your gross pay to determine your net pay.

- Finally, review all entries for accuracy. Ensure that every section is filled out completely and correctly.

Common mistakes

-

Incorrect Personal Information: Many individuals fail to double-check their name, address, and Social Security number. Errors here can lead to significant issues with tax reporting and benefits.

-

Misreporting Hours Worked: Some people inaccurately report their hours, either by forgetting to include overtime or by miscalculating their total hours for the pay period. This can result in underpayment.

-

Ignoring Tax Withholding Options: It’s common for individuals to overlook the tax withholding selections. Not selecting the correct allowances can lead to higher tax liabilities at the end of the year.

-

Failure to Update Information: Changes in marital status, dependents, or address often go unreported. This can affect tax withholdings and benefits eligibility.

-

Not Keeping Copies: Some individuals do not retain copies of their pay stubs. This can make it difficult to track earnings or resolve discrepancies later on.

Get Clarifications on Adp Pay Stub

What is an ADP pay stub?

An ADP pay stub is a document provided by ADP, a payroll services company, that outlines an employee's earnings for a specific pay period. It includes details such as gross pay, deductions, and net pay. This document serves as a record of income and can be useful for personal budgeting or when applying for loans.

How can I access my ADP pay stub?

You can access your ADP pay stub online through the ADP portal. If you are a new user, you will need to create an account using your employee information. Once logged in, navigate to the pay statements section to view and download your pay stubs. Alternatively, some employers may provide physical copies of pay stubs.

What information is included on my ADP pay stub?

Your ADP pay stub typically includes the following information:

- Employee name and ID

- Pay period dates

- Gross earnings

- Deductions (taxes, benefits, etc.)

- Net pay (the amount you take home)

Some pay stubs may also include year-to-date totals for earnings and deductions.

Why is it important to keep my ADP pay stubs?

Keeping your ADP pay stubs is important for several reasons:

- They serve as proof of income for loan applications or rental agreements.

- They help you track your earnings and deductions over time.

- They can assist in resolving any discrepancies with your employer regarding pay.

Maintaining these records can provide peace of mind and ensure that your financial information is accurate.

What should I do if I notice an error on my pay stub?

If you notice an error on your pay stub, it’s important to address it promptly. Start by reviewing the details carefully to confirm the mistake. Then, contact your employer’s payroll department or HR representative. They can assist you in correcting the error and provide a revised pay stub if necessary.

Can I receive my ADP pay stub via email?

ADP does not typically send pay stubs via email for security reasons. Instead, employees are encouraged to access their pay stubs through the secure ADP portal. However, some employers may offer the option to receive pay statements electronically, so it’s best to check with your HR department.

What if I lose my ADP pay stub?

If you lose your ADP pay stub, you can easily retrieve it by logging into the ADP portal. Pay stubs are archived, allowing you to access previous pay statements as needed. If you cannot access the portal, reach out to your employer’s payroll department for assistance in obtaining a copy.

Are ADP pay stubs secure?

Yes, ADP takes security seriously. The online portal uses encryption and other security measures to protect your personal information. However, it’s always wise to practice good security habits, such as using strong passwords and regularly monitoring your accounts for any suspicious activity.