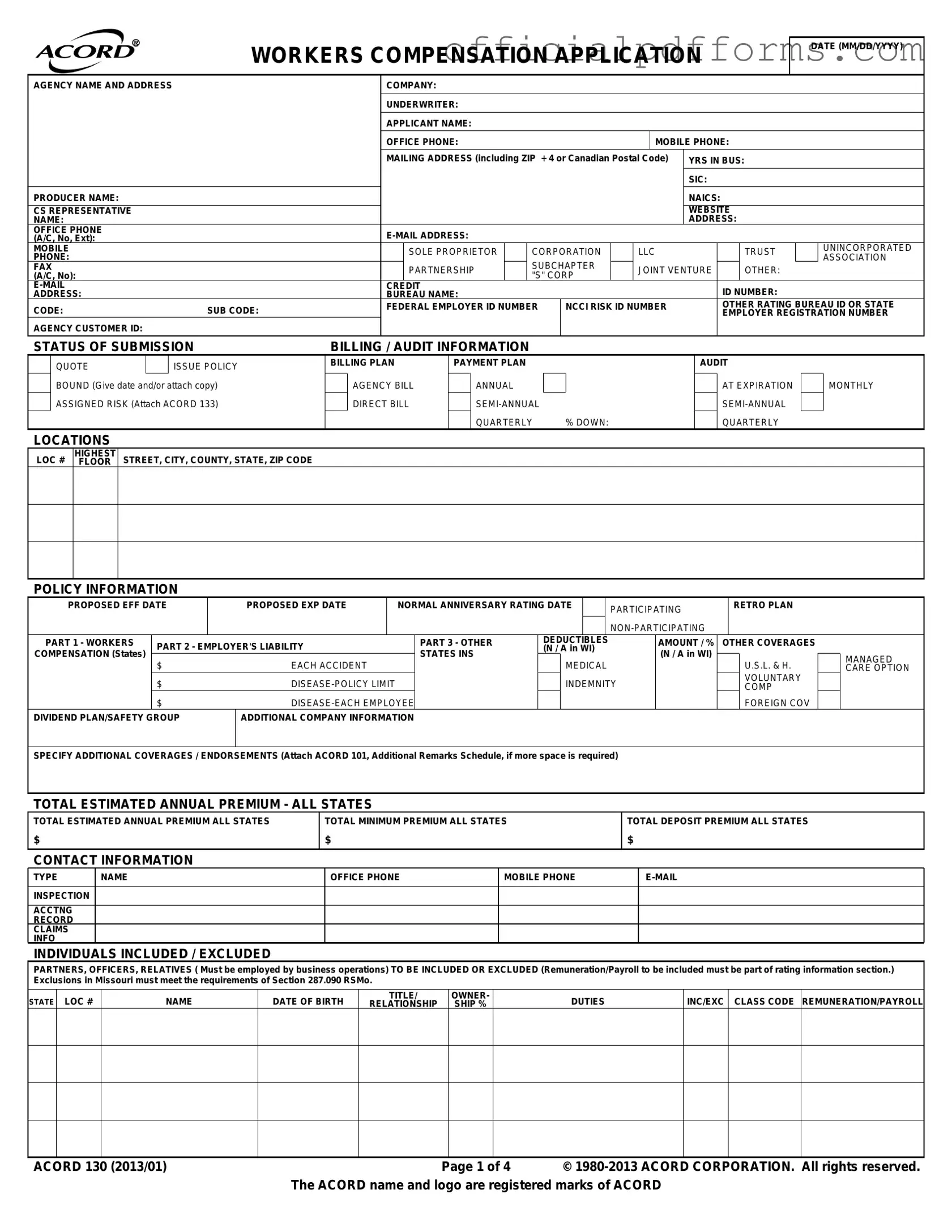

Fill in a Valid Acord 130 Form

Common PDF Forms

Western Union Receipt - Send remittances to 200+ countries and territories.

For further information on the New York Mobile Home Bill of Sale form, including its importance and how to properly complete it, you can visit OnlineLawDocs.com, where comprehensive resources are available to assist in navigating the legalities of mobile home transactions.

Broward County Animal Care - This certificate plays a vital role in sharing vaccination history with other vet clinics.

Misconceptions

- Misconception 1: The Acord 130 form is only for large businesses.

- Misconception 2: Completing the Acord 130 form guarantees insurance coverage.

- Misconception 3: The Acord 130 form is only needed when applying for new coverage.

- Misconception 4: All information on the Acord 130 form is optional.

- Misconception 5: The Acord 130 form does not require detailed business information.

- Misconception 6: Only the owner needs to sign the Acord 130 form.

- Misconception 7: The Acord 130 form is the only document needed for workers' compensation insurance.

- Misconception 8: The Acord 130 form is not subject to state-specific requirements.

This form is applicable to businesses of all sizes, including small businesses. Any company seeking workers' compensation insurance can use it.

Filling out the form does not automatically secure coverage. Underwriters must review the application and determine eligibility based on the provided information.

This form can also be used for renewals or modifications to existing policies. It serves as a comprehensive tool for updating insurance details.

While some sections may not apply to every business, providing complete and accurate information is crucial for proper underwriting and risk assessment.

In fact, the form asks for extensive details about the business operations, including employee classifications, payroll estimates, and loss history.

The form must be signed by an authorized representative, which can include officers or partners, ensuring accountability for the information provided.

Additional documents, such as the Acord 133 for assigned risks, may be required depending on the specific circumstances of the business.

Each state may have unique regulations and requirements that affect how the form is completed and submitted. It is important to consult local guidelines.

Documents used along the form

The ACORD 130 form is an essential document used in the application for workers' compensation insurance. Alongside this form, several other documents and forms are often required to provide a comprehensive overview of the applicant's business and insurance needs. Below is a list of commonly used documents that may accompany the ACORD 130 form.

- ACORD 133: This form is used for reporting assigned risk information. It provides details about the coverage and terms for businesses that are unable to obtain workers' compensation insurance through the standard market.

- ACORD 101: The Additional Remarks Schedule allows applicants to provide further explanations or additional information that may not fit in the main application. This can be crucial for clarifying specific business operations or coverage needs.

- Loss Run Report: This document details the claims history of the business over a specified period, typically the past five years. It includes information on claims made, amounts paid, and reserves set aside for future claims.

- Prior Carrier Information: This section provides information about any previous workers' compensation insurance carriers. It often includes policy numbers, coverage dates, and the nature of claims made during those periods.

- Business Description: A detailed description of the business operations, including the types of services or products offered, is often required. This helps underwriters assess risk accurately.

- Employee Classification Codes: These codes categorize employees based on their job functions, which is essential for determining the premium rates for workers' compensation insurance.

- Payroll Records: Documentation of payroll helps insurers calculate the estimated annual premium based on the total remuneration of employees, which is a critical factor in determining coverage costs.

- Safety Program Documentation: If the business has a written safety program in place, it may be beneficial to include this information. Insurers often look favorably on businesses that prioritize safety.

- Certificate of Insurance: This document proves that the business has active insurance coverage. It may be requested by clients or other parties to verify coverage before entering contracts.

- Motor Vehicle Power of Attorney Form: To authorize someone for vehicle-related tasks, utilize the comprehensive Motor Vehicle Power of Attorney resources for accurate documentation.

- Financial Statements: Some insurers may require recent financial statements to assess the financial health of the business. This can help in determining the risk associated with insuring the applicant.

Having these documents prepared and available can streamline the application process for workers' compensation insurance. It ensures that all relevant information is presented clearly, allowing for a more accurate assessment by the insurer. Always consult with an insurance professional to ensure compliance with specific state requirements and to address any unique business circumstances.

Steps to Filling Out Acord 130

Filling out the ACORD 130 form is a straightforward process. This form collects essential information regarding workers' compensation insurance. Be sure to have all necessary details on hand before you begin, as this will streamline the process.

- Date: Enter the date of the application in MM/DD/YYYY format.

- Agency Information: Fill in the agency name and address.

- Company and Underwriter: Provide the name of the company and the underwriter.

- Applicant Information: Write the applicant's name, office phone, and mobile phone.

- Mailing Address: Include the complete mailing address, including ZIP + 4 or Canadian Postal Code.

- Business Details: Indicate the years in business and the Standard Industrial Classification (SIC) code.

- Producer Information: Enter the producer's name and the North American Industry Classification System (NAICS) code.

- Contact Information: Fill in the contact details for the customer service representative, including their website name, address, office phone, and email address.

- Business Structure: Check the appropriate box for the type of business (e.g., sole proprietor, corporation, LLC, etc.).

- Credit ID Number: Provide the credit ID number if applicable.

- Employer Identification: Enter the federal employer ID number and any relevant risk ID numbers.

- Billing and Audit Information: Indicate the status of submission and billing preferences.

- Policy Information: Fill in the proposed effective and expiration dates, along with the normal anniversary rating date.

- Coverage Information: Specify the details for workers' compensation and employer's liability coverage, including any deductibles.

- Additional Company Information: List any additional coverages or endorsements needed.

- Estimated Premiums: Provide the total estimated annual premium, minimum premium, and deposit premium amounts.

- Contact Information: Fill in the contact details for individuals included or excluded from the policy.

- Rating Information: Complete the rating information for each state, including class codes and estimated annual remuneration.

- Prior Carrier Information: Provide details for the past five years, including any loss history.

- General Information: Answer the general questions and provide explanations for any "yes" responses.

- Signature: Ensure the applicant's signature is provided, along with the date and the producer's signature.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays or rejections. Each section, including contact details and business information, must be completed accurately.

-

Incorrect Dates: Providing incorrect dates, such as the proposed effective date or expiration date, can cause confusion and issues with coverage. Double-check all date entries for accuracy.

-

Misclassification of Business Type: Selecting the wrong business type or classification can affect premium calculations. Ensure that the correct SIC and NAICS codes are used.

-

Omitting Employee Information: Not including all employees, especially those who should be excluded, can lead to inaccurate premium assessments. List all relevant employees and their classifications.

-

Failure to Attach Required Documents: Not attaching necessary documents, such as loss runs or prior carrier information, can result in incomplete applications. Always check for required attachments before submission.

-

Ignoring State-Specific Requirements: Different states may have unique requirements or questions. Ignoring these can lead to compliance issues. Review state-specific guidelines thoroughly.

Get Clarifications on Acord 130

What is the purpose of the ACORD 130 form?

The ACORD 130 form is primarily used as a Workers Compensation Application. It collects essential information about a business seeking workers' compensation insurance. This includes details about the business structure, operations, and employee information. Insurers use this data to assess risk and determine appropriate coverage and premiums.

Who needs to fill out the ACORD 130 form?

Any business that employs workers and requires workers' compensation insurance must complete the ACORD 130 form. This includes sole proprietors, corporations, partnerships, and LLCs. If your business has employees, regardless of their number, this form is necessary to ensure compliance with state regulations regarding workers' compensation coverage.

What information is required on the ACORD 130 form?

The form requires a variety of information, including:

- Agency name and address

- Applicant's name and contact information

- Business structure (e.g., corporation, LLC, partnership)

- Years in business and industry classification codes (SIC and NAICS)

- Details about employees, including their roles and remuneration

- Information about previous insurance coverage and loss history

Providing accurate and complete information is crucial for obtaining the right coverage and premium rates.

How does the ACORD 130 form impact my insurance premium?

The information provided on the ACORD 130 form directly influences your workers' compensation insurance premium. Insurers assess the risk associated with your business based on factors such as the nature of your operations, employee classifications, and loss history. Higher risk businesses may face higher premiums, while those with a strong safety record may qualify for discounts.

What should I do if I have questions while filling out the ACORD 130 form?

If you encounter any questions or uncertainties while completing the ACORD 130 form, it's best to consult with your insurance agent or broker. They can provide guidance and ensure that you fill out the form accurately. Additionally, your agent can help clarify any specific requirements based on your state or business type.

Can I make changes to the ACORD 130 form after submission?

Yes, you can make changes to the ACORD 130 form after submission, but it may require a formal amendment process. If you realize that any information is incorrect or has changed, contact your insurance provider as soon as possible. They will guide you on how to update your application and ensure that your coverage remains valid.