Fill in a Valid 4 Point Inspection Form

Common PDF Forms

Place of Birth Passport Application - The DS-11 form must be printed, as electronic submissions are not accepted.

2% Mindset - Capture your successes and challenges in one place.

An Operating Agreement is a document that outlines the ownership and operating procedures of a limited liability company (LLC). This form serves as a key tool in establishing the rules and responsibilities of the members within the LLC. It is crucial for ensuring that all operations run smoothly and in accordance with the members' agreements. For more information, you can visit OnlineLawDocs.com.

Simple Shared Well Agreement Form - Specifics around how to manage changes in ownership and the impact on the water sharing arrangement are addressed.

Misconceptions

- Misconception 1: The 4-Point Inspection is only for older homes.

- Misconception 2: A 4-Point Inspection guarantees my home will be insured.

- Misconception 3: Any inspector can complete the form.

- Misconception 4: The inspection is a warranty for the systems in my home.

- Misconception 5: I don’t need to provide photos with the inspection.

- Misconception 6: The inspector will fix any issues found during the inspection.

- Misconception 7: The 4-Point Inspection is the same as a general home inspection.

- Misconception 8: If my home passes the inspection, I won’t need to worry about repairs for a long time.

- Misconception 9: The 4-Point Inspection form is optional.

- Misconception 10: I can choose any professional to inspect my home.

This is not true. While it is often required for homes over 30 years old, newer homes may also need a 4-Point Inspection, especially if they are being insured under specific policies.

A 4-Point Inspection does not guarantee insurance coverage. It provides information to the insurer, which they use to assess risk and determine insurability.

Only a Florida-licensed inspector can complete and sign the 4-Point Inspection Form. This ensures that the inspection meets state requirements.

The inspection is not a warranty. It simply reports on the condition of the roof, electrical, HVAC, and plumbing systems at the time of inspection.

Photos are a crucial part of the 4-Point Inspection. They help document the condition of various systems and must accompany the form.

The inspector's role is to evaluate and report on the condition of the systems, not to perform repairs. Homeowners must address any identified issues separately.

While both inspections assess a home's condition, the 4-Point Inspection focuses specifically on four key systems: roof, electrical, HVAC, and plumbing.

A passing inspection indicates that the systems are functioning at the time of the inspection, but it does not mean they won’t need maintenance or repairs in the future.

For many insurance policies, particularly in Florida, the 4-Point Inspection is a requirement. Not having it can delay or prevent coverage.

Only licensed professionals recognized by the state of Florida can perform and certify the inspection. This ensures that the inspection meets all necessary standards.

Documents used along the form

The 4-Point Inspection Form is a crucial document used to assess the condition of key systems in a property. Along with this form, several other documents often accompany it to provide a comprehensive evaluation. Below is a list of related forms and documents that may be required during the inspection process.

- Roof Inspection Form: This document provides a detailed assessment of the roof's condition, including age, material, and any visible damage. It may be used to supplement the roof section of the 4-Point Inspection Form.

- Electrical Inspection Report: This report focuses specifically on the electrical systems within the property. It outlines any issues, repairs needed, and compliance with safety standards.

- HVAC Inspection Report: This document details the condition of the heating, ventilation, and air conditioning systems. It includes information on system age, maintenance history, and any necessary repairs.

- Notice to Quit Form: When dealing with tenant issues, utilize the essential Notice to Quit form resources to ensure compliance and clarity in eviction proceedings.

- Plumbing Inspection Report: This report assesses the plumbing system's condition, including pipes, fixtures, and potential leaks. It provides insight into the overall plumbing health of the property.

- Insurance Application: This document is submitted to the insurance company to request coverage. It includes details about the property and the applicant, and it often requires the 4-Point Inspection Form as part of the submission.

- Disclosure Statement: This statement informs potential buyers or insurers of any known issues with the property. It may include past repairs, hazards, or other significant information that could affect insurability.

These documents work together to ensure a thorough evaluation of the property, helping to identify any issues that may impact insurance coverage or property value. Always ensure that all necessary forms are completed accurately and submitted as required.

Steps to Filling Out 4 Point Inspection

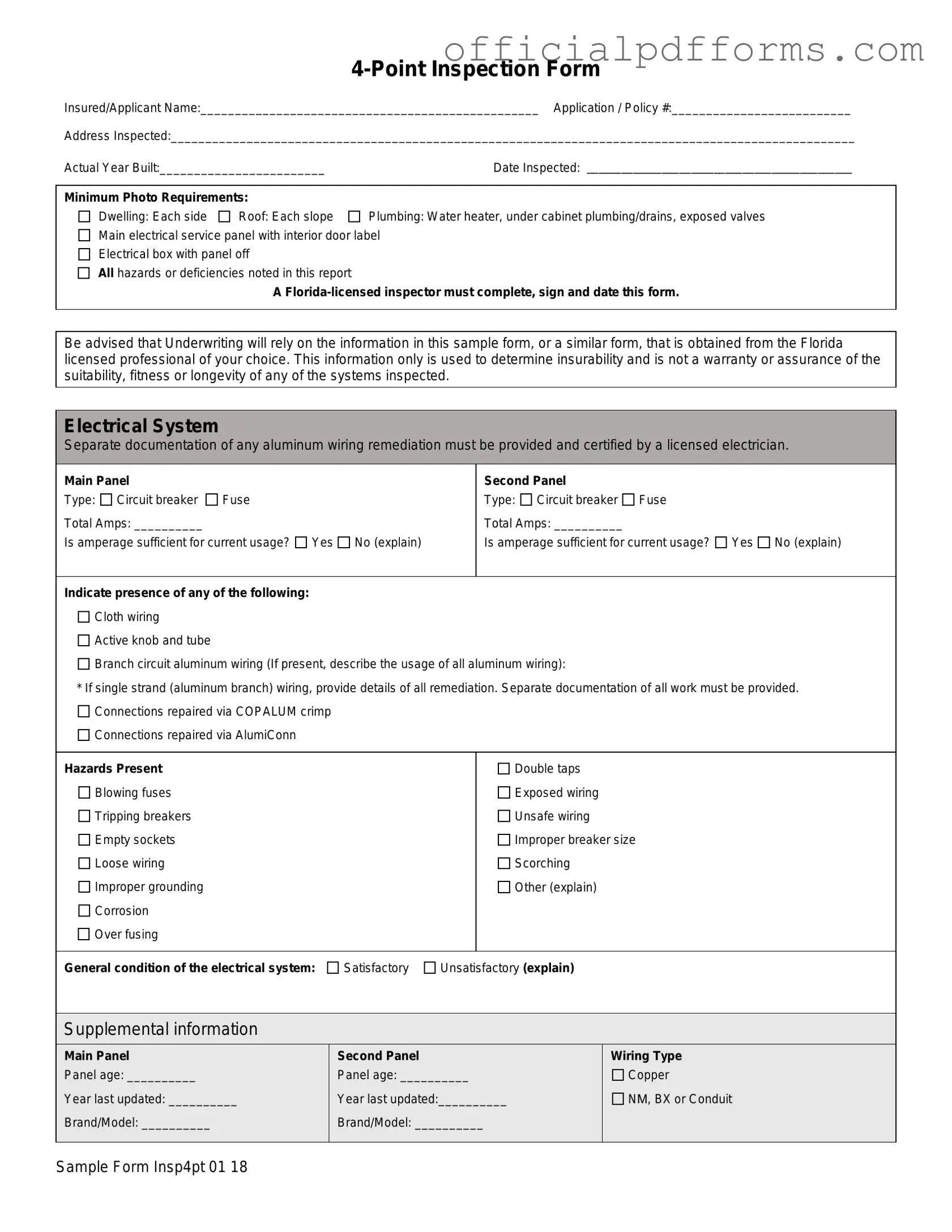

Completing the 4 Point Inspection form is an important step in assessing the condition of a property. This form gathers essential information about the roof, electrical system, HVAC system, and plumbing. After filling out the form, it will be submitted to the relevant underwriting department for review. Here’s how to fill it out effectively:

- Begin by entering the Insured/Applicant Name at the top of the form.

- Fill in the Application / Policy # next to the name.

- Provide the Address Inspected in the designated area.

- Record the Actual Year Built of the property.

- Write the Date Inspected on the form.

- Ensure you meet the Minimum Photo Requirements by including photos of each side of the dwelling, each slope of the roof, and the plumbing and electrical systems as specified.

- For the Electrical System, indicate the type of main panel and second panel, including total amps. Answer questions regarding amperage sufficiency and document any wiring issues.

- In the HVAC System section, confirm whether central AC and heating are present, and note the condition of the systems. Include the date of the last servicing.

- For the Plumbing System, check for a temperature pressure relief valve on the water heater and any signs of leaks. Assess the condition of plumbing fixtures.

- In the Roof section, provide details on the roof covering material, age, and overall condition. Note any visible damage or leaks.

- Complete any Additional Comments/Observations that may be necessary, using extra pages if needed.

- Finally, ensure the form is signed and dated by a Florida-licensed inspector, including their title, license number, company name, and work phone.

Once the form is filled out completely, it should be reviewed for accuracy before submission. This ensures that all necessary details are captured and that the inspection can be processed without delays.

Common mistakes

-

Failing to provide complete and accurate information in the Insured/Applicant Name and Application / Policy # sections. This can lead to confusion and delays.

-

Not including the Actual Year Built of the property. This detail is crucial for underwriting decisions.

-

Missing required photos for the Dwelling, Roof, Plumbing, and Electrical sections. Each side and slope must be documented.

-

Neglecting to have a Florida-licensed inspector complete, sign, and date the form. This step is mandatory for validity.

-

Overlooking the need for separate documentation regarding aluminum wiring remediation. This must be certified by a licensed electrician.

-

Failing to indicate the presence of hazards in the Electrical System. This includes double taps, exposed wiring, and other safety concerns.

-

Not providing comments or details for any unsatisfactory conditions noted in the Plumbing section. Specific issues should be clearly described.

-

Leaving the Overall condition of the roof or other systems marked as Unsatisfactory without further explanation. Details are necessary for clarity.

-

Forgetting to attach photos of the HVAC equipment, including the dated manufacturer’s plate. This information is essential for assessment.

Get Clarifications on 4 Point Inspection

What is a 4 Point Inspection Form?

A 4 Point Inspection Form is a document used primarily in Florida to assess the condition of four key systems in a home: the roof, electrical system, HVAC (heating, ventilation, and air conditioning), and plumbing. This form is often required by insurance companies to determine a property's insurability. It must be completed by a licensed Florida inspector who will evaluate each system for any visible hazards or deficiencies.

Who is qualified to complete a 4 Point Inspection Form?

Only a Florida-licensed inspector can complete the 4 Point Inspection Form. Acceptable professionals include general contractors, residential contractors, building code inspectors, and home inspectors. Each inspector must sign and date the form, certifying that the information provided is accurate. It is important to note that trade-specific professionals may only sign off on the section relevant to their expertise.

What are the minimum photo requirements for the form?

The form requires specific photos to accompany the inspection report. These include:

- Each side of the dwelling

- Each slope of the roof

- Water heater, under cabinet plumbing/drains, and exposed valves

- Main electrical panel with the interior door open

- Electrical box with the panel off

- Any noted hazards or deficiencies

These photos help provide a visual reference to support the inspector's findings.

What happens if a system is found to be unsatisfactory?

If any of the four systems are deemed unsatisfactory, the inspector must provide detailed comments regarding the issues. This includes any visible hazards or deficiencies, such as leaks, corrosion, or improper installations. Insurance agents are responsible for reviewing the form and ensuring that applications for coverage are not submitted if any system is not in good working order.

Is the information in the 4 Point Inspection Form a guarantee of the systems' condition?

No, the information provided in the 4 Point Inspection Form does not serve as a warranty or assurance regarding the suitability or longevity of the systems inspected. It is solely used by underwriters to evaluate the insurability of the property. Homeowners should still conduct regular maintenance and inspections to ensure their systems remain in good condition.

How does the 4 Point Inspection Form affect insurance applications?

The 4 Point Inspection Form plays a critical role in the insurance application process. Underwriters rely on the information provided in the form to assess risk and determine whether to offer coverage. If any systems are found to have deficiencies, the application may be denied, or coverage may be limited. It is essential for homeowners to address any issues noted in the inspection before submitting their application for insurance.